More tax pain for Kenyans as government plans to collect more revenue for the financial year ending June 2025.

According to the 2024 budget summary, the administration of President William Ruto has set the total ordinary revenue collections at 2.91 trillion up compared to Sh2.57 trillion in the 2023/24 initial budget estimates.

In a move to expand the tax base through the Finance Bill 2024, the government has received numerous criticisms and opposition as it targets key commodities that resonate with low, middle and upper-income classes.

For instance, levies increment between 15 to 20 percent on financial transactions such as M-Pesa, a widely used payment platform used across Kenya will affect everybody. Moreover, a 2.5 percent tax based on the car value with the minimum amount set at Sh5,000 will impact all those owning private and commercial vehicles.

The Kenya Revenue Authority collected Sh1.54 trillion in taxes in the nine months to March 2024 against a target of Sh2.5 trillion. This was an improvement as it was a 10 percent growth in tax revenues compared to a similar period last year that recorded Sh1.39 trillion.

“The growth in tax revenue has been attributed to the implementation of the Finance Act 2023 and the actualization of tax administration strategies,” notes the report by the Controller of Budget.

The Bottom-Up Economic Transformation Agenda will receive Sh257.3 billion coupled by significant allocations in key areas such as social services and infrastructure in the coming financial year.

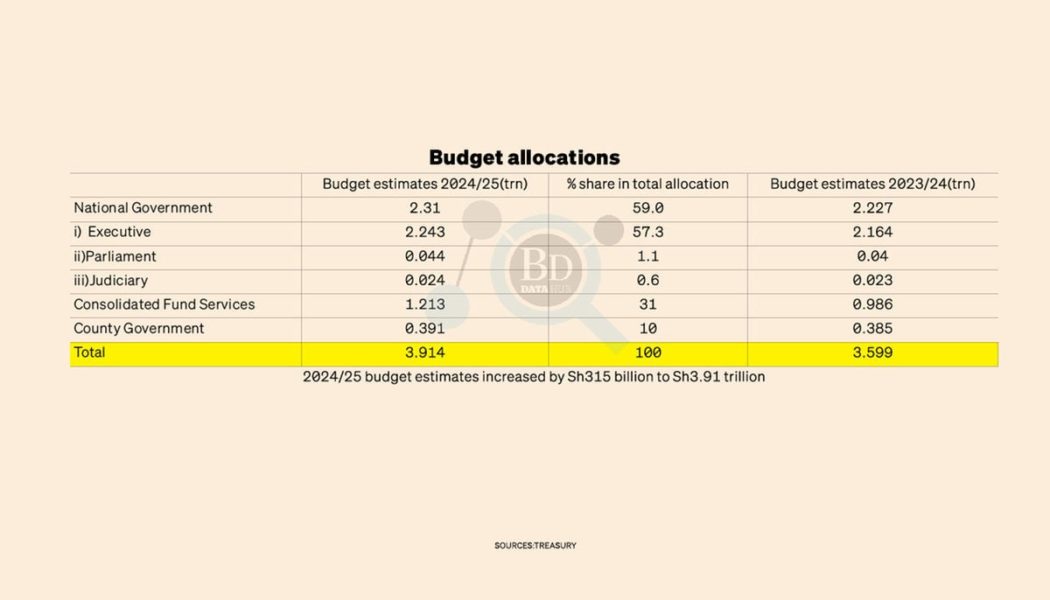

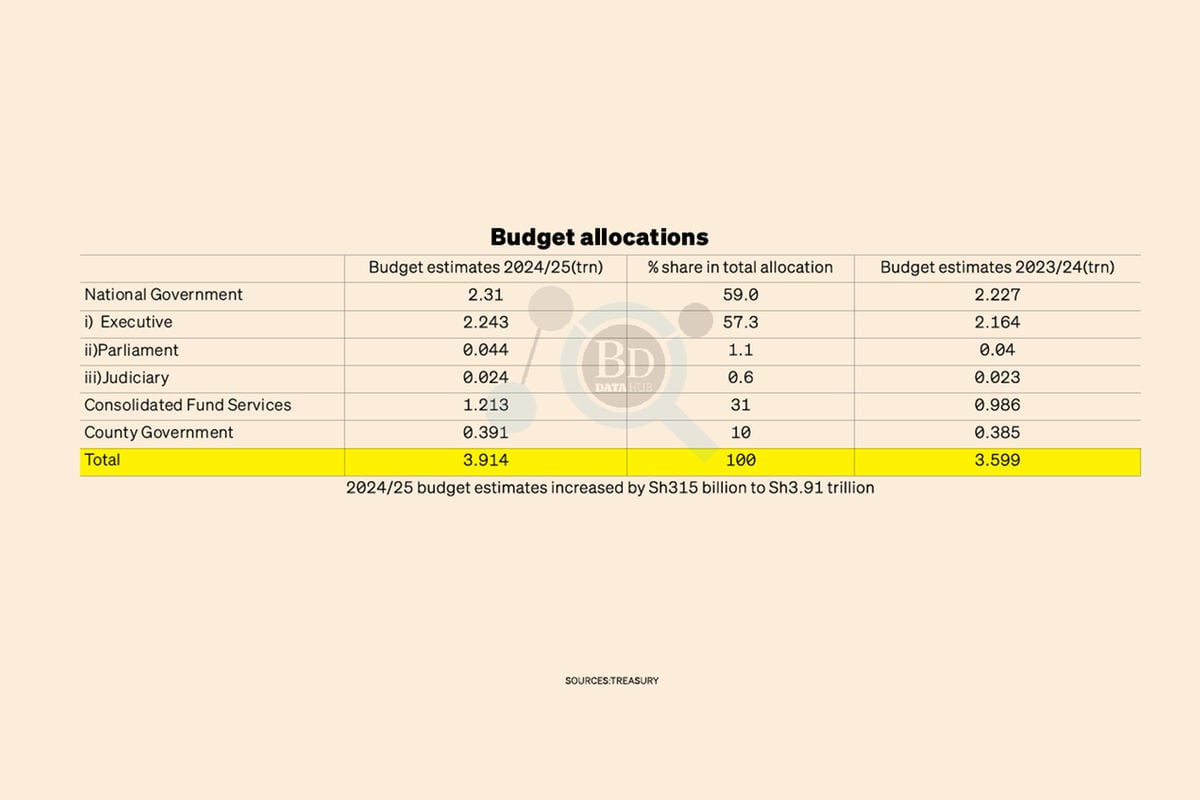

While the total spending plan as per the estimates stands at Sh3.91 trillion, serious concerns emerge regarding the enormous allocations anticipated to finance debt service and recurrent spending.

Debt service allocations are estimated at Sh1.8 trillion, accounting for 47 percent of the total budget while development spending will only receive Sh687 billion.

Projected revenue for 2024/25 will be Sh3.35 trillion down Sh81 billion from the initial estimate of Sh3.43 trillion with the government setting Sh2.91 trillion collections target.

Based on the estimates, the Treasury anticipates budget deficit to narrow to Sh514.7 billion to be financed through Sh257.9 billion in domestic financing and Sh256.8 billion in foreign financing.