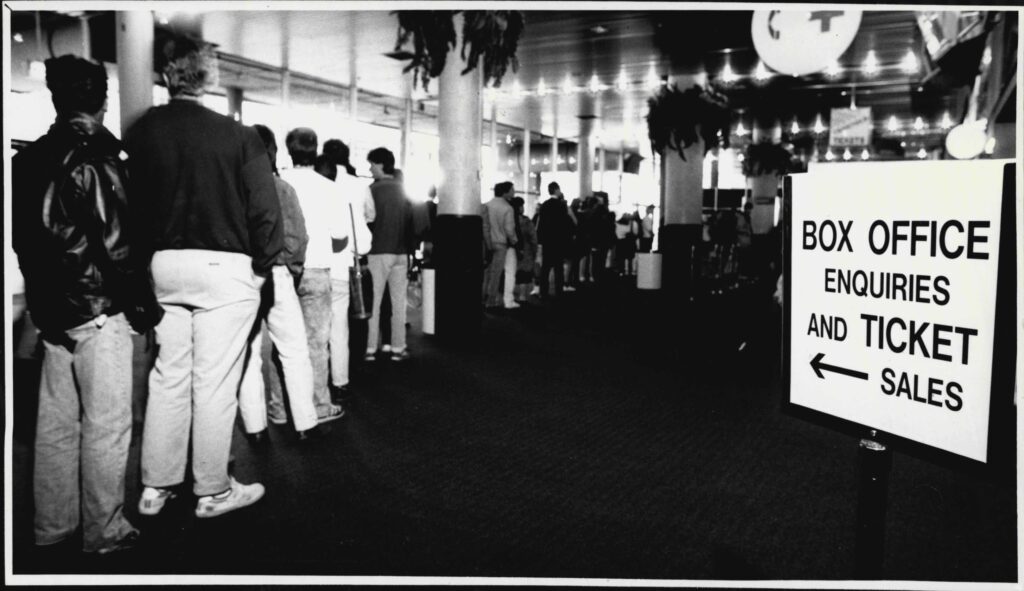

July 20 is a day many longtime Bruce Springsteen fans would like to forget. That morning, as the first six shows for The Boss’ 2023 North American tour went on sale through Ticketmaster, devotees were shocked to find most seats gone within seconds, and instead only “platinum” or dynamically priced tickets available for purchase — at costs as high as $5,000.“Surely, these multi-thousand-dollar prices were not intended or anticipated, many of us thought,” wrote the editors of the long-running Springsteen fan platform Backstreets. “Some assert the algorithm got out of control — are we sure that it was ever in control? We’d never expect Ticketmaster to balk at making money, but surely, many believed, Springsteen would put a stop to it and demand adjustments to the system, if not an overhaul, before the next on-sale.”

“This past week, too many Springsteen fans got thrown to the wolves, pushed aside in a way that seems as unfathomable as it was avoidable,” the Backstreets editorial continued, pointing out the stark contrast between Springsteen’s “man of the people” persona and this new, market-driven reality.

Springsteen manager Jon Landau did damage control in The New York Times on July 26, asserting that 88.2% of tickets were sold for between $59.50 and $399 before service fees, certainly in keeping with prices to see The Boss’ dwindling number of superstar classic rock contemporaries and, in some cases, far less than tickets for legends such as Paul McCartney or the The Rolling Stones (Springsteen has underpriced his tickets for decades).

According to Landau and Ticketmaster, only 11.8% of the seats were subject to dynamic pricing, and only 1.3% of those sold for more than $1,000. But with tickets readily available at or near those prices on Ticketmaster’s proprietary Verified Resale platform, which allows fans to buy and sell tickets from other fans without worry that they might be counterfeit, these statistics did little to soothe what many Springsteen fans described as a betrayal. It’s also unclear how many tickets actually went on sale and how many were “holdbacks” — a controversial element of the live entertainment business by which venues can restrict the total number of available tickets at on-sale without disclosing the information to potential buyers.

Ticketmaster declined multiple requests from us for comment as well as updated Springsteen on-sale facts and figures, other than to share a bulleted list of talking points. “Ticketmaster has created analytical tools that use historical and real time data to help quantify supply and demand to determine prices,” the company said. “The promoters and artist representatives then determine the specific pricing for their shows. The biggest factor that drives pricing is supply and demand. When there are far more people who want to attend an event than there are tickets available, prices go up. If prices were under market value at the on-sale, they frequently resell on the secondary market at higher price points.”

