Continued payment of allowances that were long abolished, some that are catered for in the basic salary and the creation of mystery allowances are among major contributors to the burden on Kenya’s public wage bill, which is estimated to have hit Sh1.17 trillion in the year to June 2024.

This has been revealed by a new report by the Salaries and Remuneration Commission (SRC), which exposes loopholes that have led to a proliferation of allowances in the public service from 31 in 1999 to 247 by 2019.

In the year to June 2023, allowances constituted Sh440 billion of the Sh1.1 trillion public wage bill.

In the report capturing salient features of allowances payable in the public service, the SRC reveals that over the years, different government institutions have created new allowances, some of which are unclear, illegal and others simply duplicated, contributing to the growing burden even as public servants remain unproductive.

“There are differentials in how the allowances are paid, within similar grades and across the grades, in the public sector. Allowances are paid for a similar purpose although the nomenclature varies from one institution to another and the justification and eligibility criteria for some allowances are unclear and/or vary across the public sector,” the SRC notes.

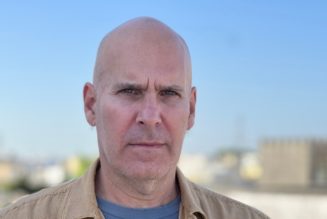

The report, released last week ahead of the current commissioner’s scheduled exit from SRC on September 11, also notes that there are inconsistencies in the payment of some allowances, notably leave allowance, which some institutions compute as a percentage of basic salary, while others in absolute figures.

As a result of the inconsistencies and the creation of new allowances amid a lack of regulation over the years, the SRC notes that in some sectors, entities have ended up paying employees allowances that are more than double their basic pay.

“The proportion of allowances to the total pay in some subsectors of the public service has increased and some allowances such as Owner Occupier House Allowance and Quarter Per Diem for local travel that were abolished are still being paid,” the commission notes.

It also says that some institutions have created allowances just for purposes of attracting and retaining some employees, while some “job specific allowances are paid for the same compensable aspects as those for which basic salary is paid.”

Inequitable pay

Between July 2020 and June 2023, the government spent a total of Sh1.25 trillion on allowances. Over the same period, the Kenya Revenue Authority (KRA) collected Sh5.87 trillion taxes, meaning that for every Sh100 taxes that Kenyans paid over the three years, public servants were consuming Sh21.26 as allowances.

The 2020/21 fiscal year saw the allowances stand at Sh394 billion, followed by Sh413 billion in the next year and rising to Sh440 billion in the year ended June 2023.

These items comprise house, commuter, hardship, annual and travel allowances.

Since 2021, the SRC has been streamlining and abolishing some of the allowances, but outgoing chairperson Lyn Mengich said last week that the next phase of review, which will address institutional-specific allowances, is where the real task lies in plugging the loopholes.

“That is where the real issue about inequitable pay happens, it is at allowances level. Streamlining allowances is one way of achieving harmonisation,” Ms Mengich said.

Among the allowances abolished in the first phase were the ministerial allowance for Cabinet secretaries, the plenary sitting allowance for MPs and MCAs and the taxable car allowance for CSs, principal secretaries and judges.

Ms Mengich said the abolition and rationalisation of allowances saved taxpayers Sh11.2 billion that would have been paid unnecessarily.

The third phase will see the SRC engage with public institutions on institution-specific allowances that either need to be merged, renamed, restructured, abolished or retained, the SRC says.

The commission notes that the proliferation of allowances in the public service has led to “lack of transparency, inequity and unfairness in coverage, multiplicity and high proportions of allowances to basic salaries, and consequently, disparities in the gross pay paid to public officers.”