For Meshack Miyogo, the path to success has always been as clear as a stream. There was never any doubt about his True North. Raised in a polygamous family in Mombasa (his father’s hands were full and he was hardly there), he always knew he had to turn his back on the hedonism and distractions of his Majengo neighbourhood to become someone.

“It was education that was going to get me everything I wanted,” he says.

He wanted to be a doctor, which didn’t happen, but other amazing things happened. Like being a student leader at Egerton University led him to meet corporations like Cooperative Bank when negotiating the opening of Jumbo Scholar accounts for university students. That interaction piqued his interest in financial services.

It later opened his life to a lucrative career in sales: Barclays Bank, NIC Bank, then into insurance, where, almost 15 years later, he is managing director at CIC Life Insurance.

“It’s a sustained mindset of ambition from an early age,” he says. “Three years ago, this was not the company I found, it was loss-making, now it’s making a profit. Mindset, hard work, support from many quarters, and God.”

Do you feel that you’ve ended up where you set out or this was very organic?

I think it’s both. I’m very ambitious. When I was growing up in Mombasa, I wanted to be a doctor. I had that mindset of wanting more. And when I got into the financial industry, I put in the work. I worked smart, I invested in myself.

To move to a certain level, there is a package that I needed; professionally, and academically. It was very intentional.

You see, I didn’t get the grades to get into medicine, instead, my degree was in education, economics, and business studies, but I knew that I wasn’t going to teach.

Now, if I take you back to when I was in Form Three in Nairobi School, we had something called job shadow. I’m a product of junior achievement.

Guys would come from different corporates and talk about careers. During my holiday, I spent some time at Alico, the current CFC Life.

I had an opportunity to interact with the then-chief executive officer (CEO) Erwin Brewster (now late); I spent the whole day with him in his office. We went for lunch at Serena Hotel.

That was my first time going to a five-star hotel and the first time I used elaborate cutlery. I wanted that.

Of course, I was thinking about medicine, but I rather liked the life of a CEO of one of the biggest life insurance companies then. The financial industry made a big impression on me, and for sure, when I finished my university, the first place I went to was Alico Insurance, then Barclays, where I was the top salesman of some 5,000 salespeople, then my career started taking shape.

I knew my path was going to lead me where I am now, God willing. I was also mentored by the likes of Stella Njunge, my former boss who’s the CEO for AIG. George Kuria, CEO of Sanlam…So many people have mentored me in this journey.

What did your folks do while growing up in Mombasa?

My mom worked for Car and General. I come from a polygamous family. My dad was a Muslim, but I’m SDA – from my mom’s side. My dad was mostly absent during my childhood.

Mombasa is a very tricky place to grow up in – drugs and things. My classmates in primary school were already indulging in some of these things so early.

The church helped me. I really appreciate my mom, because she was very keen on us attending church, which I did on Saturdays and even on Sundays. This meant that I didn’t have time for the things my friends had time for.

I was keen to work hard, which I did, earning me an entrance to a national school. Not a mean feat, if you knew the challenges of the environment in Mombasa.

Did you have any interest in having a relationship with your dad?

Not really. He would come around once in a while during a birthday and bring me a gift. I remember him buying me shoes. Thankfully, my mom was very bountiful in terms of provision, so I never lacked.

I had older siblings. My late brother was like a father figure to me. He mentored me in the absence of my father. Much later, after getting married, my wife – out of nowhere – said, “I need to meet your dad.” I said, “I don’t know where he is.” “Ask your mom, who should know.”

I did, and my mom directed me to Bulbul, Ngong where the Mohammed’s owned a huge piece of land. My dad is Maasai. We went looking for him and we found him.

He was elderly, but he could remember me even though the last time I saw him, I was in Class Six. He asked me, “Where is your mom?” I told her mom was in the UK. I met my step-brothers. They are bearded like me. It was a reunion of sorts.

Why did your wife want to meet your dad?

Women. [Shrugs] Women always want to solve mysteries. [Chuckles]

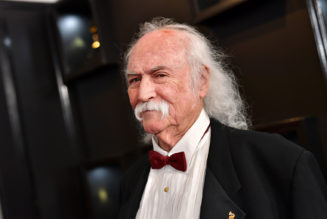

CIC Life Assurance Managing Director Meshack Miyogo during an interview at his office in Nairobi on September 25, 2024.

