October 1, 2024, could have been a day of celebration for Elijah Wachira, had everything turned out as hoped.

It was a Tuesday, and Mr Wachira, the Social Health Authority (SHA) acting chief executive officer (CEO) and his team, may have perhaps ended the day with feet up, a drink at hand, and a toast to a new public insurer with an ambitious promise to end crowdfunding for medical bills, or selling of family land or cows to buy medicines for loved ones.

But the installation of an improved social health insurance fund was hit by chaos, confusion and tears, throwing managers at the newly minted SHA into damage control mode.

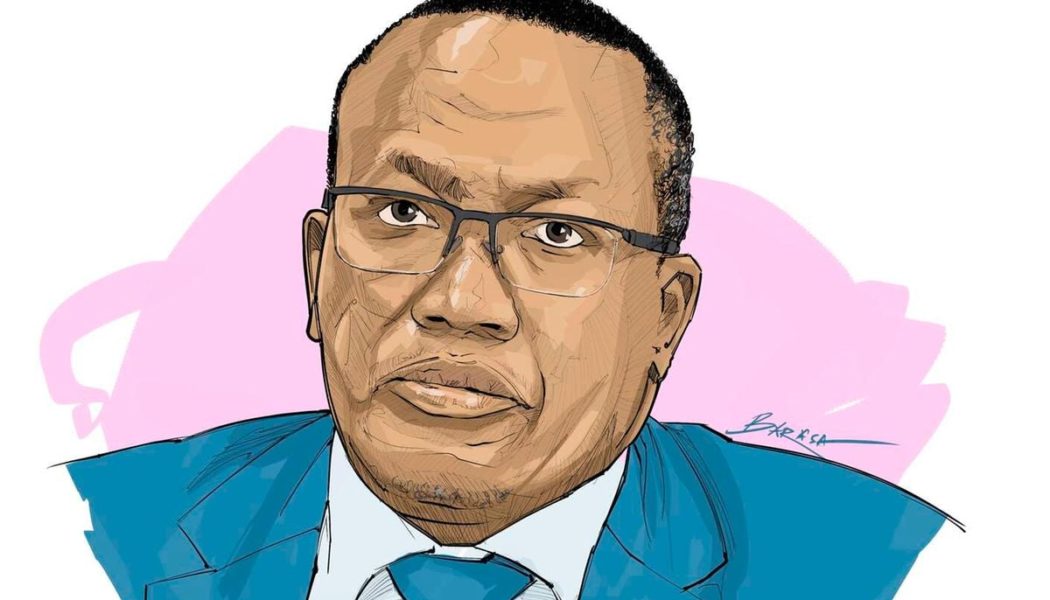

The new insurance system roll-out tumult-flung Mr Wachira, a seasoned insurer who has had decades-long experience in private practice, into the limelight.

The CEO who has been on a reassuring charm offensive to encourage Kenyans to register for insurance, was at pains to calm the nerves of patients, caregivers, hospital officials, media and defunct National Hospital Insurance Fund (NHIF) staff, who had a myriad of concerns from failure to receive treatment to job security, following the transition to SHA.

Catching up with the under-fire executive four days after the messy roll-out, Mr Wachira who could only afford a few minutes to offer a debrief of the now infamous day in SHA history, does not hesitate in conceding to the challenges.

“I acknowledge there were problems associated with the changes [shift from NHIF to SHA]. We had genuine system issues because many new systems will have bugs that come in and confuse the data,” he said in the Friday phone interview.

“I don’t like shouting about this other point, but we also had change issues because people were used to doing things in a certain way. You would expect that people adapt to change at different rates.”

Tuesday’s chaos, for instance, found many patients unawares. Patients with chronic illnesses such as cancer and kidney failure, and relying on NHIF for payment, showed up at various hospitals for their scheduled chemotherapy treatment and dialysis respectively, only to be asked to pay out of pocket.

Those who had no money missed out on their treatment. Some health facilities were also unprepared and ill-equipped as system failures caused delays in admitting sick patients into wards, and facilitating payment so that patients receive treatment and drugs. Those who were to be discharged from hospitals faced delays too.

The MBA graduate from the University of Nairobi is perhaps contending with the most challenging period of his career, with the past few months punctuated by public unrest over SHA, and unflattering remarks as Kenyans’ patience over ailing public services wane fast.

For some patients, the transition to SHA sold as a new dawn, quickly turned out to be a nightmare as they had already registered for the new scheme. In the shift to SHA, some Kenyans found a list of dependants including ghostly spouses and children. There are also concerns over high deductions and very low limits for services such as dental and eye care.

Under SHA, Mr Wachira has a big vision that many of his predecessors have struggled with; end the burden of paying health bills out of pocket, a heavy financial load that has impoverished Kenyans. He equates SHA to free and affordable education.

“20 years ago, we used to do harambees to raise school fees, now it [harambees] have reduced because the government has mechanisms to pay fees. Now almost everyone is on a WhatsApp group for crowd-funding for medical bills. Our vision, in two or three years from now, this shall be a thing of the past because SHA will cater for all medical expenses,” he said recently in Kakamega, one of the counties with low SHA registrations.

Mr Wachira also faces a steep hill climb to differentiate SHA from its beleaguered predecessor, NHIF. He is a former acting NHIF chief executive, and the stakes could not be higher, as the successor must shake off a history undermined by allegations of staff-driven fraud, and patient complaints about the delay in the approval of medical bills and payment.

The pressure to attain efficiency is exacerbated by increased premiums paid by Kenyans who are already lamenting greater deductions to income, as the government parts with 2.75 percent of gross pay to bolster the new fund.

Mr Wachira, while seemingly unfazed by the weight of expectation, sees better days for SHA.

“I have just been taken through a final version of the claims system that is now working and have sent a link to all hospitals to now use the modified link that is working perfectly,” he said.

“I am convinced that we shall be able to offer three funds that were not there in the past. Some are funded by the government like the primary healthcare fund, the emergency fund and a fund for the indigent. We shall also offer foreign treatment, dental, optical and enhanced surgical packages including transplants. Once the ICT portion stabilises, the structure itself and financing is excellent.”

The success of SHA is likely to make or break the career of the decorated insurer who has already had fruitful outcomes in the private sector. Mr Wachira has walked through the doors of several underwriters, serving in top management including as the general manager for Madison Insurance Company Kenya Limited, Sanlam and CIC. At CIC, he rose to the top of the pecking order serving as the Group CEO on an interim basis from October 2019.

SHA is designed to provide healthcare services from both empanelled and contracted healthcare providers and healthcare facilities on referral from primary health facilities.

The authority is expected to ensure that every Kenyan can access a comprehensive range of quality healthcare services without the burden of financial hardship. Every person resident in Kenya is required to register to the authority which proverbially places SHA under the microscope of over 50 million pairs of eyes.

His first success yardstick will be making SHA work for Kenyans. As they say, the ultimate test of greatness in a CEO is how they can lead change with vision and resilience.