That may be true, but it’s also true that Ticketmaster is making millions of added revenue from its share of the dynamic and platinum programs. Venues and artists are, meanwhile, resisting transparency about holdbacks because shows naturally sell out more quickly when there are less actual seats on sale. And who doesn’t love a sell out?

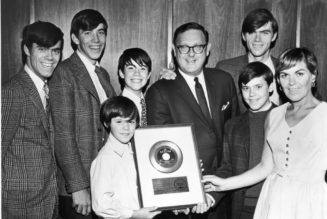

The Springsteen incident has resurfaced these and numerous other hot-button issues about the ever-controversial business of selling tickets, which has been subject to periodic review by the Justice Department but appears to have dodged most big oversight-related bullets, dating back to when two members of Pearl Jam found themselves on Capitol Hill testifying about Ticketmaster’s perceived industry monopoly back in 1994.

On a larger level, it has further widened the gulf between conglomerates like Live Nation Entertainment (the company formed when Live Nation merged with Ticketmaster in 2010) and the fans on whose money its business is built. That money keeps on flowing, the shaky economy be damned.

In its Aug. 4 Q2 earnings call, a transcript of which was reviewed by SPIN, Live Nation reported revenue of $4.4 billion, an uptick of $1.3 billion compared to Q2 2019 (an increase of 40%). Average ticket prices rose approximately 15% for the first half of the year relative to 2019, Live Nation Entertainment president/CEO Michael Rapino said on the call.

Rapino added that “with market-based pricing being widely adopted by most tours, we expect to shift over $500 million from the secondary market to artists this year, continuing to support those who created the concert and ensuring they are benefiting from it.”

To get a sense of how the industry feels about these subjects, SPIN spoke to more than a dozen executives within the worlds of ticketing, booking and artist management (all of whom requested anonymity either due to ongoing professional relationships with Ticketmaster and Live Nation or fear of retribution), as well as lawmakers and advocates attempting to protect consumers with new legislation aimed at ticketing transparency. It could be too late to win back Springsteen fans burned by the recent on-sales, but there may be some light at the end of the tunnel.

Like most everything else, the price for tickets is governed by supply and demand. When planning a tour, artists and promoters put their heads together to determine how to price tickets in order to make a profit, and, hopefully, how to also get these tickets into the hands of their most devoted fans rather than a bunch of scalpers. Things get tricky when a particular show or tour is heavily in demand, or when supply (ie., 18,000 sellable seats at New York’s Madison Square Garden) is incapable of accommodating the exponentially larger number of people who want to attend. After all, there’s only one Bruce Springsteen — which is not strictly the case when it comes to other dynamically priced commodities like flights or hotel rooms.

According to Ticketmaster, its opt-in platinum ticket offering and dynamic pricing model, helps level the playing field and put millions of extra dollars in the hands of artists that would otherwise have gone to ticket brokers. Platinum tickets constitute some of the best seats in the house for a given show, the quantity of which is agreed upon in advance by the artist and promoter (the number generally ranges between a few dozen to several hundred). The artist can choose to cap the price of the dynamic tickets or let Ticketmaster’s algorithm handle it instead.

Clearly, the initial dynamic tickets in the Springsteen on-sales were not capped, resulting in the sky-high prices that shocked fans. “That’s what’s crazy to me,” says an executive who has worked both on the legal and management side of the industry. “Doing dynamic pricing for an artist like Springsteen, you really don’t know without a cap how high the price can go. Why not price the front row at $1250 and cap them at two times that? The idea that it’s an uncapped, untethered crap shoot is pretty wild.”

Sources say a top-level artist can receive the vast majority of the revenue associated with these tickets, which could amount to an extra seven figures over the course of a lengthy tour. “If a broker is buying a ticket for $1,000 at on-sale and selling it for $5,000 on the secondary market, why shouldn’t the artist participate in that revenue?,” asks a veteran live music executive, adding, “Artists love the money it brings into their nightly gross, but they don’t want to deal with the bad press that might come with it” — exactly what the Springsteen camp is dealing with now.

“It’s a fundamental conundrum for artists,” says a worldwide concert promoter. “Do they make the money so the scalpers and others don’t? Or do they not try to make the money because they made it off the blue-collar guy in the audience?”

