Kenya’s parastatals have been banned from holding idle cash in bank accounts under a new public finance reform plan seeking to enhance transparency and efficiency in the use of public resources.

Treasury Cabinet Secretary Njuguna Ndung’u disclosed that the exchequer has officially adopted a hybrid model of a single account where ministries and State departments (MDAs) will operate accounts at the Central Bank of Kenya (CBK) while the accounts of the semi-autonomous agencies will remain in commercial banks on condition that no idle cash will be kept in these accounts.

“The National Treasury has adopted the hybrid model of Treasury Single Account (TSA) where accounts are in Central bank of Kenya for ministries and State departments while the accounts for SAGAs [semi-autonomous State agencies] are retained commercial banks but the National Treasury will be given visibility to monitor the balances and ensure no idle cash is retained by public entities,” Prof Ndung’u disclosed in the estimates for the 2023/2024 fiscal year signed on April 30, 2024.

“In the meantime, the National Treasury is taking stock of the SAGAs bank accounts in commercial banks.”

Most government accounts in commercial banks are owned by State corporations and SAGAs such as the Kenya Urban Roads Authority (Kura), the Kenya National Highways Authority (KeNHA) and the Kenya Rural Roads Authority (KeRRA).

Ministries, departments and agencies on the other hand mostly bank with the CBK.

President William Ruto said at the beginning of this year that interest earned on government deposits in commercial banks belongs to taxpayers and “not a few individuals.”

Removing a huge chunk of government deposits from commercial banks is likely to reduce the funding and liquidity of some of the lenders.

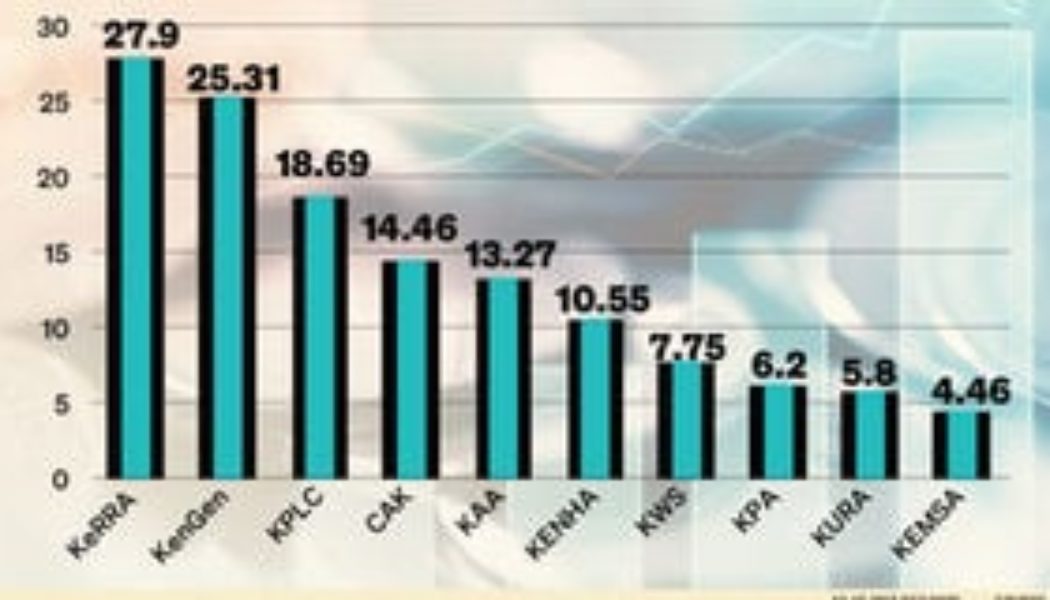

Treasury data shows that the KeRRA accounts for 13.89 percent (Sh27.93 billion or $206 million) of the idle cash held by State corporations in commercial banks as at December 2023, making it the most cash-rich parastatal in the country.

In total the 177 parastatals listed by the Treasury held Sh201.05 billion ($1.5 billion) in banks during the period, with those in the energy and infrastructure sectors particularly having the healthiest bank balances.

Big banks hold the lion’s share of the public funds and stand to face the greatest hit on loss of deposits.

According to the Treasury, bankers have already been prepared for the impending withdrawal of government deposits.

“Yes, they (banks) can’t be comfortable. Eventually, the government will move significant balances from them. They have been sensitized to prepare and adjust to this reality eventually,” said Bernard Ndungu, the director-general in charge of accounting services and quality assurance at the Treasury, in an earlier interview.

Photo credit: Design by Chrispus Bargorett

“But it’s not true that all the accounts in commercial banks will be closed. Public entities will continue to hold operational accounts in commercial banks, but all the idle funds and deposits will be held at CBK.”

East African Community (EAC) partner states in 2018 agreed to close multiple bank accounts operated by their ministries, departments and agencies and keep their revenues in a single account each as part of efforts to increase transparency and accountability in the use of public funds.

The partner states agreed on the Treasury Single Account (TSA) to ensure proper oversight of government cash flows and to reduce the cost of keeping public money in several commercial banks.

Kenya is moving faster on this front, with the Public Finance (Administration and Management) Regulations 2013, setting the stage for the creation of a single government account.

The piloting of the initial phase involving the MDAs is currently ongoing. The second phase involves counties and the third phase involves State corporations and SAGAs. The full implementation of the TSA is expected to happen within a three-year period.