/cdn.vox-cdn.com/uploads/chorus_asset/file/24144155/1243896997.jpg)

“Look, I get that a lot of people might disagree with this investment, but from what I can tell, I think this is going to be a very important thing,” he said. “People will look back a decade from now and talk about the importance of the work being done here.”

“People will look back a decade from now and talk about the importance of the work being done here”

The problem is that a decade is a long time from now. And as Zuckerberg experienced on today’s earnings call, he is losing faithful supporters quickly. “I think kind of summing up how investors are feeling right now is that there are just too many experimental bets versus proven bets,” one Wall Street analyst said on the call.

“We do anticipate that Reality Labs operating losses in 2023 will grow significantly year-over-year,” Meta said in its earnings press release, just a few days after a large shareholder publicly pressured the company to reign in its spending.

Meta’s stock dropped a staggering 20 percent today after it reported a 4 percent drop in revenue growth. The results show Apple’s ad tracking prompt has cost it over $10 billion, advertising spending on its platform is continuing to weaken, and its stock is currently trading at a price not seen since the end of 2015.

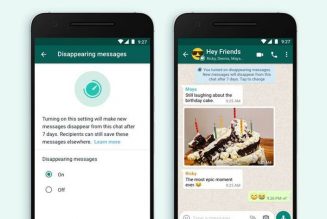

Zuckerberg tried to give investors reasons to be bullish today. He said there are more daily users on Facebook than ever before. Instagram and WhatsApp both have over 2 billion users, with the latter just starting a significant marketing push in the US that takes aim directly at iMessage. Even the company’s TikTok competitor, Reels, is starting to grow dramatically, with Zuckerberg saying, “we believe we are gaining time spent share on competitors like TikTok.”

That may be true, and this could be another painful moment of transition akin to Facebook’s shift from desktop to mobile or the introduction of Stories like Zuckerberg suggested. But for now, he is experiencing a crisis of confidence.