Why Intel’s longtime ‘frenemy’ thinks the chipmaker getting out of its mess ‘may be too big of a hill to climb.’ Plus: the scoop on Samsung’s leadership shuffle, Bezos kisses the ring, and Altman lowers the AGI bar.

Share this story

See our ethics statement.

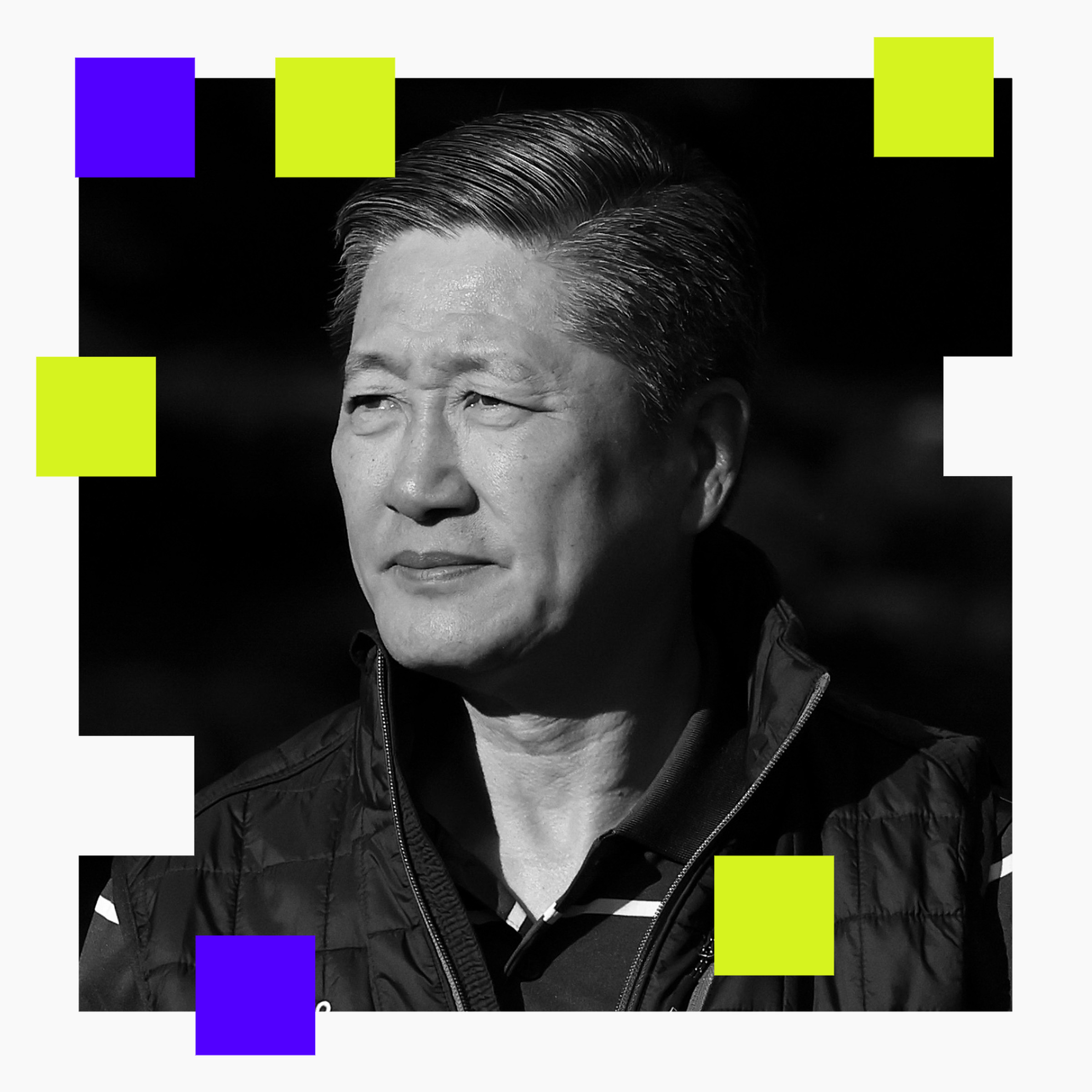

Arm CEO Rene Haas has a unique, bird’s eye view of the tech industry. His company’s chip designs are in the majority of devices you use on a daily basis, from your smartphone to your car. The SoftBank-backed company he leads is worth almost $150 billion, which is now considerably more than Intel.

