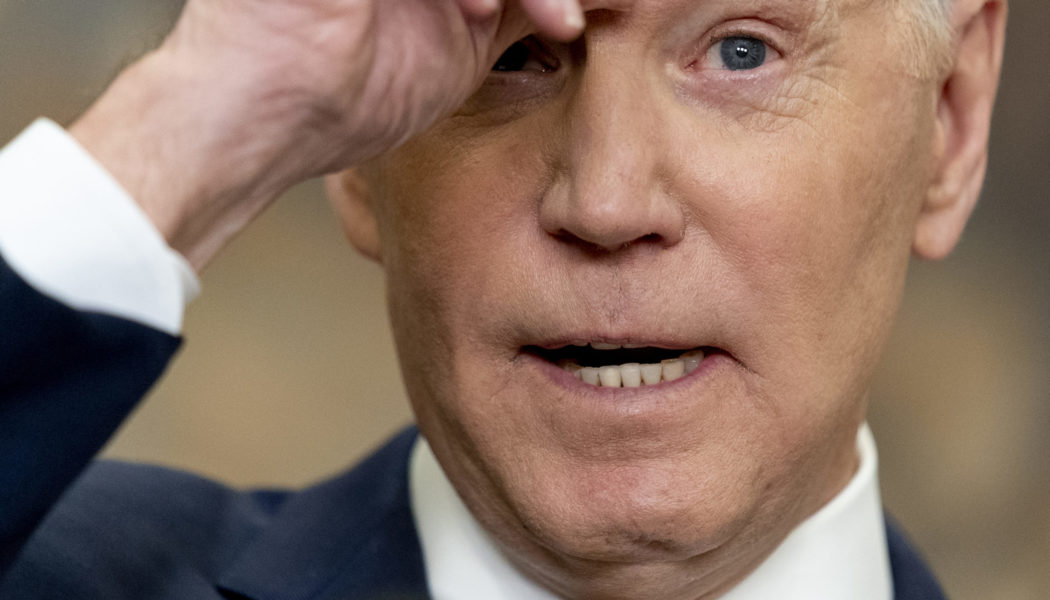

The move comes as the administration has been meeting with oil company executives to negotiate ways to lower fuel prices ahead of the midterm elections in which inflation, partly driven by high energy prices, will be a key issue.

The administration is also considering another release that would be separate from the previously authorized one, though a decision hasn’t been made on whether to do so, the two people said. “It’s on the table, but they haven’t made a go or no-go decision,” one of the people said.

The administration also intends to announce plans to refill the reserve, two people familiar with the talks said. Details such as how much the administration would pay for the oil and when it would buy were still being worked out in one-on-one meetings with industry representatives, the people said.

Oil prices shot higher last week after the oil producing cartel OPEC and its allied countries announced they would cut their collective production by 2 million barrels a day.

Biden had promised a response to OPEC’s decision, though the administration’s options to lower fuel prices are limited. Prices had already come down from a recent high of $5.02 a gallon this summer, but started to increase last month amid refinery outages in California and Ohio. The national average price was $3.87 a gallon as of Tuesday morning, according to AAA.

A release from the Northeast Home Heating Oil Reserve could also be authorized, one of the sources added. That reserve, which holds about 1 million barrels of heating oil in New England, hasn’t been tapped since 2012, according to its Web site.

The Department of Energy has also raised the possibility of limiting fuel exports in a bid to force domestic gasoline prices lower, but the administration has in recent days toned down its rhetoric, according to two industry people. Oil company executives and analysts have said the move could backfire because it could cause producers to slow their drills if they no longer have access to foreign markets, increasing domestic prices.

“The temperature appears to be coming down on the export control threat,” said one of the people. “They still haven’t taken it off the table, but said it wouldn’t happen before the midterms.“

Officials at the White House and Department of Energy did not comment.

Adam Cancryn contributed to this report.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]