The luxury market in the Middle East – and particularly in Saudi Arabia and the UAE – is expected to grow significantly in the coming years, with more big spenders shopping for the finer things.

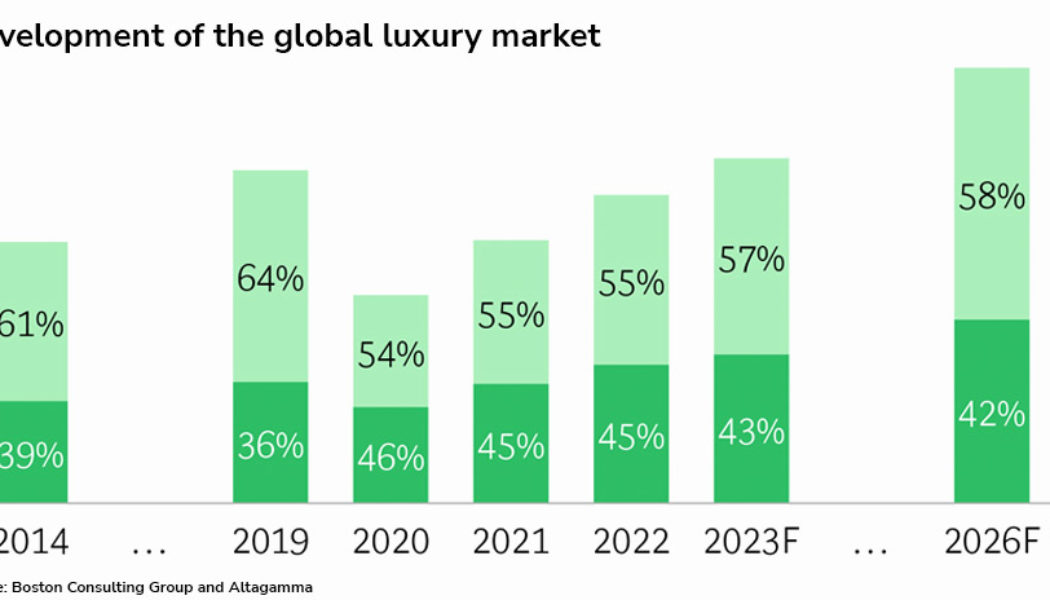

The luxury market in the Middle East is now worth nearly $16.5 billion and is expected to double in size by 2030, reaching up to $38.5 billion. That growth is projected to be driven mainly by the United Arab Emirates (UAE) and especially Saudi Arabia, according to a survey published by Boston Consulting Group (BCG) in partnership with Altagamma, the association of Italy’s top luxury labels.

“The high-end consumer has a double figures increasing propensity to spend. The number of points of sale is stable but with a significant increase in size and with the creation of unique experiences that are increasingly personalized and exclusive,” said Matteo Lunelli, Chairman of Altagamma.

“Consumer habits, values and omnichannel distribution methods are changing, while new collaborative and consolidation strategies are emerging both downstream and upstream of the supply chain,” he added.

The UAE and Saudi Arabia are the two main drivers of regional growth in the luxury market. In Saudi Arabia, the market is thought to be worth around $3.3 billion and is expected to double in size to reach about $6.5 billion in 2030. The luxury goods market offers many untapped potential owing to several factors including local development fueled by Vision 2030, increased domestic demand, and growth in high-end tourism.

The Middle Eastern countries – particularly the UAE – have become a haven for wealthy Russian nationals that have been eager to find places they can spend their money as Russians were hit with waves of sanctions from the US and EU. The Gulf countries have not enacted any sanctions on Russia or Russian citizens and have not shown a willingness to comply with existing sanctions from Western countries.

China, too, is expected to see serious growth in the luxury goods sector, also thanks to higher incomes and increased interest. Luxury goods are sure to be a hit when countries have a higher number of high net worth individuals – or those with personal assets of more than $1 million.