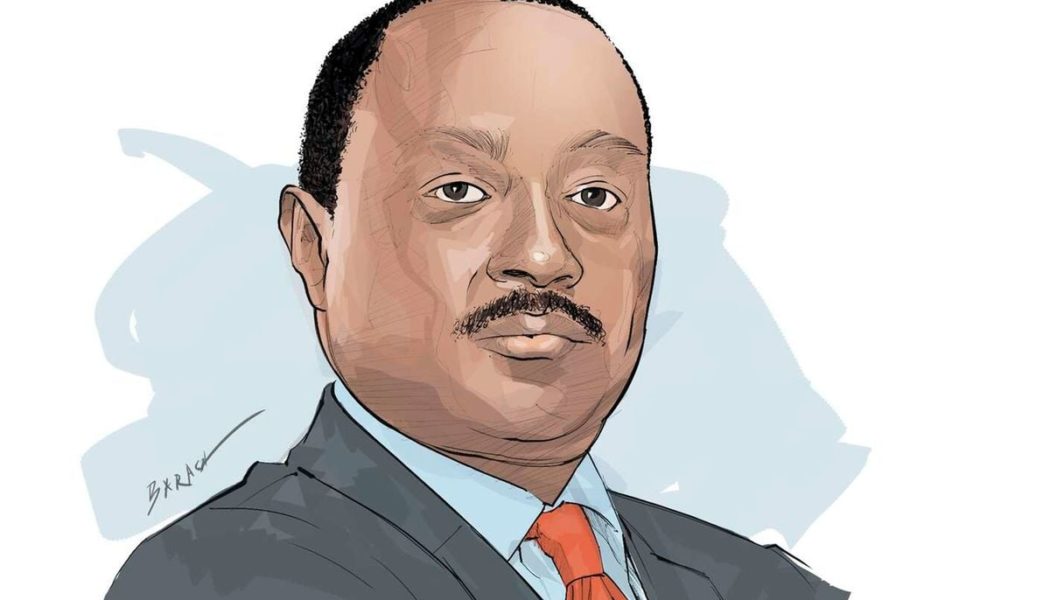

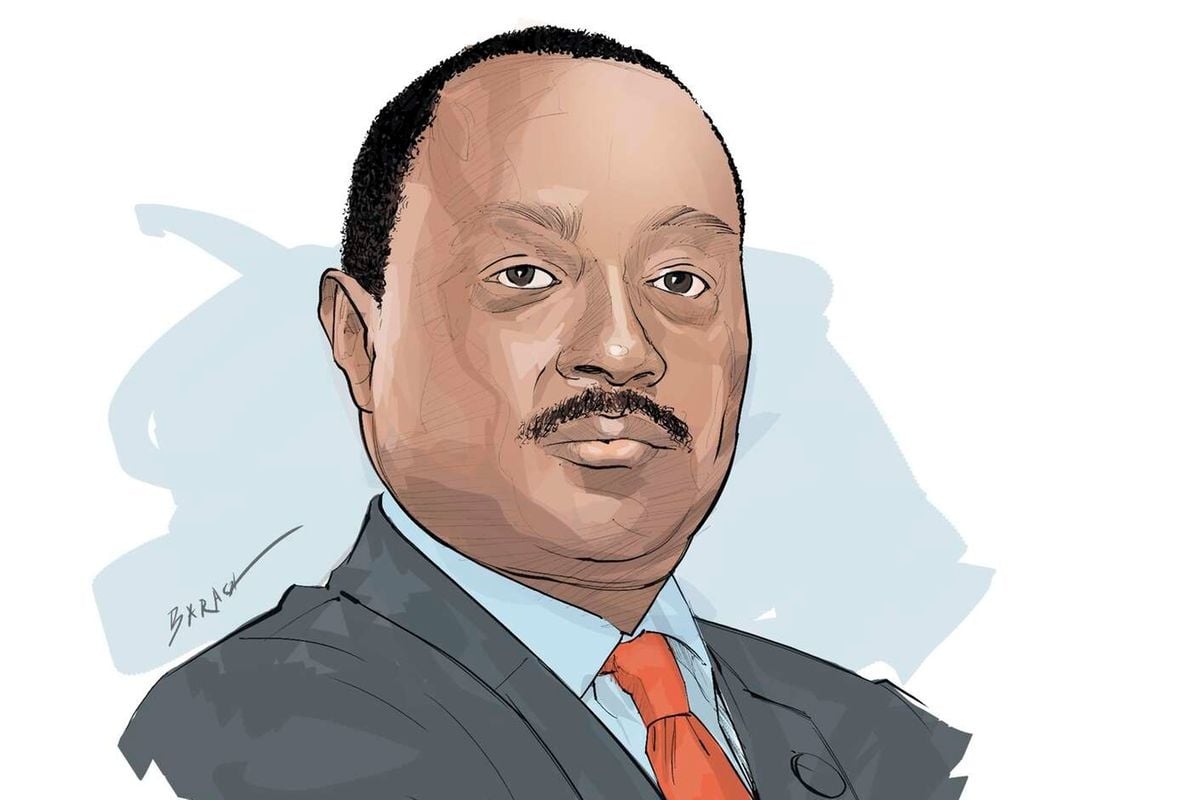

Frank Mwiti’s reign as the chief executive officer of the Nairobi Securities Exchange (NSE) kicked off in May on an upswing as the market was buoyed by improving investor sentiment following the successful refinancing of the $2.0 billion Eurobond.

Coming from the private sector into the public markets, some have characterised him as an unusual pick to steer the bourse at a challenging time. Mwiti talked to Julians Amboko on his agenda for the NSE.

Many of us were surprised by your appointment as the CEO of the NSE. Your background is in private markets having served as markets leader for East Africa at Ernst & Young. What stark differences are you seeing and how well prepared are you for the public markets?

It is true, I have spent years serving clients from an investment bank and corporate finance standpoint.

One major difference now is that in my new role the interface with government and regulation is a lot higher than what I am used to.

Another difference is that the interface with larger foreign investor communities is now also more pronounced than what I am used to.

Also, the interface with retail investors, who are quite demanding, is more pronounced than what I am used to.

One of the value adds that I see from the private markets is in addressing fragmentation in the public markets so that stakeholders are more integrated. Another area I see the private markets experiencing impacting the public markets is in the speed of execution when we take a decision.

Wooing strong activity from domestic investors has arguably been the main headache for all your predecessors. Our exchange is dominated by foreign investors and that means its performance is highly susceptible to external factors that are largely beyond its control. How do you intend to address this?

Solving that is what I literally wake up every day thinking about. The first bit has to deal with investor education and awareness. We need to have the majority of our would-be investor community very clear on how to invest and why they invest. If you are investing for capital gains, the value proposition on some of the counters is very different from that for an investor investing for dividend yield.

The second thing is that we need to enable investors to come to market without a lot of friction and they should be able to exit the market similarly. There’s also some work to be done on the issuer side through creating awareness on their corporate actions. Some listed companies issue dividends and the market does not even know.

Some have argued that the NSE suffers a product-market mismatch. Whereas new products are rolled out periodically and relatively better than peer exchanges in this region, uptake by the investor community tends to be low because of what some have assessed to be a product-market mismatch. How do you respond to this assertion?

