Less than half of the PPP’s more than $284 billion in current funding has been used since it relaunched Jan. 11, with little concern that it would be exhausted. But the program has been dogged by worries since its creation last year that it was failing to reach the hardest-hit employers, particularly minority-owned businesses that lack relationships with banks responsible for processing PPP applications.

While the Small Business Administration, which runs the PPP, has seen improvements in funds reaching smaller businesses, administration officials told reporters Sunday night that they were limiting access to the program to push lenders to do even more to work with the smallest employers. Ninety-eight percent of small businesses have fewer than 20 employees, according to the Biden administration.

“During that two-week period we want lenders to be really focused on serving existing clients that are in the under-20-employee category and then going out proactively to find new small businesses with under 20 employees to help,” one administration official said.

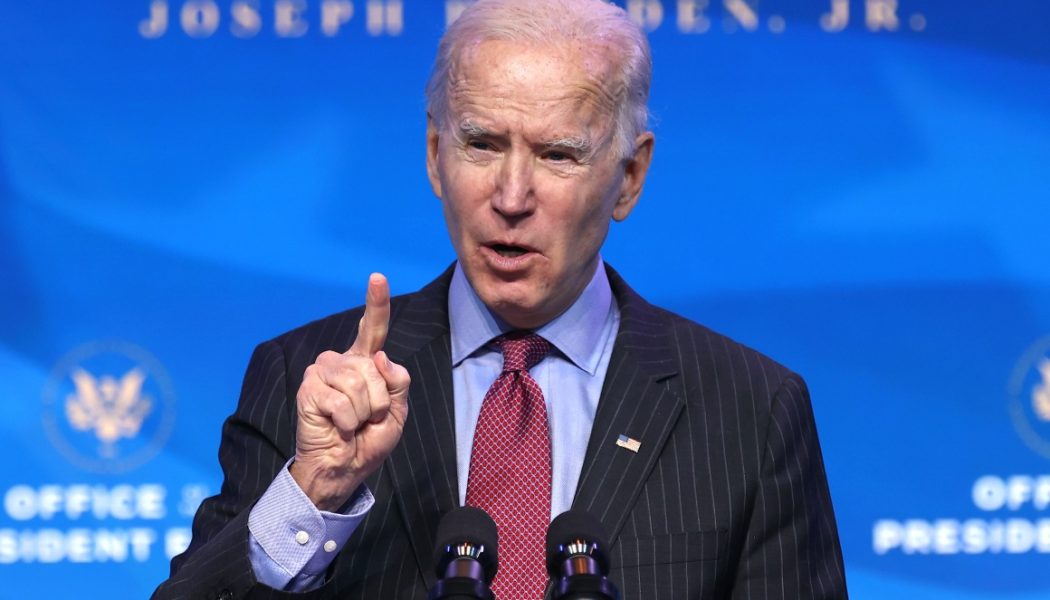

The announcement marks Biden’s first major move to put his stamp on the program and reflects his pledge to make economic equity a top priority. It is also the latest twist in the operation of the PPP, which has made available more than $662 billion to businesses since its creation last March. The program has been hugely popular but has faced a series of controversies related to loans that initially went to big companies, unclear rules for lenders, and significant fraud.

Most recently, the SBA faced complaints that anti-fraud measures it imposed in the latest iteration of the program in response to criticism last year were too stringent, forcing it to rethink its safeguards against scammers so legitimate businesses didn’t face delays in receiving aid.

In addition to the window for small employers to apply, the administration will take steps to expand PPP access to underserved businesses.

The changes include revising eligibility calculations so that sole proprietors, independent contractors and self-employed individuals receive more funds. The administration said it also planned to set aside $1 billion for businesses that are in that category and are located in low-and-moderate-income areas.

The change disappointed some small business owners who had already applied for and received PPP funds. An SBA spokesperson said the agency was not able to retroactively revise the loan amounts on any PPP loan that had already been approved.

In addition, the SBA will eliminate restrictions on business owners with non-fraud felony convictions and those delinquent on their federal student loans. The agency will also clarify that business owners who are non-citizen, U.S. residents can use Individual Taxpayer Identification Numbers to apply for relief.

While many businesses will be prohibited from applying during the two-week window planned by the SBA, administration officials said they expected larger employers to have plenty of time to apply for PPP loans before lending authority expires on March 31. They also said applications submitted by larger businesses before Wednesday would continue to be processed and would not face a delay.

The $1.9 trillion economic aid bill that Biden is seeking would provide another $7 billion to PPP but does not extend the life of the program. An administration official told reporters Sunday that if Congress wanted to pursue an extension, “we’ll consider it then.”

PPP lenders, which had not been briefed on the plan before its announcement, will be key to implementing the changes. The administration plans to brief them today. Some bankers were already voicing skepticism about how the changes would work and whether they were even necessary.

Lenders say they aren’t facing crushing demand that prevents them from assisting small borrowers. There is also evidence that the businesses highlighted by Biden are receiving loans. Bank of America, one of the top lenders, said 93 percent of the 87,000 PPP loan applications it has processed this year have been for firms with fewer than 20 employees.

Consumer Bankers Association President and CEO Richard Hunt said the revamp will make it “somewhat easier” for the smallest businesses in the country, including those in low- and moderate-income areas, but that the administration needed to do more to cut red tape.

“However, without addressing issues lenders have raised since the program reopened, like streamlining some of the bookkeeping requirements imposed by Congress and addressing issues with the SBA’s internal processing systems, this two-week window will not fundamentally alter the roadblocks businesses are facing,” he said. “It is like giving everyone a train ticket on an unfinished railroad.”