An activist investor is said to be pushing for change at the French conglomerate, which announced a sweeping reorganization of its top ranks this week.

Kering, the French luxury goods company that owns brands like Balenciaga, Alexander McQueen and Yves Saint Laurent, surprised the fashion industry this week when it announced a sweeping reorganization of its top ranks, including the departure of Marco Bizzarri, the longtime chief executive of Gucci, Kering’s premier brand.

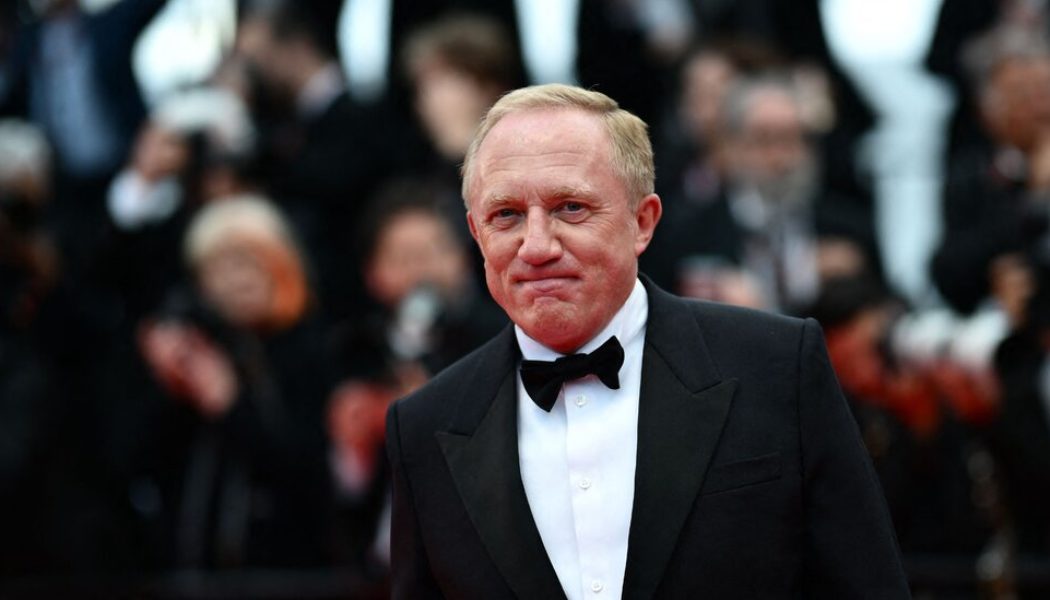

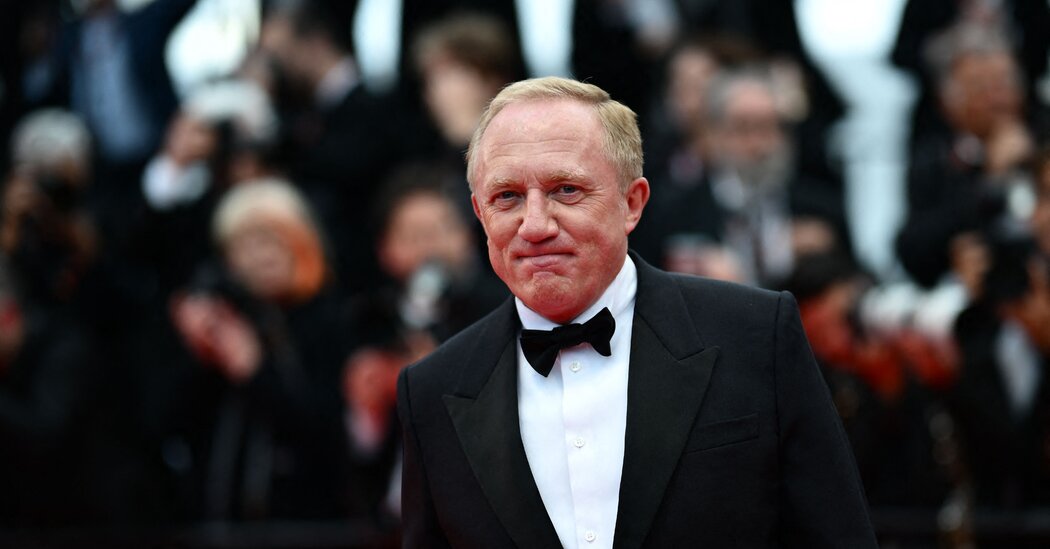

The move came amid a year of declining sales and stock performance. But the conglomerate run by the billionaire François-Henri Pinault is also under pressure from Bluebell Capital Partners, an activist hedge fund in London that has tangled with luxury titans before, said a person with knowledge of the matter who spoke on the condition of anonymity.

Kering declined to comment.

Activists have turned on the luxury industry in recent years. Dan Loeb’s Third Point as well as Artisan Partners called for change at Richemont, the owner of jewelry brands like Cartier and Van Cleef & Arpels. But the most active recently is Bluebell, a four-year-old, $250 million firm that has also taken aim at Richemont and the fashion brand Hugo Boss. (Bluebell has also pushed for change at BlackRock and the pharmaceutical giant GlaxoSmithKline.)

Bluebell failed to persuade fellow Richemont shareholders to add Francesco Trapani, the former chief executive of Bulgari, as a director, but the conglomerate agreed to give public investors more influence.

Bluebell has an ambitious goal for Kering. Though the hedge fund is seeking a number of changes at the conglomerate and at Gucci, it has also proposed a merger with Richemont, the person with knowledge of the discussions said.

But making the deal happen will not be easy. Richemont’s founder, Johann Rupert, said in May that he was not interested in a merger — and had rejected such a proposal two years ago. Mr. Pinault may not be interested, either. Moreover, both luxury companies are controlled by their founding families, making it nearly impossible for outside investors to prevail in corporate elections.

Bluebell is hoping that restive shareholders will join its push. Kering’s stock price has been eclipsed by rivals such as Hermes and LVMH in the past year, while sales rose just 1 percent, to 5.08 billion euros (then $5.58 billion) in the first quarter. But Kering’s stock rose more than 7 percent on Wednesday after Bloomberg first reported on Bluebell’s efforts.