A resurgent US dollar amidst heightened geopolitical risks and fading hopes of multiple interest rate cuts by the US Federal Reserve have reversed a major rally of the Kenya shilling in what has seen the local unit begin to weaken.

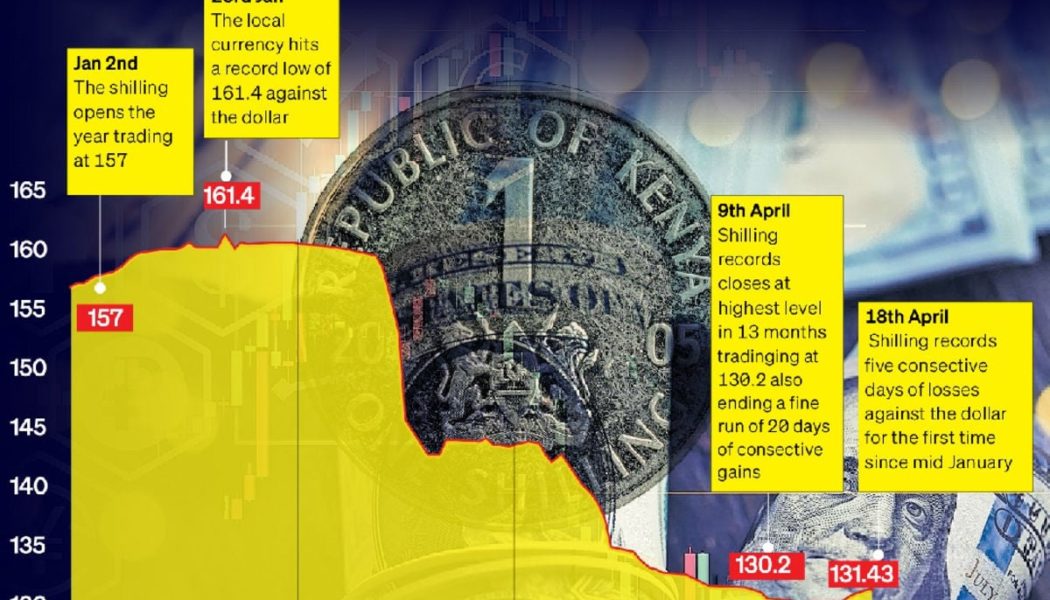

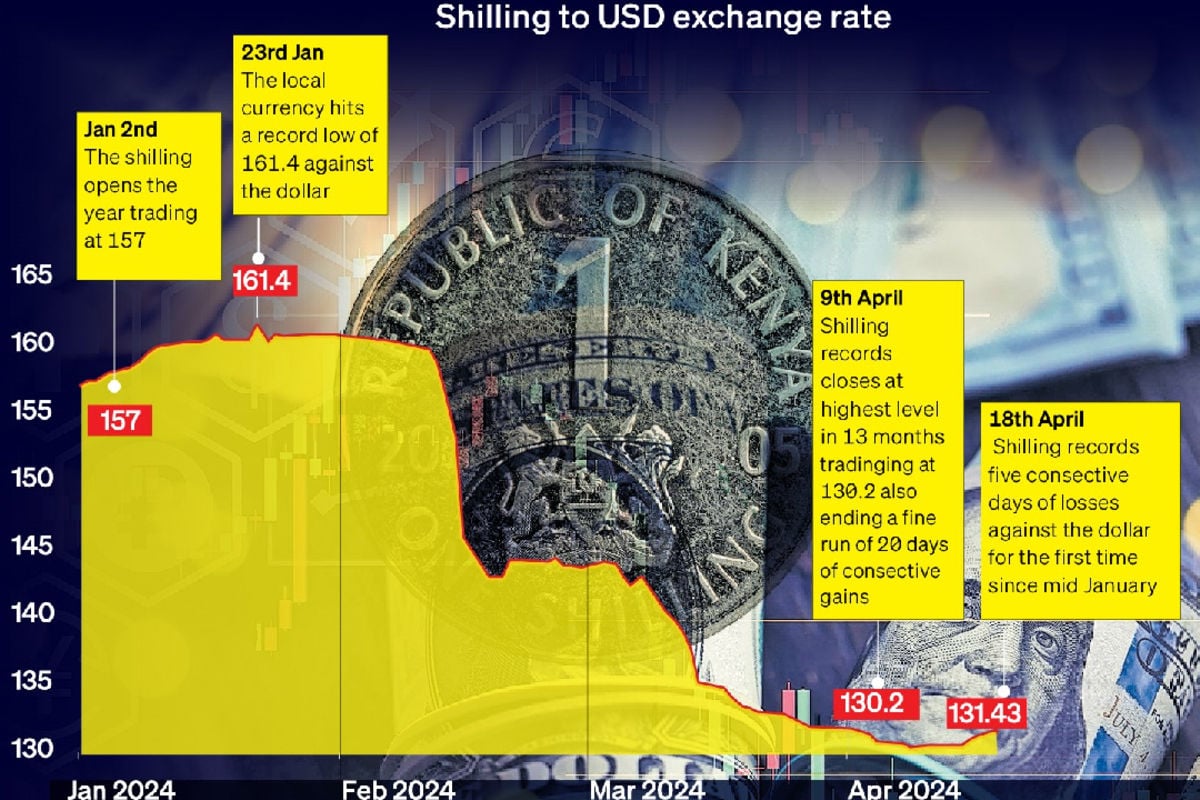

Data from the Central Bank of Kenya (CBK) shows that one dollar was exchanging for 131.44 shillings by end of last week, representing a fifth straight day of weakening for the local unit since April 11 when the official exchange rate stood at Sh130.35, having aggressively gained from a record low of 161.36 at the end of January.

On Friday, commercial banks quoted the local unit as high as Sh137 in contrast to lows of Sh131.9 a week prior.

Equity Bank sold dollars at Sh137 at the end of last week while Co-operative Bank of Kenya and Stanbic Bank both quoted the exchange rate at Sh136.5. KCB had a lower quote of Sh135.3.

Previously, the Kenyan shilling had staged a 20-day winning streak against the greenback, rallying to Sh130.22 on April 8 from Sh142.8 on March 7.

Analysts have attributed the changing exchange rate trend to a stronger dollar which has resulted from an escalation in geopolitical risks in the Middle East following the Israel-Iran tiff, which has raised investor jitters.

The US dollar index, which measures the value of the US dollar relative to a basket of foreign currencies that includes the Euro, British pound and Japanese Yen, has gained by more than one percent so far in April, reaching 106.151 as at the close of Thursday last week from 105.019 on April 1.

“The Kenya shilling is not necessarily losing ground but rather, the US dollar has been gaining ground against all major world currencies. The depreciation is a factor of dollar strengthening and the shilling is performing just as well,” Standard Investment Bank Senior Research Associate Stellar Swakei told this publication.

A weaker shilling returns the prospect of costlier debt and expensive imports on the table as more shillings are demanded for goods and services of the same US dollar value.

Muathi Kilonzo, the head of Equities at EFG Hermes, said that the weakness of the shilling is positive as it mirrors the unit’s correlation to other world currencies.

