Breadcrumb Trail Links

Watch brand Zenith one of a few luxury brands that are exploring vintage resale.

Reviews and recommendations are unbiased and products are independently selected. Postmedia may earn an affiliate commission from purchases made through links on this page.

Article content

Situated in the heart of Le Locle, a Swiss town identified alongside La Chaux-de-Fonds as an area of relevance to the history of watchmaking by UNESCO, is the sprawling headquarters of the luxury watch brand Zenith.

Advertisement 2

Story continues below

Article content

Home to the company’s manufacturing operations, head office, repair and restoration workshops, as well as its expansive archives and museum, the location presents a comprehensive take on the company’s past, present and planned future.

Article content

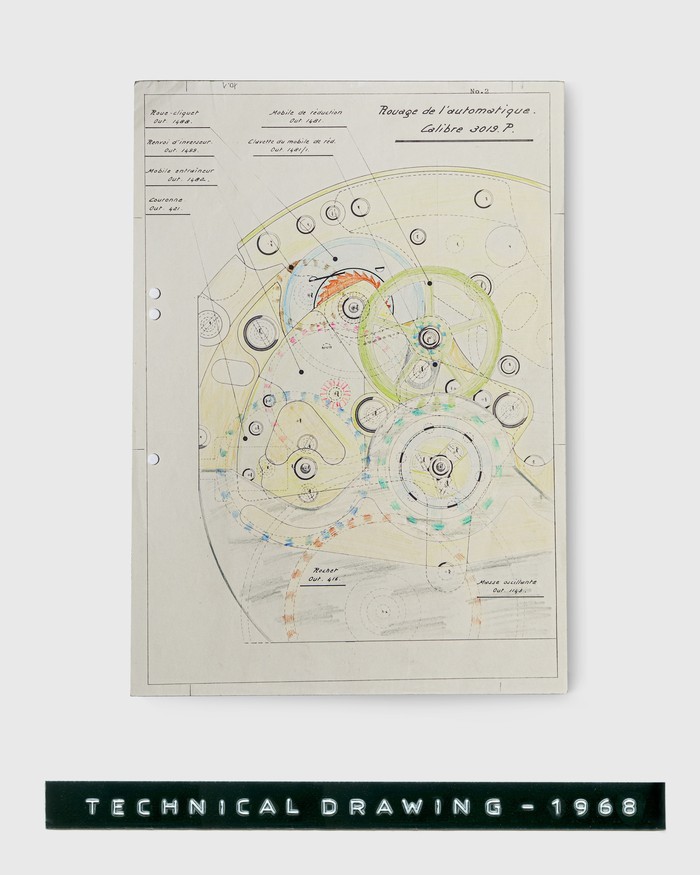

Started in 1865 by Georges Favre-Jacot, a watchmaker and entrepreneur, the timepiece brand is perhaps best known for its El Primero movement. Debuted on Jan. 10, 1969, the ultra-thin, high-frequency integrated automatic chronograph movement made Zenith the first watch manufacturer to launch its own calibre of this kind, at that time.

The El Primero lives on in Zenith collections today and is regarded as one of the “world’s best and most accurate movements,” according to WatchTime.

During a visit to the headquarters this spring, Romain Marietta, product development and heritage director, and Laurence Bodenmann, heritage manager at Zenith, delved deeper into the brand’s history, revealing a unique way the company is making its timepieces of the past into its timepieces of today.

Called Zenith ICONS, the program sees the release of a curated selection of vintage timepieces sourced and handpicked by in-house watch “hunters” before being meticulously restored for resale. The timepieces, billed as “some of the manufacture’s most emblematic and rare vintage watches from the 1960s and 1970s,” include an 18-karat gold-cased G581 (priced at $50,400 US) that features an El Primero movement from it original release year.

Advertisement 3

Story continues below

Article content

The timepieces are rare. But Bodenmann further justifies their price by pointing to the fact that each one is fully documented, verified and properly serviced by the manufacturer.

“We aren’t just buyers and sellers. We are working as an expertise team to really give access to watches that’s as original as possible,” Bodenmann explains. “We are using our sources — we have over one kilometre of archives …

“Connecting the dots is essential.”

In addition to cutting out a middleman, such as vintage watch resellers operating online and in marketplaces, the ICONS program represents a step toward a concrete closed-loop control of vintage stock within a luxury brand pillar.

“The whole purpose behind it is to rebuild the brand heritage. And of course, this is really what all the brands would like to control or to elevate, to promote, to nourish. This is exactly what we want,” Marietta says. “We can demonstrate that we have archives and experts internally that can restore it, that we have history and a chapter of our history that still inspires our new developments. So, everything is linked.

Article content

Advertisement 4

Story continues below

Article content

“And if we can regulate or control or influence the prices of the secondhand, that’s perfect.”