Adds a prominent artist manager of dynamic pricing, “The technology now allows artists to be so much smarter about all of this. Fans don’t understand it, but who would they rather have that money? The artist? Or some fat dude in his living room scalping tickets for a living?” Says an agent working with multiple arena-level tours, “This is 100% the artist’s decision to make, but Ticketmaster does a very good job volunteering to be the villain.”

Artists such as Phish and Pearl Jam have previously opted into the Platinum program, only to designate all or a portion of the proceeds to a charity of their choice, while Rage Against The Machine raised $1 million alone for immigration reform and hunger charities from platinum tickets at five recent Madison Square Garden concerts. Some observers say that if the Springsteen camp had done this either before or after the first on-sales, the fan response would have been markedly different. “I just don’t think they read the room,” a longtime music manager says. “You better have a good response to these complaints or some charitable component to announce. You can’t just blame it on scalpers.”

Landau declined to comment to SPIN on this and other ticketing-related subjects.

Launched in 2017, Ticketmaster’s Verified Fan program is another measure in the vein of Verified Resale that it says aims to “level the playing field so that more tickets go to fans who intend to go to the show — and not to ticket bots.” Fans register in advance of the on-sale for the show of their choice and are then given a unique code to use when the time is right. Although this process does not guarantee tickets, it in theory shuts out third-party brokers who don’t want to jump through the procedural hoops to get the proper access codes. Harry Styles utilized Verified Fan for the on-sales for his fall 2022 arena residencies and as such none of those seats are available through Verified Resale, but there are still tickets on StubHub being sold for close to $7,000 each.

While useful, Verified Fan is also still somewhat of a manual process, according to sources who say the labor-intensive nature of the program often means Ticketmaster can only handle one Verified Fan presale per week. “In theory, Verified Fan is supposed to look at your history within Ticketmaster to understand how much of a fan you are,” says an executive at a rival ticketing company. “If you register with a bunch of other emails with no history with Ticketmaster, presumably those other accounts shouldn’t get access to the presale. That’s where things are more opaque. How does Verified Fan actually work? What is it doing?”

Springsteen has in the past gone to great lengths to reduce scalping at his shows, sometimes making them “will call only” (ie., the purchaser must bring a photo ID and credit card to the box office on the day of the show to receive their tickets). He has also tussled with Ticketmaster over the company’s former practice of simultaneously offering tickets for sale from the primary side as well as its now-defunct TicketsNow secondary site, prompting intervention from New Jersey attorney general Anne Milgram and a legal settlement between the parties in early 2009. The run-up to that year’s E Street Band tour even prompted Milgram to sue brokers for advertising tickets they didn’t actually possess, since they hadn’t even gone on sale yet.

Another workaround has come from Billy Joel, who has long since stopped selling the first two rows at his concerts. Instead, he deputizes his road crew to find fans in the cheap seats and bring them up to the very front. “I got tired of looking down [and] the first row tickets were always scalper tickets,” Joel told Jimmy Kimmel in 2017. “So, there’s always somebody who paid way too much money to be a big shot and sit in the front row. You see some guy sitting front row with his bimbo, right? And he’s got the gold chains, and they’re just sitting there like, ‘Entertain me, Piano Man!’ I’m looking down, I go, ‘Screw this. The real fans are in the back.’”

But there remains a disconnect in the way some fans view obtaining tickets to see their favorite act as a kind of god-given right, rather than a function of supply, demand and other market-driven factors. “I understand people wanting to see Bruce, but what made you entitled to that?,” asks a high-level booking agent. “I want a Ferrari, but it’s too expensive, so I’m not going to get one. I get that it’s different, because Bruce’s thing is that he’s a ‘man of the people,’ but there are lots of things in this world that are impractically expensive, and that’s not unjust. It’s just the deal. I don’t know how we got to a point where the touring industry is supposed to transcend the same economic forces that set the prices for literally everything else.”

When it comes to legislative efforts to protect consumers in ticketing transactions, New York state senator James Skoufis is, at the moment, just about the only game in town. Since becoming chairman of the Senate Investigations and Government Operations Committee in 2019, Skoufis has made event ticketing reform a major priority.

In 2021, he launched an in-depth investigation with public hearings into the industry, resulting in a 113-page white paper, and in June, he steered the passage of the new bill S.9461. The legislation’s primary components are a requirement for resellers to publish the original price paid for a ticket, and for both sellers and resellers to display “all-in pricing,” including fees, as part of the initial listing, and not several clicks into an online transaction. Both are first in the nation reforms.