With the news earlier this week that Intel CEO Pat Gelsinger “retired” and Intel is evaluating its options for a possible spinoff or outright sale, I wanted to hear what Haas thought should happen to his longtime frenemy. There were reports that he approached Intel about buying a big chunk of the company before Gelsinger was ousted. At the same time, Arm is also rumored to be eyeing an expansion into building its own chips and not just licensing its designs.

Haas and I touched on all that and more in an exclusive interview earlier today, which will air in full on a future episode of Decoder. (You can listen to my episode about AI spending in the enterprise that just came out as well.) In the meantime, I wanted to give subscribers the first peek at the highlights from my conversation with Haas.

The following interview has been edited and condensed:

On what he makes of the Intel situation:

As someone who has been in the industry my whole career, it is a little sad to see what’s happening… Intel is an innovation powerhouse. At the same time, you have to innovate in our industry. There are lots of tombstones of great tech companies that don’t reinvent themselves.

I think Intel’s biggest dilemma is how to disassociate being either a vertical company or a fabless company, to oversimplify it. That is the fork in the road that they’ve faced for the last decade. Pat [Gelsinger] had a strategy that was very clear that vertical was the way to win. In my opinion, when he took that strategy on in 2021, that was not a three-year strategy. That was a five-to-10-year strategy. He’s gone and there’s a new CEO to be brought in and the decision has to be made.

My personal bias says that vertical integration is a pretty powerful thing. If they could get that right, I think they would be in an amazing position. But the cost associated with it is so high that it may be too big of a hill to climb.

I’m not going to comment on the rumors that we wanted to buy them. But I think, again, if you’re a vertically integrated company and the power of your strategy is in the fact that you have a product and you have fabs, inherently, you have a potential huge advantage in terms of cost versus the competition. When Pat was the CEO, I did tell him more than once, “You ought to license Arm because if you’ve got your own fabs, fabs are all about volume and we can provide volume.” I wasn’t successful in convincing him to do that.

On the rumors that Arm will build its own AI chips:

If you’re defining a computer architecture and you’re building the future of computing, one of the things you need to be very mindful of is that link between hardware and software in terms of really understanding where the tradeoffs are being made, where the observations are being made, what are the ultimate benefits to consumers from a chip that has that type of integration.

That is easier to do if you’re building something than if you’re licensing IP… If you’re building something, you’re much closer to that interlock, and you have a much better perspective in terms of the design tradeoffs to make. So, if we were to do something, that would be one of the reasons.

On Arm’s ongoing lawsuit with Qualcomm:

The current update is that it plans to go to trial on December 16th, which isn’t very far away. I can appreciate — because we talk to investors and partners — that what they hate the most is uncertainty. But on the flip side, I would say the principles as to why we filed the claim are unchanged.

On Sam Altman’s prediction that AGI will arrive in 2025:

I know he has his own definitions for AGI and his reasons for those definitions. I don’t subscribe so much to what is AGI versus ASI [artificial superintelligence]. I think more around when these AI agents start to think and reason and invent. To me, that is a bit of a “cross the Rubicon” moment… If you would have asked me this question a year ago, I would have said it’s quite a ways away. You ask that question now, [and] I say it is much closer.

On David Sacks being named President-elect Donald Trump’s AI and crypto czar:

Kudos to him. I think that’s a pretty good thing. It’s quite fascinating that if you go back eight years to Trump 1.0, in terms of where we were in December as he was starting to fill out his Cabinet choices and appointees, it was a bit chaotic. At the same time, there wasn’t a lot of representation from the tech world.

This time around, whether it’s Elon [Musk], whether it’s David [Sacks], whether it’s Vivek [Ramaswamy] — I know Larry Ellison has been very, very involved in terms of discussions with the administration — I think it’s a good thing. Having a seat at the table and having access to policy, I think, is really good.

Big leadership changes hit Samsung Electronics this week, per an internal memo I’ve obtained. North America CEO KS Choi is out and has been replaced by Yoonie Joung, a 33-year company veteran. Dave Das now solely oversees the mobile business while former co-head Brent Yoo is heading to Brazil to run sales there. And Shane Higby now runs the following divisions: Home Entertainment, Display, and Digital Appliance. There were a bunch of other shuffles at the C-level, but those are the highlights.