At a time when interest in secondhand shopping is increasing — according to Statista, the secondhand apparel market alone was valued at an estimated $177 billion US with a projected growth to $351 billion US by 2027 — there is little surprise at big luxury brands entering the vintage market.

Italian fashion house Gucci debuted its own take on revisiting its previous designs, dubbed Gucci Vault, which debuted in Fall 2021. The selection of “unique customizations and rare reconditioned pieces” ranges from small leather goods to ready-to-wear designs.

A vintage, reconditioned Papaveri Scarf, dating to the 1970s, is available online for $970, while a customized card set housed in a case of red leather was available for $3,235.

Circularity is becoming a consideration at several levels of the fashion industry. Swedish brand COS, an elevated offering within the H&M company portfolio, launched its own resale platform in 2020 called COS Resell. The platform was created with the “ambition of extending the lifecycle of preloved clothes,” according to Francesca Lilley, head of sustainability and brand strategy for the London-headquartered company.

Advertisement 5

Story continues below

Article content

“The digital marketplace offers a secure, peer-to-peer reselling service, where COS shoppers can discover a range of pre-loved pieces, offering our brand’s community the opportunity to re-invent their wardrobe in a more considered way,” Lilley says of the platform, which is currently available in the U.K. and Germany only.

In addition to offer a more “circular” shopping option for customers, Lilley says the ambition of the program is to attract even more shoppers to the idea of secondhand.

“We really hope to open this platform to new markets very soon and see COS Resell grow as we help more COS fans discover new and more responsible ways to update their wardrobe,” Lilley says.

The idea of shopping secondhand fashion — and more specifically — pre-loved luxury pieces, isn’t new. Courtney Watkins, owner of the Vancouver-based designer resale store Mine & Yours, has been investing, specifically, in the secondhand designer market since opening the business in 2013.

Throughout the past decade, Watkins says she’s seen a marked shift in consumer perception of shopping secondhand.

Advertisement 6

Story continues below

Article content

“I find that the boom is being driven by people realizing the importance of sustainability, coupled with the ability to secure luxury fashion and quality made garments more conveniently at a lower price,” Watkins says. “At Mine & Yours, we strongly believe that resale is better for your closet, your wallet and the planet.”

An insider in the luxury resale industry — an industry that’s expected to reach a market size of $52 billion US by 2026 — Watkins is eager to see how luxury brands enter or further build their own preloved platforms to meet the demand.

“The barrier to luxury brands getting involved in secondhand offerings, in my opinion, is because certain brands are not identifying that resale is an obvious trend and gateway to a more sustainable future,” Watkins says. “On the other hand we’ve seen certain luxury brands like Gucci identify resale as an important part of their business by launching Gucci Vault … Gucci’s owner Kering also bought five per cent of Vestiaire Collective, a resale company.”

Watkins also points to British designer Stella McCartney’s eponymous brand as another example of a fashion line — one already built around a sustainable ideal — that has partnered with large resale companies. She expects to see more luxury companies follow suit in the coming seasons.

Advertisement 7

Story continues below

Article content

“As brands integrate resale into their business strategies, the circular fashion industry will flourish,” Watkins says. “We can hope for a future where secondhand shopping becomes fully de-stigmatized — imagine a world where consumers turn to resale as their first choice. This mindset shift will allow for a more sustainable fashion ecosystem, and a circular economy.”

That future may not be so far off as Marietta notes that interest in their preloved program is coming from the top down within their parent company, billed as the world’s “leading luxury product group,”LVMH Moët Hennessy.

“It became something that even Bernard Arnault (Chairman and CEO of LVMH) was really involved in the process of ICONS,” Marietta says. “Whenever he sees Julien (Tornare), our CEO, he asks what’s going on with ICONS. Because it’s very important for him. Because it’s a demonstration of your ability to have a patrimony, to have stories.

“And he is very much into that because he has so many brands that have a strong patrimony.”

Brands in the LVMH portfolio include a roster of 75 prestigious labels spanning fashion and beauty to beverage and fine jewelry including the namesake French fashion house Louis Vuitton, Italian fashion house Fendi, French beauty and fragrance brand Guerlain, and vintage champagne company Dom Pérignon.

Advertisement 8

Story continues below

Article content

“It’s huge,” Marietta says of the potential impact incorporating similar programs among the other brands could have. “And (Arnault’s) a guy who wants to conserve this craftsmanship and history.”

For now, though, the Zenith team is happy to be leading the charge of this secondhand stage.

“We are the only brand that has the oldest movement still in activity,” Marietta says, referencing the celebrated El Primero. “No one else still has, in their collection at this moment, a movement from 1969.

“We still have most of the components, which is something that they just don’t have.”

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation