- ANZ bank minted and transferred 30 million A$DC tokens, in a pilot test, before redeeming them into fiat

- The bank, one of the big four in Australia, leveraged its EVM compatible smart contract to mint the A$DC stablecoin

In what is the first event of its like in Australia, Melbourne-headquartered big four bank ANZ today announced the minting of A$DC stablecoin. A$DC IS the first-ever stablecoin pegged on the Australian dollar. The minted tokens were availed via crypto-asset investment platform Zerocap to the Victor Smorgon Group that wanted to invest in crypto markets.

“An ANZ-issued Australian dollar stablecoin is a first and important step in enabling our customers to find a safe and secure gateway to the digital economy,” ANZ Banking Services Lead Nigel Dobson said. “Stablecoins are a new way for customers to transact and in this case was an efficient and direct way for Victor Smorgon Group to access Zerocap’s digital asset exchange and move funds across a decentralised network.”

As per a report published by the Australian Financial Review today, A$DC would be initially limited to enterprise clients but could soon roll out for retail trading.

According to the official announcement by the bank, the A$DC token is backed by the bank and would run on an “in-house purpose-built” EVM compatible stablecoin smart contract deployed via Fireblocks. The development of the said smart contract also saw the participation of OpenZeppelin and Chainalysis.

An improvement on slow transaction speeds synonymous with traditional finance

Having already completed its ‘pilot’ transaction, the bank said it successfully minted and moved 30 million ANZ tokens between the Victor Smorgon Group, a family office and Zerocap, the fund manager hosting the Ethereum wallet. Eventually, the cash was settled in fiat.

“In this particular transaction, it was 20 minutes end to end, including minting. We ran tests beforehand, which took longer as we carefully moved through each step and I would expect future transactions to be even shorter once there is a tested, repeatable process in place,” Zerocap CEO Ryan McCall explained.

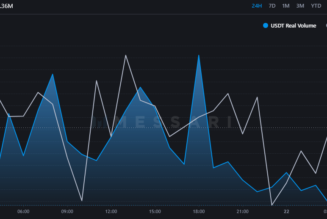

A step forward in processing transactions, the Victor Smorgon Group avoided the fee inconvenience of cash conversion into USDC (Circle’s stablecoin that Zerocap employs to complete trades). Using A$DC to complete the transaction also eliminated the challenge of low speeds.

“Stablecoins are a new way for customers to transact and in this case was an efficient and direct way for Victor Smorgon Group to access Zerocap’s digital asset exchange and move funds across a decentralised network,” he said.

Notably, this isn’t ANZ’s first incursion into crypto. The bank co-founded IBM blockchain-based Lygon, which has made the process of issuing bank guarantees much more efficient.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: Australia, crypto blog, Crypto news, Stablecoin, technology