African Music Goes Global With Universal Deal

An investment in Nigeria’s Mavin label—coupled with interest from China and South Korea— highlights the increasing allure of Africa’s cultural exports.

Welcome to Foreign Policy’s Africa Brief.

Welcome to Foreign Policy’s Africa Brief.

The highlights this week: The leader of Chad’s opposition is killed, a controversial Chinese-built stadium is commissioned in Kenya, and Washington sanctions Zimbabwe.

If you would like to receive Africa Brief in your inbox every Wednesday, please sign up here.

U.S. Investments Fuel African Music’s Dominance

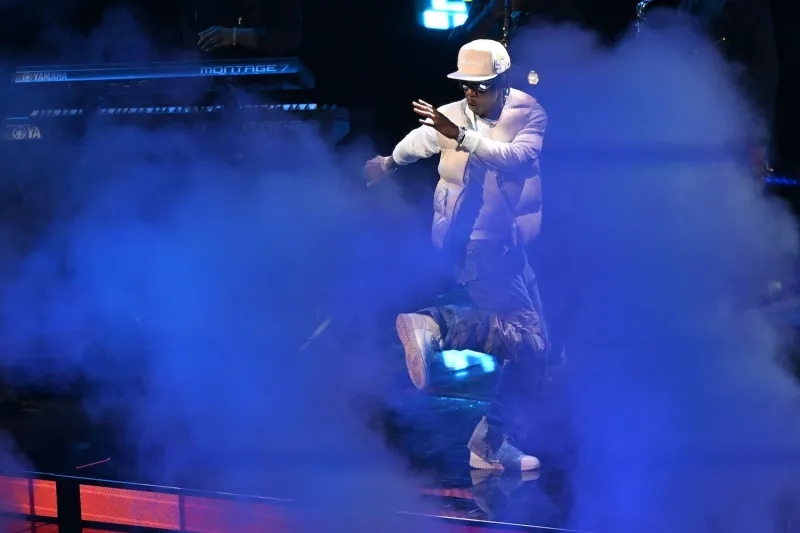

Universal Music Group announced last week that it would purchase a majority stake in Mavin Global, the record label behind the viral hit “Calm Down” by Nigerian artist Rema.

Nigerian and South African musical genres—Afrobeats and Amapiano—have recently gained an international fanbase, and the investment is designed to capitalize on that rise. Rema’s track is the most successful song of all time by an African artist both in numbers of plays and views, having racked up more than 1 billion streams on Spotify, becoming the most watched music video by an African artist on YouTube, and reaching No. 3 on the Billboard 100 last year for a record 57 weeks.

Afrobeats songs were streamed more than 13 billion times on Spotify in 2022, a nearly 500 percent increase from 2017. Mavin is home to some of Nigeria’s biggest music stars, including Beninese-born Nigerian singer Ayra Starr, Ladipoe, Crayon, and Rema. Universal has said that the operation of Lagos-based Mavin will remain unchanged following its investment. CEO Don Jazzy—who founded Mavin in 2012—and Chief Operating Officer Tega Oghenejobo will continue to run the label. The deal is expected to close by the end of 2024, pending regulatory approval.

Africa has the world’s fastest-growing music market, but the potential of the continent’s creative export is still hugely undervalued. A lack of internet connection has impeded the growth of the creative economy. About 600 million people living in sub-Saharan Africa alone, or 4 in 10, lack electricity. (The editing of this column was interrupted by power outages in Lagos.)

Although slow to acknowledge the rise of African music, the support of U.S. firms could cement the African music industry’s global dominance for years to come. Last month, “Water,” a song by South African star Tyla, won a new Grammy Awards category introduced for the best African music performance. Nigerian singer Burna Boy became the first African artist to sell out a U.S. stadium last summer when he played New York’s Citi Field.

Sony and Warner Music have set up shop in Nigeria and South Africa—signing up Tyla, Burna Boy, and fellow Nigerian star Davido. Warner Music in 2022 acquired Africori, one of Africa’s leading digital music distributors, whose clients include South Africa’s Master KG, the artist behind 2020 global hit “Jerusalema.” In August 2023, Gamma, a music label partly backed by Apple, opened its African office in Lagos. “We’re going straight to the source,” Sipho Dlamini, a Gamma executive told the New York Times. Dlamini previously headed Universal’s South African subsidiary.

As Aubrey Hruby wrote in Foreign Policy in September 2020, “After years of trying to sell Western music in Africa, global music labels are now looking to Africa for talent. … [I]n the era of U.S.-Chinese competition, U.S. investment in Africa’s burgeoning creative industries has never been more important.”

