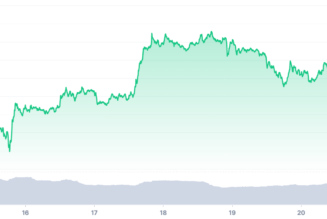

Investor sentiment across the cryptocurrency ecosystem has seen a significant shift in the positive direction over the past week, despite events in the wider world. Currently, Bitcoin (BTC) is back above $43,500 and many altcoins are also witnessing double-digit gains.

The ongoing conflict in Ukraine and recent actions taken by governments to limit access to banking services may have helped to shine a light on the value of holding cryptocurrencies, which offers some protection against uncontrollable events and what some might perceive as government overreach.

Data from Cointelegraph Markets Pro and TradingView shows that the price of BTC has oscillated between $43,350 and $45,400 on March 2 as the world awaits some form of resolution to the current conflicts.

Here’s what several analysts are saying about the recent price action for BTC and where it could be headed in the weeks ahead.

Bitcoin accumulation has begun

The sideways price action for Bitcoin has been largely influenced by the fact that the top cryptocurrency “has entered a volume gap” according to crypto analyst and pseudonymous Twitter user Rekt Capital, who posted the following chart highlighting the lower demand in the current price range.

Rekt Capital said,

“Volume Gaps tend to get filled entirely. Major Volume Gap resistance lies ahead at the ~$48,000 region, which happens to be the mid-range area of the macro range.”

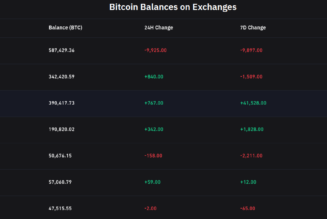

Evidence that the price is likely to head higher was provided by Ki Young Ju, CEO of the on-chain analysis firm CryptoQuant. According to Ki, the “BTC accumulation phase” has begun.

According to Ki, “newbies who joined last year are evolving to long-term holders” as the market cap for Bitcoins that are older than six months now accounts for 52% of the total market cap of BTC as opposed to 13% at the recent cyclic top.

He said,

“Unlikely to hit the previous low ($28,000) as the newbies will wait for other newbies in the next cycle.”

Rate hikes could be the next major catalyst

A more in-depth analysis of the effect of current events on the cryptocurrency market was offered by David Lifchitz, managing partner and chief investment officer at ExoAlpha, who noted the hard bounce in BTC from $37,000 to $44,000 “in the couple of hours following Russian President Vladimir Putin’s announcement of a national ban on foreign FX transfers.”

The rapid move upwards “stalled at $44,000, which coincided with the 100-day moving average,” according to Lifchitz, which is “also near the top of the $33,000-$45,000 range in which Bitcoin has been trading in for weeks.

Lifchitz sees the $45,000 resistance as holding firm for now and highlighted the “next hurdle” at $51,000 that still stands in the way before BTC can even attempt to make a run at its all-time high above $64,000.

As for what comes next for BTC in the short term, Lifchitz suggested that “BTC may go down a bit toward the middle of its $33,000–$45,000 range” and noted that “it’s difficult to see BTC breaking above $45,000 and then $51,000 without any significant catalyst.”

Lifchitz said,

“There’s the FOMC meeting on March 16th where the FED decides if it hikes rates or not. Technically a rate hike “strengthens” the USD and therefore “weakens” BTC in the BTC/USD pair, so it will be interesting to see how BTC reacts then if the FED hikes rates in 2 weeks, but the impact on BTC may not be drastic.”

Related: Bitcoin bulls aim to solidify control over BTC price by flipping $44K to support

Vertical accumulation is a “possibility”

A final bit of insight into BTC’s historical performance was provided by analyst and pseudonymous Twitter user Altcoin Sherpa, who posted the following chart showing that the current range has been a significant support and resistance zone since last May.

Altcoin Sherpa said,

“Watching $40,000 to see if we get a pullback. If this is like September then we’ll see vertical accumulation and Bitcoin is not going to dip (unless on low time frames) much at all for a bit. I’m guessing I won’t get this in the short term.”

The overall cryptocurrency market cap now stands at $1.924 trillion and Bitcoin’s dominance rate is 43.2%.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: Bitcoin Price, BTC Markets, crypto blog, Crypto news, cryptocurrencies, Federal Reserve, Interest Rates, Market Update, Markets, Russia, Ukraine