“The dollar is probably back to where it was in November last year. The weakness is kind of a good thing as it shows that our exchange rate is tracking movements of other world currencies,” he noted.

The CBK noted recently that it had allowed the exchange rate to float freely while keeping the intervention button close by in the case of volatility.

The apex bank did not, however, disclose what it finds to be the equilibrium for the exchange rate.

Market consensus on the fair exchange rate has also been lacking as participants continue to debate the equilibrium point for the shilling.

For instance, while Equity Group CEO James Mwangi considers the exchange rate is slowly creeping to the equilibrium, NCBA Group CEO John Gachora recently warned of the likelihood of a weaker shilling from a resurgence in forex pressures.

“I think the demand will come back because people will need to trade. Perhaps, what was bought and built up is what’s in use. Very soon, they will come back for more and we will see the shilling going back to its true value. We don’t know the true value but certainly, it’s not where it was, I don’t think it’s where it is at the moment, it’s somewhere in the middle,” Mr Gachora said.

The shilling remains among the best-performing currencies in 2024, with its year-to-date gains against the dollar standing at 16.2 percent.

The issuance of a new Eurobond whose proceeds were used in a partial redemption of Kenya’s debut Eurobond, which will mature in June, catalysed the unit’s gains as investors discounted default risks attached to the maturity.

Fears of a potential default by Kenya saw investors take bets on the potential devaluation of the shilling, sending the exchange to a low of as much as Sh161.35 on January 22.

Besides importers, the government has emerged as one of the biggest winners of the strengthening shilling after it cut the stock of external debt by Sh1.124 trillion in the last three months as a result of strengthening against major currencies.

Recent CBK data shows that the country’s stock of external debt now stands at Sh5.06 trillion down from Sh6.19 trillion at the end of January.

The 18 percent fall in external owings has been attributed to the recovery of the local currency.