Companies

Banks to link part of bonus to green financing targets

Friday September 08 2023

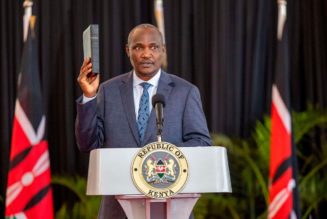

Kenya Bankers Association Chief Executive Officer Dr Habil Olaka at Sarova Stanley Nairobi on March 1, 2023. PHOTO | DENNIS ONSONGO | NMG

Commercial banks are set to link part of staff pay, including bonuses, to climate-related milestones following the adoption of a climate-related financial disclosures template.

The guideline is anchored on governance, strategy, risk management, metrics and targets and aims to enable banks to appropriately and comprehensively report their respective climate-related risks and opportunities.

Read: Global banks are fuelling Africa climate crisis: report

Banks will be expected to increase the amount of executive management remuneration impacted by climate change considerations while other staff would have bonuses based on the sale of green products relative to a year-to-year baseline.

The adoption of the template moves away from the current remuneration structure where compensation to staff is tied heavily to the financial performance of respective institutions and profits.

In addition to tying staff pay to climate considerations, banks are expected to apportion investments to be deployed toward climate-related risks and opportunities including allocations to portfolios such as electric vehicle manufacturing.

Lenders are to set a proportion of revenues, assets and other business activities, aligned with climate-related opportunities.

For example, banks would document revenues from products or services supporting the transition to a low-carbon economy or the number of green buildings financed.

The template is expected to allow commercial banks licensed by the Central Bank of Kenya (CBK) to comply with its guidance on climate-related risk management issued in 2021.

Read: Treasury set to establish climate finance bank

“Through our Sustainable Finance Initiative e-learning training, we have been able to sensitise our members to make lending decisions that benefit the environment, society and economy,” noted Kenya Bankers Association CEO Habil Olaka.

KBA said the programme had reached over 45,000 banking sector employees including ex-staff since 2015.

The climate-related reporting template was developed through KBA’s Sustainable Finance Initiative.