Economy

NHIF to slap 9.5pc interest penalty on all defaulters

Thursday April 13 2023

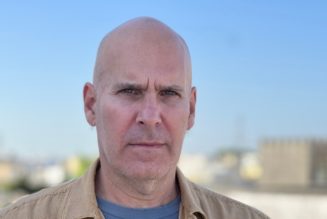

NHIF building in Nairobi. FILE PHOTO | NMG

Companies will from next month pay an interest penalty equal to the Central Bank of Kenya lending rate if they fail to remit or match contributions of their workers to the National Health Insurance Fund (NHIF) on time.

Acting NHIF chief executive Samson Kuhora said the insurer will start implementing the new penalty from May 1 to stop employers from defaulting on the contributions that should be remitted before the 9th day of the following month.

The fine is part of the NHIF (Amendment) Act, 2022 that took effect in January last year, but its implementation was delayed after companies went to Employment and Labour Relations Court and successfully challenged this requirement and its penalties.

CBK’s base lending rate is currently set at 9.5 percent, highlighting the hefty fines that await employers who default on their NHIF obligations.

The court froze implementation of the law and also barred Health Cabinet Secretary from gazetting any regulations that would operationalise the amended law, temporarily halting efforts by the insurer to collect an estimated Sh31 billion from employers.

“The NHIF Act No. 9 of 1998 which was amended on January 10th 2022 highlights the revised penalty rate on late contributions. The effective date for the new penalty rate is May 1st 2023,” Mr Kuhora says in the notice.

Businesses seeking to be exempted from this requirement are required to provide a private medical scheme with benefits equal to or better than those offered by the NHIF.

Employers went to court seeking revocation of the clause saying that it would increase operational costs and hit hiring

Self-employed contributors who fail to remit their Sh500 monthly contributions by the 9th of the following month will also pay a fine which is equivalent to 10 percent of the rate.