Average monthly pay in Kenya’s private sector has fallen for the first time in over three decades to Sh75,781, reflecting the impact of the country’s soft economy that has pushed firms to keep a lid on costs.

The Kenya Revenue Authority (KRA) says the pay per employee has dropped from the Sh78,034 clocked in the quarter ended September last year.

This suggests firms are asking workers to take pay cuts as they navigate a period marked by low sales or tapping cheaper labour with new hiring.

The reduced pay comes in a period when inflation wiped out the average 2.8 percent salary increase offered to the Kenyan workers last year, making it the fourth year in a row when wage rises lagged behind the cost of living measure.

“Reduction in average monthly cash pay per employee… pointing to effects of ongoing restructuring by various organisations to manage operational costs,” said the KRA in an internal document highlighting tax performance.

The available public records from 1990 failed to capture years when the average private sector pay dropped, including during the Covid-19 economic hardships when firms shed jobs and forced workers to take pay cuts as the virus put business on hold.

The KRA recorded a shortfall in pay as you earn (Paye) taxes from the private sector, signalling the impact of a tough labour market on government revenue.

For instance, Paye receipts from the private sector for October fell short of the target by slightly more than Sh1.2 billion, said the KRA without disclosing the expected amount for the month.

Businesses have this year complained of a cash crunch in an economic setting where the consumer purchasing power has in recent years been eroded by double tax deductions on gross pay.

President William Ruto’s administration introduced a housing levy at the rate of 1.5 percent of gross pay for workers, which is matched by employers, and from October a 2.75 percent levy towards the Social Health Insurance Fund (SHIF).

Both levies are gross-on-gross taxation on workers’ income where the KRA uses the same gross to also calculate the PAYE, hence a form of ‘triple taxation’.

The eroded purchasing power together with economic uncertainty that followed deadly anti-government protests further depressed business orders, prompting firms to adopt a cost savings mode.

Overall, taxes on salaries, wages and allowances, including the public sector’s, fell short of the KRA targets by Sh10.43 billion in the first four months of the current financial year ended October.

The revenue authority collected Sh178.04 billion in the four months against a goal of Sh188.72 billion.

The underperformance was recorded despite the collections growing 4.8 percent over Sh169.94 billion in a similar period last year.

The Paye performance was partly boosted by remittances from the public sector especially in October, “an indication of exchequer disbursements to various agencies”, the KRA said.

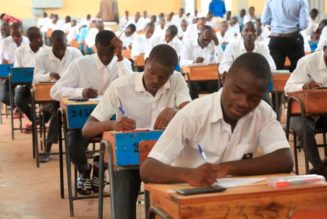

The Federation of Kenya Employers (FKE) said earlier that rising cost of doing business was forcing companies to retrench tens of thousands of workers every month to sustain their businesses.

The lobby said there has been a rise in notifications from its members on intention to declare redundancies to cope with rising cost of operation and protect profit margins.

Findings of Stanbic Kenya Purchasing Managers Index (PMI), based on feedback from about 400 business leaders, have in recent months indicated a trend of companies having paused hiring on falling demand for goods and services.

There have also been suggestions companies are replacing permanent employees with contract staff to rein in operating expenses through lower wages.

“Anecdotal reports suggest that hiring was centred on temporary workers as firms looked to boost capacity,” analysts at Stanbic Bank and American analytics firm, S&P Global, wrote in the PMI report for October.

Confidence regarding future activity rose to a four-month high, says the October Stanbic report, with firms planning new outlets and investments in products and marketing.

However, sentiment remained subdued compared to historical trends.

The drop in basic earnings, which the KRA uses to calculate Paye, will worry policymakers in an economic setting where take-home or net earnings have been falling for the last four years.

Latest findings of an annual economic survey by the Kenya National Bureau of Statistics (KNBS) showed that wages adjusted for inflation slumped to a negative 4.1 percent in 2023 when the cost of living remained elevated on costly fuel and food.

This left many households struggling to pay their bills despite Kenya’s economy growing 5.6 percent in 2023 from a revised 4.9 percent in the previous year, buoyed by robust output in the agriculture sector.

Employers are warning it will take longer for pay raises to return to pre-pandemic levels, with firms fretting over business uncertainties despite the economic rebound.