We need to bring more innovative products to our market and we are thinking along the lines of indices, exchange traded funds, deepening our derivatives offering, and bring more cross-listings.

We are in the process of building a new strategy for the period 2025 – 2029 and one of the issues in it is product development. We want to enable investors who don’t necessarily have big tickets to be able to come to market.

Suppose you have Sh1000 you should be able to come to market and so we are looking at fractional trading among other offerings which will then mean that more liquidity comes to market.

What makes you so bullish about fractional trading as a game changer in this market? Day trading was launched in December 2021 with immense hype around appealing to the retail market. It hasn’t delivered. We had a similar conversation when Securities Lending and Borrowing (SLB) was launched in February 2022 and it was precisely targeted at the challenges you are highlighting. It has never lived up to the billing.

We have recently done a review of Day Trading and the truth is that the way it was planned for launch versus the way it was implemented point to gaps.

So, we are relooking at the product including following up with the market so that it is aware of the offering. On Securities Lending and Borrowing, it is the same thing and in fact for it we are almost starting from scratch. You might have good ideas but it is all about execution at the end of the day.

We must be careful about copying and pasting products from other markets and I think SLB has a bit of that problem. SLB, Day Trading and Fractional are tried and tested ways of developing markets and we don’t need to re-invent the wheel. Fractional trading is taking a different route and we have decided we must pilot it properly. I have no intention of spending my time doing bell ringing and then look for another thing to do bell ringing, we must get execution right.

In your half-year 2024 numbers, it looks to me like the NSE has a cost management problem. Is this a view you share and what’s your plan to remedy it?

Our cost-to-income ratio is not the best in the market. There are two big components of costs and one related to our tech and the other is staff costs.

We are looking at opportunities where we could get into revenue share models so that we don’t get into a capital expenditure discussion, it becomes an operational expenditure discussion that is tied to outcomes. We have quite some opportunity to manage our tech costs.

We have halted any material upgrades that are either unnecessary or that can be delayed as we figure out what our new tech roadmap will be.

We also relooked into our existing costs to see where we either are overpaying or paying for things that we are not using. So, we will be rationalising that.