The scenarios are hotly debated across Wall Street, and plenty of market professionals fear the market risks are among the greatest they’ve seen in their lives. Their theories generally hold that the recent spike in bond yields (a signal from investors that they expect higher inflation) will eventually force the Fed to pump the brakes, pulling cash out of the financial system and potentially leading to a much faster and more dangerous popping of bubbles.

“The Fed has inflated asset prices and [Chair Jerome] Powell could wake up one day and say, ‘I may be losing control of the bond market and maybe I should be less dovish,’” said Peter Boockvar, chief investment officer at the Bleakley Advisory Group. “And if rates jump and inflation becomes a problem, that’s going to do real damage to the economy.”

Even those who don’t worry that much about inflation and think any general increase in prices across the economy will be temporary — the result of a quick burst of pent-up consumer demand after Covid-19 — still worry that some of the bubbles are going to blow up even without the Fed raising interest rates.

Among the more worrisome is the incredible explosion in SPACs, often called blank-check companies, which are essentially pools of cash from investors looking to acquire hot startups and take them public while avoiding the traditional initial public offering process. Former Trump administration officials like Larry Kudlow and Wilbur Ross are now among the investors setting up their own SPACs, as are famous entertainers and athletes such as Shaquille O’Neal.

“I’m more concerned about the bursting of bubbles in cyber assets, gold and SPACs,” said Joseph Brusuelas, chief economist at consulting firm RSM US. “I mean Shaq has a SPAC. What could go wrong?”

Investors have pumped more than $130 billion into SPACs since the beginning of last year. Their ability to pump cash into startups with no revenues and sketchy business models to take them public reminds many of the dot-com boom: a few huge winners and many giant losers.

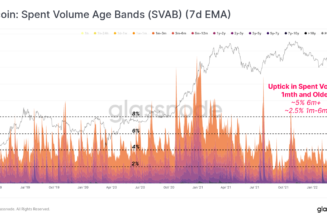

Huge surges in cryptocurrencies like Bitcoin also worry market watchers. The products, which many investors think could rival so-called “fiat money” issued by governments, also show signs of speculative frenzy. Bitcoin is up 420 percent over the last year. Dogecoin, a cryptocurrency created as a joke based on an internet meme, is up more than 2,000 percent in a year.

In the meme-stock frenzy, partly driven by devotees in internet chat rooms such as Reddit’s r/wallstreetbets, shares in troubled game retailer GameStop are still up nearly 3,000 percent over the last year even after a big crash earlier this month. The shares popped higher again late last week.

House prices, especially in certain attractive markets such as Miami and the suburbs around New York, have surged over the last year, fueled by low interest rates, more millennials moving into their homeownership years and buyers realizing they can work from anywhere following the Covid-19 lockdowns.

Data from Realtor.com on Feb. 20 showed median listing prices up 14.5 percent over last year, the 28th consecutive week of double-digit price gains.

After bottoming out last March during the initial Covid-19 lockdown, stocks have raced back to record highs with tech shares enjoying the biggest boost. The Nasdaq is up more than 90 percent since its Covid-era low.

The question is whether some or all of these bubbly assets could come crashing down in ways that would challenge the economy and present questions about whether Washington lawmakers should be doing more to intervene.

The House held a hearing recently on meme stocks and the Robinhood trading platform but little is expected to come from it. SPACs remain very lightly regulated. Key stock indexes remain near their lofty records.

But stock and bond markets are starting to show signs of significant stress and fear. The Dow sank 1.8 percent last week while the S&P 500 fell 2.5 percent and the Nasdaq plunged 4.9 percent.

The culprit: sharply higher yields on Treasury securities such as the 10-year note, suggesting the bond market sees potential inflation ahead that would cut into American’s buying power and possibly force the Fed into rate hikes that would drain money from the system and cut into the housing market boom.

The yield on the 10-year note, used as a benchmark for many loans, rose as high as 1.6 percent last week — the highest level since before the Covid-19 pandemic began — before finishing at 1.42 percent.

Bond investors are now suggesting they believe the confluence of easy-money policies from the Fed and other central banks, massive stimulus from Washington and a potential boom in consumer demand — coupled with lower supply — could lead to an inflation spike later this year.

And fears about bubbles are percolating throughout the financial world. Results of a recent survey by investment management firm Natixis of institutional investors found that 41 percent expect a correction in real estate prices and 39 percent foresee corrections in tech stock and cryptocurrency values.

Powell and other Fed officials, meanwhile, are eager to see slightly higher inflation and continue to believe a spike in prices as Covid-19 wanes will only be temporary. They remain far more focused on healing a damaged labor market than they are worried about inflation.

“We’ve shown that we can, over the course of a long expansion, we can get to low levels of unemployment, and that the benefits to society — including particularly to lower- and moderate-income people — are very substantial,” Powell said in congressional testimony last week, while stressing that he did not anticipate inflation reaching “troubling levels.”

But if that turns out not to be the case, the wider economy — not just the bubbles — could be at risk.

“It’s understandable that the Fed’s focus is on unemployment and getting those 10 million people still out of work back on payrolls,” said Boockvar. “It’s the focus on unemployment without regard to potential inflation that is the problem. Because you can’t have low unemployment without stable prices.”