Photo credit: Bonface Bogita | Nation Media Group

What’s the downside of getting the corner office?

Number one; it’s very lonely. The office comes with invisible boundaries that keep people off even when you have an open-door policy, like I do.

You think more in the corner office; you think about how you can make the organisation better because you carry the hopes of so many people. There is more pressure and responsibility here.

Then you have to actually create time for your family when you reach here, because the office can consume you and your time. I have four children, and I’m intentional in raising them.

I drop them off at school every morning, and I make time for them. You have to create time for family as well because it’s demanding.

In the corner office, you are always managing competition, regulators, stakeholders, internal and external…it’s endless the demands it has on you. But we work towards this office, and so we have to make it work.

What would you tell your younger self about money?

Start early and save more. When I was in university, my brother would send me Sterling Pounds from the UK, where he’s based, on top of the Higher Education Loans Board I was receiving. I had loose money to play with.

I should have saved the extra cash because the moment I left university, my brother told me, “I’m not sending you any more money. You are now a man on your own. Find your way.” [Laughs]

I wish I had been more disciplined with money then; I wish I started saving early. I did start saving in my career. I have learnt to not drastically change my lifestyle in terms of the way I do my things, even when my financial position was changing for the better.

I think I’ve made more investments that I’m happy with. And I’ve tried to also balance off fun as well, because what’s the fun in denying oneself when you have money sitting somewhere?

What are your fears now at 42 years old?

Health. Things start going haywire in your 40s. Your body changes, and if you haven’t been taking care of yourself, your 40s can be the beginning of your Waterloo.

The other fear is my children, them growing up and leaving the nest. My daughter is now 16, and before long she will be going to university.

My son is also coming of age. The last two are still young, so I have some time with them. My first two are getting exposed to life, they are thinking independently, and they are going to leave and be what they want to be. Thankfully, most of these fears have solutions.

You just have to be positive and also focus on yourself as you give the best to yourself and your family. Fears around health are mitigated by going to the gym every single weekday.

I used to play rugby when I was younger, and now, in my 40s, I’m seeing the importance of exercise. I’m working out more than I did, I’m smaller now than I was in my 30s. One needs to manage their health otherwise the little coins you’re making now will end up at the hospital.

When were you least positive in your life?

When I just got married and we were expecting our firstborn. I didn’t have a stable job. I was a salesman; just getting by. We were staying in a one-bedroom house, with no medical cover. I didn’t know how the life of this child would span.

I felt uncertain about their future. But that was also an advantage because it drove me and made me work harder knowing the responsibilities were coming up. Nonetheless, it was one of the most stressful moments of my life.

What are you most uncertain about when it comes to the future?

In insurance, we say you can never have certainty about the future. Things that will happen will happen. Of course, you want to know that you will always provide for your family and that you live long enough to see your grandchildren. You pray to God to give you good health. The rest I can’t control.

The mindset I have now is that if things were to happen and I was forced to go back and start afresh, I think I’d still get back to where I am now, probably even faster because now I know the routes to this place. I’m reading Steven Bartlett’s Diary of a CEO.

It talks about things like knowledge, skill, reputation, and resources. You can lose everything else, but you can never lose the knowledge and skills you’ve acquired over the years. Everything else might go, but I still have my knowledge and skills.

What skills do you wish you had?

Normally when I have a problem with my computer, our IT guy comes into my office and touches the keys for a few minutes, and my machines suddenly start working again. I wish I knew what he knew. I wish I had that IT skill to navigate the computer.

What do you do for fun?

The gym is part of my unwinding. I love working out. Travelling. For my 42nd birthday, I did a photoshoot with my son, whom I share a birthday with, then went out with the family.

I then travelled to the US to visit my brother and cousins. I toured Texas, Boston, Seattle, and Pittsburgh. It was a treat.

I’m also the treasurer for Mwamba Rugby Football Club. It’s a community club. It keeps me busy and helps me learn how to manage a crop of young players, the Gen-Zs.

Managing the club helps me to unwind. I don’t drink alcohol, but I have friends who drink, and I enjoy socialising with them. Lastly, I play golf on Sunday evenings when I have time.