Absa Bank Kenya has posted a 33.5 percent growth in profits in the first quarter to Sh5.9 billion from Sh4.4 billion, largely on account of higher lending income in the first three months of the year.

The lender has realised an 18.8 percent growth in total operating income to Sh16.4 billion from Sh13.8 billion previously, with net interest income growing the fastest at 21.5 percent to reach Sh11.3 billion.

The bank has booked Sh13.4 billion in revenues from loans and advances to customers, a 41 percent growth from Sh9.5 billion last year, signalling the lender’s success in repricing its loan book within the rising interest rate environment.

The interest rates, however, cut both sides as Absa’s interest expenses soared by 77.7 percent in the quarter to Sh4.8 billion from Sh2.7 billion with costs for customer deposits doubling from Sh4.2 billion from Sh2.1 billion in March 2023.

Non-interest income for the bank has also grown, albeit at a slower rate of 11.1 percent, reaching Sh5 billion from Sh4.5 billion previously.

Growth in non-funded income is anchored on steady growth in fees and commissions on loans and advances, and other fees, which offset a marginal decline in foreign exchange trading income in the quarter. Despite the notable rise in interest expenses, Absa has seen total operating expenses only grow by 6.7 percent to Sh7.9 billion from Sh7.4 billion prior.

The slower growth in expenses, which was more than offset by both interest and non-funded income, is largely anchored on flat provisioning for loan losses with the cover for expected credit losses remaining unchanged at Sh2.4 billion.

The pause on additional provisioning has come despite the lender’s gross non-performing loans racing forward by 24.7 percent to hit Sh38.8 billion from Sh31.1 billion in the same quarter last year.

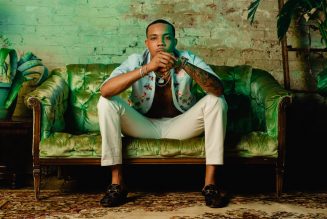

Absa Bank Kenya managing director Abdi Mohamed has credited the improved performance of the bank in the quarter to the lender’s strategy, which has been premised on business diversification.

“We are pleased with the resilient financial outcomes attained in the quarter under review, which demonstrates that we are sustaining strong business performance anchored on our new strategy while aligning with the needs of individuals, businesses, and society and living our purpose of empowering Africa’s tomorrow together, one story at a time,” he noted.

The bank notes that its strategic investments to contain expenses have seen its cost-to-income ratio improve to 33.9 percent.

Absa’s earnings per share in the quarter have improved to Sh1.09 from 82 cents in March 2023.

The lender has joined other Tier-I peers in stretching the banking industry profitability, mostly through higher lending income.

Absa has nevertheless highlighted the stay of prevalent risks, magnified in the banking industry by rising loan impairments.

“We remain cognisant of the challenges in our operating environment but also mindful of the numerous opportunities that await us. As we navigate these uncertain times, we are confident that the bank’s resilience, agility and unwavering commitment to excellence will guide us toward long-term development and prosperity,” added Mr Mohamed.