With China’s consumer confidence in 2024 still taking hits, the recovery of luxury goods consumption has proven to be shaky. Some brands like Miu Miu achieved stratospheric growth in 2024, while others, like Burberry, have suffered, so much so in the British fashion house’s case that a long term look at the brand’s company structure is necessary.

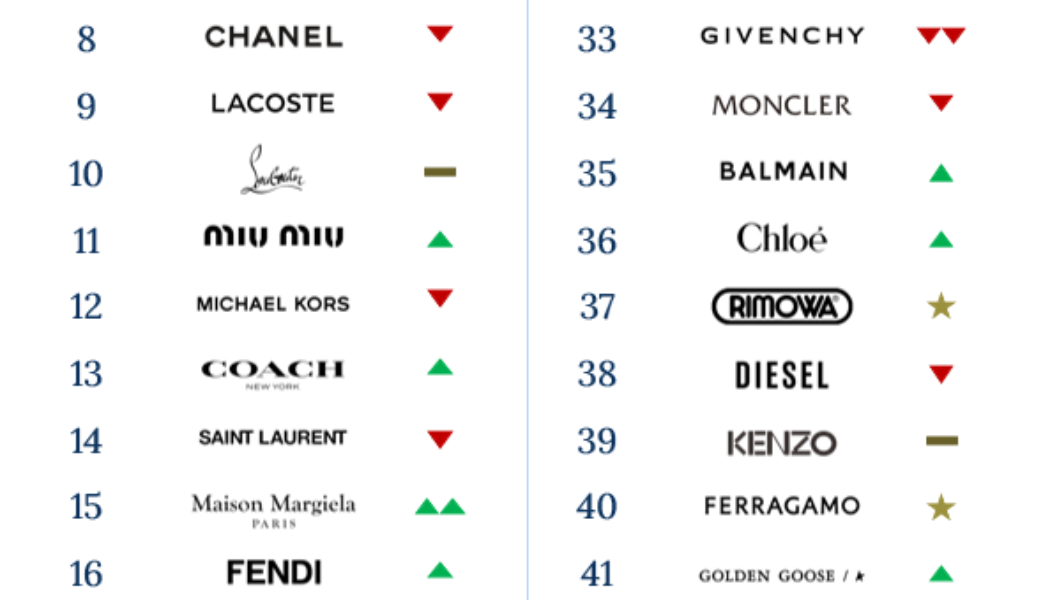

As social media impact is key to brand performance in China, ReHub’s quarterly Compass Index provides a barometer for luxury and premium brands and the impact of their marketing and consumer noise. Based on data from both Brand Generated Content (official accounts) as well as user generated content (organic mentions and engagements), the index covers WeChat, Douyin, Xiaohongshu (Little Red Book) and Weibo.

ReHub’s Compass Index looks at how brands rank among competitors and uncovers the marketing impact across key social media channels in China.

The second quarter includes key milestones for luxury brands. With the 520 and 618 shopping festivals both falling in the quarter, as well as an extended public holiday at the beginning of May, it is a key period to attract consumers’ attention.

A successful second quarter can produce immediate returns from these festivals and travel periods, and in turn can also help build momentum leading into the summer travel period, Qixi Festival, October national holidays and finally Singles’ Day on November 11. This period can be the difference between growth or decline for brands with Chinese consumers.

This year an even more complex picture has emerged. First quarter revenue reports revealed significant performance polarization among key players in the industry, with some generating strong growth in China as well as other key global locations.

In addition to this polarization, the travel recovery, coupled with favorable currency valuations, has led to markets such as Japan becoming key destinations for Chinese consumers spending on luxury spend.

While the point of purchase may be shifting, it is important to note that the point of influence is relatively more stable. There is no more important time than now for brands to be communicating their values in the Chinese market to fuel revenue growth.

Balenciaga

Balenciaga held its Spring/Summer 2025 show amid the backdrop of a rainy Shanghai. Holding fashion shows in China has proven to be a good move over the past year. Shows such as Balenciaga’s recent foray and Louis Vuitton’s Voyager presentation in April have helped to drive relevance and deeper connection with Chinese consumers.

Maison Margiela

Maison Margiela has had a very successful past year and is one of the key driving forces for growth within OTB Group, which posted 10.2% YoY growth for 2023. Specifically, in Q2 Margiela successfully navigated the complexities of the 520 and 618 shopping festival, being relevant and present for both.

Its 520 T-shirt was a mainstay product on Tmall throughout the festival, and in 618 it doubled down on shoes, going beyond the classic replica sneakers to develop its Tabi collection – the brand’s Tabiology event was the key driving factor for engagement in Q2.

Loewe

Lacoste shot up the Compass Index last quarter thanks in large part to its signing of Chinese superstar Wang Yibo. Loewe followed suit, signing him as its ambassador in late June, coinciding with its Spring/Summer 2025 fashion show during Paris Fashion Week. The brand has also driven brand uplift through interesting designs (its Pixel clothing line being a key highlight).

The Loewe Crafted World exhibition in Shanghai, while launched in Q1 continued to drive engagements and uplifts in Q2 – all in all the brand has cemented its place as a go-to case study within luxury on how to blend heritage, innovation, and celebrity into one coherent brand experience.

Ami Paris

Another brand taking its shows to China, Ami’s presentation was held in Suzhou in April, driving a huge uplift in user generated content

Ferragamo

Ferragamo has found its feet by revitalizing its connection with lady’s footwear. Its Vara shows have been top performers on Tmall over the past months.

Dolce & Gabbana

Opening Casa Dolce & Gabbana in Zhuangyuan, Shanghai, a trendy district packed with luxury houses, heralds a return to the China stage for the Italian fashion brand, perhaps one of its boldest moves since its public relations fiasco in 2018.

As we move into Q3, expect to see similar global revenue performances as Q1, but with a relatively more favorable basis for comparison in Q3 and Q4, pockets of growth should start returning. Brands that have invested ahead of this during, will no doubt hope to start seeing a return on this investment in China, and are the ones to keep an eye to see how the luxury segment continues to evolve.

Shanghai-based Thomas Piachaud PhD is Head of Strategy at luxury data solutions agency ReHub.