Hruby reported that these investments are vital to keep pace with China, which has modified its investments beyond rail and road infrastructure. China is investing in the industries where African markets are headed—online gaming and digital entertainment—mainly by funding internet infrastructure through building fiber optic cables and launching cheaper smartphones and streaming targeted at the African market; somewhere between 50 percent to 70 percent of Africa’s internet networks belong to Huawei.

Chinese mobile phone manufacturer Transsion is Africa’s biggest smartphone seller, which allows it to control the African apps market. Since Transsion’s Boomplay first launched in Nigeria in 2015, it has become Africa’s most popular music streaming app. Interestingly, Boomplay signed an agreement in 2021 with Universal to expand its catalog licensing from seven to 47 African countries.

South Korean companies are also trying to get into the market, and K-pop bands have recreated Afrobeats and Nigerian languages within their music which has been a divisive issue among Nigerian artists. Mavin rejected a buyout bid by Hybe, the company that owns the K-pop label behind the globally popular South Korean band BTS.

Music and film are Nigeria’s biggest export after oil largely due to online streaming platforms, which significantly reduced a piracy problem that had meant music stars earned little or no profit from their songs. Before streaming, music was sold on pirated CDs, and it was difficult—if not impossible—for artists to reach foreign audiences. Royalties earned from streaming platforms such as Boomplay and Spotify allowed for some income.

Only 3 percent of the total funding raised by Nigerian start-ups in 2023 went to entertainment start-ups, despite the creative industry being the second-largest employer after the oil industry. Nigerian lawmakers passed the Copyright Act of 2022 in March last year to better protect musicians although digital piracy persists. In 2019, Abuja introduced a loan scheme called the Creative Industry Financing Initiative, but because it was bogged down by bureaucracy and a severe dollar shortage, not many benefited.

Prosper Africa, a U.S. government initiative to improve commercial trade with Africa, has recently focused on encouraging more U.S. investors into the continent’s creative industry, producing a report on opportunities in the sector. An investment from Washington, D.C.-based investor Kupanda Capital in 2019 helped Mavin boost marketing to global audiences. According to Universal, its acquisition will build on that and allow Mavin to “break more talent globally.”

If the United States is serious about drawing Africans away from China’s and Russia’s spheres of influence, no better path exists than investing in an industry that could employ more than 20 million young Africans annually.

The Week Ahead

Wednesday, March 6, to Thursday, March 7: Swedish-East African Chamber of Commerce Business and Investment Forum, which began Monday, is held in Kampala, Uganda.

Thursday, March 7, to Friday, March 8: Global Trade Review held in Cape Town, South Africa.

Sunday, March 10, to Monday, March 11: Finance and foreign ministers from the Southern African Development Community regional bloc meet in Luanda, Angola.

What We’re Watching

Chad opposition leader killed. Chadian politician Yaya Dillo was killed last Wednesday during a shootout with security forces. Dillo leads the opposition Socialist Party Without Borders. Several others were shot dead alongside Dillo near the party’s headquarters in the capital, N’Djamena. A government statement said party members had attacked Chad’s internal security agency, resulting in several deaths. But opposition parties called it a government assassination.

Chad has been under three years of military rule by transitional President Mahamat Idriss Déby, who seized power after his father, Idriss Déby Itno, was killed fighting rebels in April 2021. Déby senior ruled for more than 30 years after seizing power in a coup. Chad has a history of shifting political alliances, and many Déby family members openly oppose the younger Déby. Dillo is believed to be a cousin or nephew of the president.

The military ruler’s uncle, Gen. Saleh Déby Itno, defected to Dillo’s party last week. Presidential elections are to take place in May. Even before the deaths, Chad had no unified opposition, and it is expected that Déby will win the election. He’s likely to use his late father’s playbook and offer opponents personal deals and access to power in order to keep himself in office—although a palace coup can’t be ruled out.

U.S. sanctions Zimbabwe. Washington on Monday sanctioned Zimbabwean President Emmerson Mnangagwa and 10 other officials over “their involvement in corruption or serious human rights abuse.” Mnangagwa is accused of facilitating gold and diamond smuggling in Zimbabwe in exchange for bribes. The United States also ended blanket sanctions on the country on Monday. U.S. Deputy Treasury Secretary Wally Adeyemo said the changes “are intended to make clear what has always been true: our sanctions are not intended to target the people of Zimbabwe.”

Kenya-Haiti deal. Kenya and Haiti on Friday signed an agreement for the deployment of 1,000 Kenyan police officers to Haiti’s capital city, Port-au-Prince. Kenya’s High Court ruled the deployment to tackle gangs in Haiti unconstitutional in January. The court said authorities could only deploy officers abroad if there was a “reciprocal arrangement.” Haitian Prime Minister Ariel Henry visited Nairobi to sign the deal with Kenyan President William Ruto in order to in part meet the court’s demands—although the court also ruled that only the Kenyan army and not police officers could be sent abroad.

