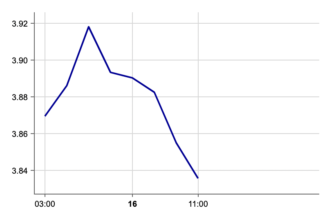

Question: I am married with two children aged five and nine. I work in Nairobi, but my family is upcountry. This is my third month of employment, and I am earning a net salary of Sh43,500. My budget is as follows: Rent in Nairobi Sh9,000, rent upcountry Sh7,000, upcountry household budget Sh11,000, my Nairobi household budget Sh6,000, fare Sh3,000, upcountry fare Sh1,200 (biweekly). I am left with about Sh6,300 but most times, I can’t account where this disposable income goes.

I have raked in four different mobile debts amounting to Sh36,700 which are in default; one debt of Sh6,700, Sh24,000, Sh2,500 and Sh3,500. I would like to pay these debts off and get out of CRB to take a bank loan of Sh250,000 to open a business upcountry for my spouse who is currently jobless. I am thinking about opening a cereals or hair salon business. Please advise on how to achieve this.

Answer: Getrude Njeri is an accountant, personal finance and investment consultant. She works as a community manager for an investment company in Nairobi

It’s great to see that you’re thinking about setting up a business for your wife. It is clear you’re focused on creating a stable future for your family, and that’s commendable.

Starting a business could be a game-changer, not just for your household income, but also for your wife’s financial independence and growth.

However, before diving into this plan, you must make sure your current finances are in order so that you can move forward without compromising your current financial status.

Start by tracking every expense to understand where that Sh6,300 is going. Use a simple app or a notebook to jot down every purchase and amount sent upcountry, and any that you spend in Nairobi. This will help identify any unnecessary expenses. If you are not sure about every item you spent money on in the previous month, and or, in the August days to today, you can start this from the moment you receive your upcoming paycheck. List down every expenditure, big or small. You must realise that what may seem like a minute expense at the start of the pay cycle could accumulate into a significant expenditure by the end of the month.

Next, prioritise debt repayment. This should actually be your first priority. With a total of Sh36,700 in mobile loans, it’s crucial to get out of default and off the CRB blacklist. Start with the smallest debt (Sh2,500) and work your way up. Pay Sh2,500 first (while making minimum payments on the other loans) then pay off Sh3,500, then Sh6,700 and so on. This is known as the snowball method and can give you quick wins to build momentum.

Reduce your expenses. Consider whether you can reduce the rent by relocating to more affordable places. If, for instance, you can find places at Sh6,000 and Sh5,000 respectively for Nairobi and upcountry, you would save up Sh6,000. Since you live alone, it can be especially possible for you to find and access affordable rentals within Nairobi – the caveat being that affordability for such might not be accompanied with the comfort you’d otherwise need if you were looking for a family rental.

Cutting down on rent would reduce the percentage of income spent on rent from 36.8 per cent to 29.9 per cent, which would free up funds for debt repayment or for building of an emergency fund. It would also reduce your financial pressure without significantly impacting your family’s living conditions.

Examine the Sh11,000 upcountry and Sh6,000 Nairobi household budgets for any possible savings. Small adjustments like meal planning, reducing utility usage, or cutting non-essential expenses can make a difference. One way to do this is by taking advantage of your upcountry family travel-time to access affordable groceries for your meals in Nairobi.

Allocate any savings from reduced expenses directly to debt repayment until you’re back on track. Consider starting an education savings fund for your children. Even small, regular contributions can grow over time and help cover future education costs.

Before taking a Sh250,000 loan, research the market demand for cereals and hair salons in the area you think you will establish the business. Speak to local entrepreneurs and gauge which business has higher potential, then create a simple business plan that will outline the startup costs, expected monthly expenses, and projected income. This will help determine how much capital is needed and whether the loan amount is realistic.

Given your current financial situation, taking on a large loan may not be the best move right now. Focus on clearing your existing debts first and consider saving up gradually or seeking alternative funding (like a smaller Sacco loan or a business grant).

You have mentioned that your spouse is currently jobless. Sit with her and explore other income-generating hustles she can engage in that will not be as capital intensive. For instance, based on her academic qualifications, what job can she get upcountry?

This exploration can also determine if her credentials would be more marketable in Nairobi and the approximate net salary she could earn, based on which you could explore whether bringing your family closer to you in Nairobi and living under one roof would be financially feasible or not if you were both formally employed and earning.

Once you are debt-free, start building an emergency fund to avoid falling back into debt. Aim for at least one to three months of expenses for a start. If possible, involve your spouse in finding ways to cut costs or increase income.

This could be through a side hustle, part-time work, or helping with business planning. By tracking your spending, prioritising debt repayment, and making strategic budget cuts, you can regain control of your finances.

If you have any money problems, send us an email at [email protected] and leave your number for contact. Money questions will be answered in this column