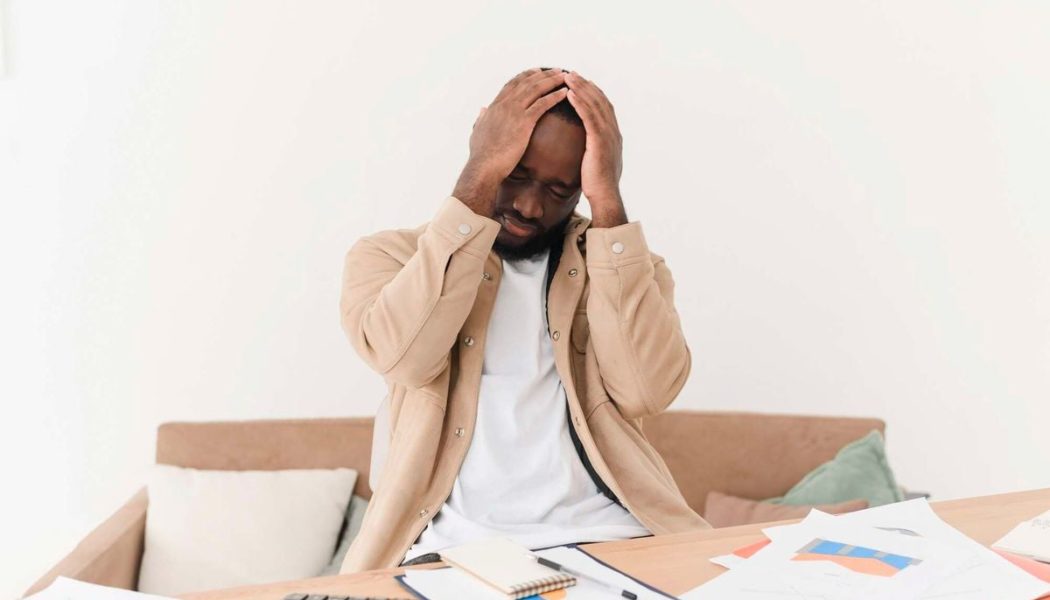

I earn Sh90,000 per month but despite getting a salary increase a year ago, I haven’t saved anything. I have an unpaid bank loan of Sh700,000 and my wife, who is a student, requires Sh10,000 monthly. I pay Sh8,000 for our daughter’s schooling, Sh9,000 for housing, Sh1,500 for Wi-Fi and Sh4,000 for water and electricity. I also provide Sh2,000 for my mother’s upkeep and Sh6,000 for my younger sibling’s university fees. I am repaying a shylock loan of Sh200,000 in monthly instalments of Sh30,000, and my monthly shopping expenses amount to Sh30,000. Please help me to get out of debt as I am approaching 40 years.

Dominic Karanja, a financial and investments consultant

You are in the accumulation phase of your life where you should focus on building and growing your wealth. This phase involves higher earning potential, active saving, investing, and planning for future financial goals.

It is time for you to make hard choices because your current expenses exceed your income, which is why you are struggling to pay your debts.

Your monthly income is Sh90,000, and your monthly expenses are around Sh100,500. On your list of expenses, you may have overlooked items such as transport costs, personal care, healthcare, entertainment and more.

To reach your financial goals, develop a comprehensive financial plan and a budget. Monitor all your income and expenses to identify areas where you can cut back.

Consider using budgeting apps or spreadsheets to help you manage your finances. Apply the 50:30:20 budgeting rule, where you allocate 50 percent of your after-tax income to your needs, 30 percent to your wants and 20 percent to your savings and investments.

A need is something you require to survive while want is something you desire. Savings refer to the money you set aside, while investing involves putting those saved funds into productive income-generating activities.

I would classify your wife’s education, daughter’s schooling, housing, water and electricity, shylock loan repayment, commercial bank loan repayment and shopping as part of your needs, and the rest of your expenses as part of your wants.

Based on that classification then you are spending Sh91,000 on your needs against the expected target of Sh45,000 and Sh9,500 on your wants against the expected target of Sh27,000.

You spend a third of your income on shopping and you need to reduce this amount to about five to 10 percent of your income to save at least Sh18,000 from this expense item.

Evaluate your shopping habits and identify areas where you can cut back. Consider cooking at home more often, limit dining out and avoid impulse purchases.

You spend 20 percent of your income on paying school fees for your wife and daughter. If you move your daughter to a cheaper school, you can save Sh4,000 per month, which is half of her fees. Look for ways to reduce water and electricity usage.

While supporting your parents and siblings is commendable, you should always make sure it is within your means. Have an open conversation with your dependents about your financial situation and consider alternative ways to support them without overburdening your finances.

Currently, you are spending Sh8,000, which is eight percent of your income on your mother’s upkeep and sibling’s university, which is commonly known as “black tax”.

Although there is no recommended amount of black tax, I would recommend that you dedicate not more than five percent of your income on this and maintain this discipline so that you can save Sh3,000 from this expense category.

You should consider reducing Wi-Fi expenses by more than half so that you can save at least Sh1,000 per month unless you need the internet for remote working arrangements.

Your spouse needs to be involved in some income-generating activities so that you can save the 11 percent of your income that you are spending on her school fees. The income that your spouse will be generating should assist in paying some of the family expenses.

The cost-cutting measures can save you around Sh36,000 per month. Based on your income, the target on the saving and investment should be at least Sh18,600.

I would recommend that you set up an emergency fund that can take care of at least six months of your living expenses in case of unexpected mishaps. I would encourage you to invest your emergency fund in a money market fund.

Make sure you have adequate insurance cover to protect yourself against unexpected expenses. Considering the financial pressure, you are under now, it is crucial that you seek ways to increase your income.

This could involve finding a higher-paying job, taking on additional work, or improving your skills to enhance your market value.

Prioritising debt repayment is key, as it will allow you to direct more of your income toward savings and investments. You need to limit your monthly loan repayment to not more than 30 percent of your net salary.

To manage your debt situation, you can consider debt consolidation. If you go this route, the consolidation should be from the Sacco so that you offset the more punitive shylock debt first. If debt consolidation is not possible you will need to adopt the debt avalanche repayment method.

This involves making minimum payments on all your debts and then applying any additional funds to the debt with the highest interest rate first. Since shylock loans are short-term and expensive, prioritise paying them off first.

Contact your bank to discuss restructuring your loan or extending the repayment period to reduce monthly payments. A personal loan of Sh700,000 with an annual reducing balance interest rate of 18 per cent, payable over 36 months, would require monthly payments of Sh25,500.

Ensure that loan repayments do not violate the “one-third rule”, which requires that you retain at least one-third of your salary after all deductions.

Make your retirement savings part of your financial goals because pension saving assures you a good life after retirement and it also offers you some tax benefits.

I would encourage you to start saving with the Sacco and always remember to capitalise your Sacco dividends to deposits to help increase your borrowing power and earning of high dividends in the subsequent years.

Saccos are a good source of development loans because they can advance a loan amount that is three times your savings. Consider seeking advice from a financial advisor who can assist you create a customised financial plan.

If you have any money problems, send us an email at [email protected] and leave your contact number. Money questions will be answered on this column.