Nearly 4,000 prisoners were freed in Haiti, including high-profile gang members, during Henry’s Kenyan visit. The jailbreak was orchestrated by gang leaders demanding that Henry—who was not elected—resign. Many Kenyans are opposed to the deployment and the pact is expected to face further legal challenges in Kenya’s courts.

Rwanda asylum bill defeat. In a defeat for Rishi Sunak’s government, Britain’s House of Lords on Monday voted in favor of a number of amendments to the United Kingdom’s asylum pact with Rwanda that would require a treaty implementing legal safeguards in the Rwandan asylum system before refugees can be sent there. Other changes voted through sought to allow for the courts to decide whether it is safe to send asylum-seekers to Rwanda and to strengthen the bill’s compliance with international and domestic human rights laws.

Ghana anti-LGBT bill. Ghana’s finance ministry, its federal bank, and the national revenue authority have urged the president not to sign into law an anti-LGBT bill passed by parliament last week. The bill could jeopardize $3.8 billion of World Bank funding and a $3 billion bailout from the International Monetary Fund that has yet to be fully disbursed.

In the ministry’s statement, it recommended that President Nana Akufo-Addo defer signing the bill until the Supreme Court decides whether it aligns with the constitution. The ministry also suggested that the president start a dialogue with religious leaders so they understand the economic impact of the legislation. Uganda saw its World Bank funding suspended over a similar bill passed in May 2023.

This Week in Sports

Kenya has commissioned a Chinese state-owned company—the one behind the construction of the controversial nearly $5 billion railway from Nairobi to Mombasa—for another megaproject. China Road and Bridge is set to build a 60,000-seat stadium for Kenya’s hosting of the 2027 Africa Cup of Nations (AFCON) soccer tournament. The stadium in the capital, Nairobi, will be known as Talanta Sports City when it is completed in December 2025. Talanta translates as “talent” in Swahili.

In 2021, Kenya ended its contract with Afristar, which is owned by China Road and Bridge, to run the railway five years earlier than initially planned over ballooning costs. The move was expected to save the country more than $120 million in annual fees for a railway project that was mired in lawsuits, criminal investigations, and accusations that the deal unfairly increased Kenya’s debt burden since it was paid for through secretive Chinese loans. Chinese companies have built or renovated almost half of the stadiums hosting AFCON matches over the past 15 years, including the $260 million 60,000-seat Ouattara stadium used at this year’s tournament in Ivory Coast.

FP’s Most Read This Week

China Starts the Lunar New Year With an Economic Hangover by ChinaFile Contributors

War Between Israel and Hezbollah Is Becoming Inevitable by Steven A. Cook

NATO’s Military Has a New Nerve Center by Jack Detsch

What We’re Reading

Senegal’s constitutional crisis. Fresh demonstrations took place in Senegal over the weekend to demand an election before April 2, when President Macky Sall’s term is set to end. In Foreign Policy, Elodie Toto reports that Sall’s opponents remain unconvinced that he will step down and hold elections. One reason “for Sall delaying the elections—and extending his time in office—may be that he could face trial once he is out of power,” one analyst noted.

EU-funded crackdowns. An investigation by Al Jazeera and Spanish non-profit media PorCausa found that Senegalese police deployed to violently crack down on pro-democracy protests were funded by the European Union. The 300-strong EU-funded Rapid Action Surveillance and Intervention Group troops were meant to fight terrorism and migrant smugglers in Senegal’s border with Mali but were instead used to quash protests.

Nosmot Gbadamosi is a multimedia journalist and the writer of Foreign Policy’s weekly Africa Brief. She has reported on human rights, the environment, and sustainable development from across the African continent. Twitter: @nosmotg

More from Foreign Policy

NATO’s Military Has a New Nerve Center

The alliance has transformed its once sleepy headquarters into a war command focused on Russia.

The Brutal Logic to Israel’s Actions in Gaza

The Biden administration’s delicate, much criticized line recognizes the lack of a coherent alternative strategy.

NATO’s Confusion Over the Russia Threat

Scenarios and timelines for Moscow’s possible war goals in Europe are a veritable Tetris game of alliance planning.

War Between Israel and Hezbollah Is Becoming Inevitable

It’s time to stop the wishful thinking and start looking at the facts.

Join the Conversation

Commenting on this and other recent articles is just one benefit of a Foreign Policy subscription.

Already a subscriber?

.

Subscribe

Subscribe

View Comments

Join the Conversation

Join the conversation on this and other recent Foreign Policy articles when you subscribe now.

Subscribe

Subscribe

Not your account?

View Comments

Join the Conversation

Please follow our comment guidelines, stay on topic, and be civil, courteous, and respectful of others’ beliefs.

Change your username |

Log out