Economy

Insider fraud bleeds saccos Sh118 million in past 2 years

Friday September 08 2023

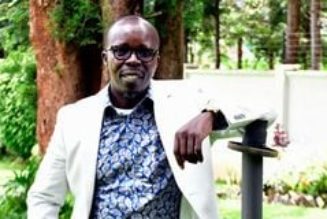

CEO of the SACCO Societies Regulatory Authority (SASRA) Peter Njuguna speaks during the SACCO Central(Shared Services) annual delegates’ meeting on April 15, 2023, at Sarova Stanley. PHOTO | WILFRED NYANGARESI | NMG

Savings and credit co-operative societies (Saccos) have lost Sh118.1 million in the past two years to fraud, mainly driven by staff, pointing to the increased need for reinforced systems and insurance covers to protect members’ billions of shillings.

Sacco Societies Regulatory Authority (Sasra), which oversees 359 Saccos, has for the first time disclosed the fraud in the latest supervision report that sheds light on the operations of these entities that held Sh620.45 billion deposits at the end of last year.

Read: Sacco savers with more than Sh1m grows fastest to 92000

The loss was reported to Sasra’s investigative unit, Sacco Societies Fraud Investigations Unit, in addition to a Sh114.4 million that is also suspected to have been lost in the same period. Sasra does not disclose the names of the saccos that were hit by the fraud.

The fraudsters are capitalising on weak internal controls and mobile money services such as M-Pesa to carry out theft in a sector that is still waiting for the implementation of an insurance scheme to protect depositors from such losses.

The regulator notes that the cases show that the main perpetrators of the fraudulent activities are internal sacco officials.

There was only one incident of a cyberattack and breach-related fraud reported last year but it was also perpetrated in collusion with inside staff.

“The internal technical staff working within saccos’ ICT and credit departments have been noted to be the greatest collaborators in the perpetuation of fraudulent activities, and thus saccos are called upon to constantly review the adequacy of the internal controls in their ICT and credit functions,” says the Sasra.

In one instance, Sasra reports that in June last year, there was illegal withdrawal of Sh29.4 million from certain members’ savings accounts using unregistered mobile phone numbers, and then the money was transferred to M-Pesa accounts.

Another sacco reported last October that an internal staff linked members’ savings accounts to unauthorised mobile numbers and withdrew Sh1.6 million.

The same October witnessed a bizarre case where a person walked into a commercial bank, opened an account in the name of a Sacco, and tapped loans worth Sh1.16 million.

“An unknown person acting on behalf of a Sacco fraudulently opened an account at a branch of a commercial bank in the name of the complainant, then borrowed money from the sacco, which was deposited into that account,” says the Sasra.

The regulator also discloses that four saccos were, during a single weekend in December 2021, hit by several fraudulent transactions worth Sh22.2 million.

The Sh22.2 million was withdrawn from the saccos’ float and paybills, transferred to other M-Pesa accounts, and then withdrawn, leaving the saccos counting losses.

In April of the same year, unnamed sacco officers diverted to their account Sh642,000 meant for M-Pesa floats as well as commissions paid for undertaking mobile money business.

In one of the largest thefts, members of the public in January 2021 reported to Sasra investigators that they had lost Sh63 million to a certain unlicensed entity operating as a sacco.

Sasra says the investigating unit was told the unnamed entity mobilised millions of shillings from the public with promises of returns but folded abruptly. The case remains pending.

In yet another fraud case, fraudsters in February last year used dead members’ accounts and credentials to tap loans worth Sh24,784, leaving another Sh486,879 exposed to theft.

Read: Savers cash out Sh31bn Sacco savings on woes

Sasra notes that its investigative unit in the same February also received reports that certain officials of a sacco had fraudulently used the entity’s funds to purchase land, exposing members to a Sh55 million loss.

July last year also saw officials of an unnamed sacco reported to investigators for having embezzled Sh55.2 million from a sacco then channelling the same to a subsidiary between 2015 and 2020.