Samsung has been restructuring across the board for months now and did layoffs in Choi’s division at the end of September, so this week’s news isn’t really a surprise. Perhaps the company hasn’t announced this news externally yet because its Korean investors will be meeting in the US next week (a company rep didn’t have a comment by press time).

“Our sales have been down, especially in consumer electronics,” one company insider tells me. “My guess is that we’re just not hitting our targets quarter-over-quarter and so he [Choi] had to go.”

It was fascinating to be in the audience at the DealBook Summit for the first public interview Jeff Bezos has done in years. While I maybe should have been expecting it, I was still shocked at how much he gushed about Donald Trump and his archnemesis for Blue Origin, Elon Musk.

Another part of the interview that stood out was when Bezos said he is spending a lot of time at Amazon, “95-percent” of which is focused on AI. This week, Amazon announced its Nova family of foundational AI models at AWS re:Invent — a project I first scooped in this newsletter earlier this year.

Amazon is obviously still playing catch-up in the AI race, but it seems to have closed meaningful ground with Nova. If anything, this week shows how quickly the AI race is still shifting. It feels like any of the big players could leap ahead at any moment. Even if you’re an AI skeptic, that’s pretty exciting.

- It’s an early Christmas for big tech’s M&A teams: As expected, TikTok lost on appeal and is still staring down the barrel of a ban from the US next month unless it can somehow manage to find a win with the Supreme Court, which seems incredibly unlikely. My sources say that, inside TikTok, leadership has been radio silent to the troops about the news today. It now seems highly probable that Trump — likely with involvement from Musk — will push to get some kind of deal done. I could see Amazon, Google (especially given that I’m hearing search ads will be a big focus for TikTok next year), Microsoft (yes, maybe again), Meta, and a few other players make a bid if they knew it would pass antitrust scrutiny.

- “Not with a bang but a whimper.” I was reminded of that line from T.S. Eliot while watching Sam Altman lower the bar for AGI at DealBook this week. OpenAI is clearly gearing up to declare that AGI has been reached next year so that it can officially become the next mega-profitable, possibly ads-driven commercial entity it is already becoming. Contractually, saying it has reached AGI lets the company keep future profits to itself, making it a more attractive investment opportunity and not as reliant on Microsoft. This makes perfect business sense. It’s also a deeply cynical thing to do after beating the drum that AGI’s arrival would change the world forever.

Some other notable job moves this week:

- Alvin Bowles, Meta’s head of ad sales for the US, Canada, and Latin America announced he was leaving after nine years to “explore new challenges.”

- Rob Witoff rejoined Coinbase to lead its platform team. Meanwhile, Coinbase marketing chief Kate Rouch joined OpenAI as its first CMO.

- Alexander Kolesnikov, Xiaohua Zhai, and Lucas Beyer left Google DeepMind to start OpenAI’s Zurich office. Meanwhile, Behnam Neyshabur, the co-lead of the Blueshift “reasoning” team inside Google DeepMind, joined Anthropic. And three of the leaders of NotebookLM, a rare and viral zero-to-one product from Google, have left to do their own startup.

- Snap’s first-ever partnerships hire, Juan David Borrero, is leaving after 11 years.

- A Google researcher’s take on OpenAI’s o1 reasoning model.

- Cohere CEO Aidan Gomez’s essay on “where enterprise AI is headed.”

- Stanford’s latest AI Index Report.

- Wired interviewed Tim Cook, and he confirmed Apple looked at investing in OpenAI and is working toward more lightweight AR glasses.

- Coming to a Presidio mansion near you: an AI-powered security system literally called Sauron.

- The Democratic Party made an official account on Bluesky, and it went about as well as you’d expect.

- A new gadget I wrote about: the Xreal One “AR” glasses.

- Two excellent features from my colleagues that are worth your time: Josh Dzieza on what it actually means to fall in love with an AI chatbot, and Sarah Jeong on being drunk in South Korea while under martial law.

If you aren’t already getting new issues of Command Line, don’t forget to subscribe to The Verge, which includes unlimited access to all of our stories and an improved ad experience on the web. You’ll also get full access to my archive, featuring scoops about companies like Google, Meta, OpenAI, and more.

As always, I want to hear from you, especially if you have a tip or feedback. Respond here, and I’ll get back to you, or ping me securely on Signal. I’m happy to keep you anonymous.

Thanks for subscribing.