S.9461 also increases the penalty for bot activity, prevents resellers from charging for tickets that were originally free and removes delivery fees for tickets printed at home or delivered electronically. “While I’m certainly disappointed that there were a whole host of reforms in my proposal that didn’t make it across the finish line, I’m elated a number of really meaningful ones did,” Skoufis told us.

If Skoufis had his way, the bill would have also tackled Ticketmaster’s exclusivity clauses with venues, the seemingly arbitrary nature of the company’s mounting per-ticket fees, and ongoing bot activity. It would also prevent platforms from “indefinitely postponing” shows rather than offering immediate refunds, and clean up the hazy practice of holdbacks.

“Right now, we have what just about anybody, except apparently regulators, would characterize as a monopoly in the primary marketplace with Ticketmaster,” Skoufis says. “We have a structure in place that allows Ticketmaster to perpetually protect that monopoly through these exclusivity clauses. Ticketmaster and a venue draw up a contract with revenue sharing and other stipulations. In virtually every one, there’s a condition that the venue is legally not allowed to use any other platform in this space if they’re signing up with Ticketmaster. That’s not just a de facto monopoly, it’s an unequivocal protection of that de facto monopoly.

“One of my proposals in the original bill was banning these clauses. If a venue wanted to use a smaller seller in the primary space for a few shows here and there, they should be allowed to do that. That would foster a healthier marketplace, and a more competitive one. It would allow smaller upstart primary sellers to survive. Right now, there’s no oxygen for them.”

On the subject of Ticketmaster’s fees, Skoufis is more circumspect. In New York, the existing state statute requires fees to pass a “reasonable-ness test,” but those parameters are not actually defined. “There’s been literally zero enforcement of that provision. Not one prosecution,” Skoufis says dejectedly. “But we know these fees are unreasonable. I don’t know what the right answer is, but 100 out of 100 consumers would agree that there’s a massive problem with fees. Do you put in a cap? I think maybe that’s a place to start a conversation — 20 or 25%. Even those are high, but there are egregious examples of fees being 50 or 75% of the total ticket cost. It’s outrageous. It’s highway robbery. Let’s rein in those situations.”

Bot activity during on-sales is illegal on both the state and federal level, but again, “there’s no enforcement and it continues to run rampant,” Skoufis says. “The reason is not because the attorney general isn’t interested. It’s because the attorney general doesn’t know when it’s happening. The only ones who do are the platforms, especially Ticketmaster. When they catch it, almost all the time, they don’t send the information to the attorney general. They deal with it internally by clawing back the tickets or banning IP addresses, but they don’t make criminal referrals. One of the more creative provisions I tried to advance was a mandate that when platforms identify bot activity, they must make that referral to prosecutors. As an incentive, I proposed platforms would get a slice of the fines associated with the prosecutions. Unless you’re requiring that referral, bot activity will still happen. There’s no deterrent.”

Skoufis is particularly rankled by holdbacks, which he says constitute “enormous volumes of tickets held back and distributed to platinum credit card members, VIPs and friends and family of the artist. There are instances where in a 50,000-seat venue, there could be 20,000 seats held back. I guarantee you, if it needed to be disclosed how many seats were not being offered to fans of that artist at on-sale, you’d see nowhere near the volume happening right now with no disclosure. The last thing Justin Bieber wants is for all his rabid fans to see that 40% of the tickets are not going on sale to them. When that show sells out in 45 seconds and fans are disappointed because the tickets weren’t offered up, they’d be furious.”

Skoufis’ achievements prove that it is possible to bring Ticketmaster to heel on certain issues, but without many allies in other legislatures, the senator is engaged in what he describes as “a lonely fight at times. Ticketing is an esoteric thing. I also have very strong feelings on health care, tax policy and education. Those are really big issues that are constantly evolving, with billions of dollars associated with them in the state budget. It can be difficult to get my colleagues focused on ticketing amid these competing interests.

“When I started down this road and took on this fight, every single industry stakeholder hired a small army of lobbyists,” he continues. “I’m talking about dozens of lobbyists whose sole job it was for a couple of months of session this year to defeat this bill. The industry has an incredibly outsized voice and power within our capitol, compared to the average fan just looking to go to a show.”

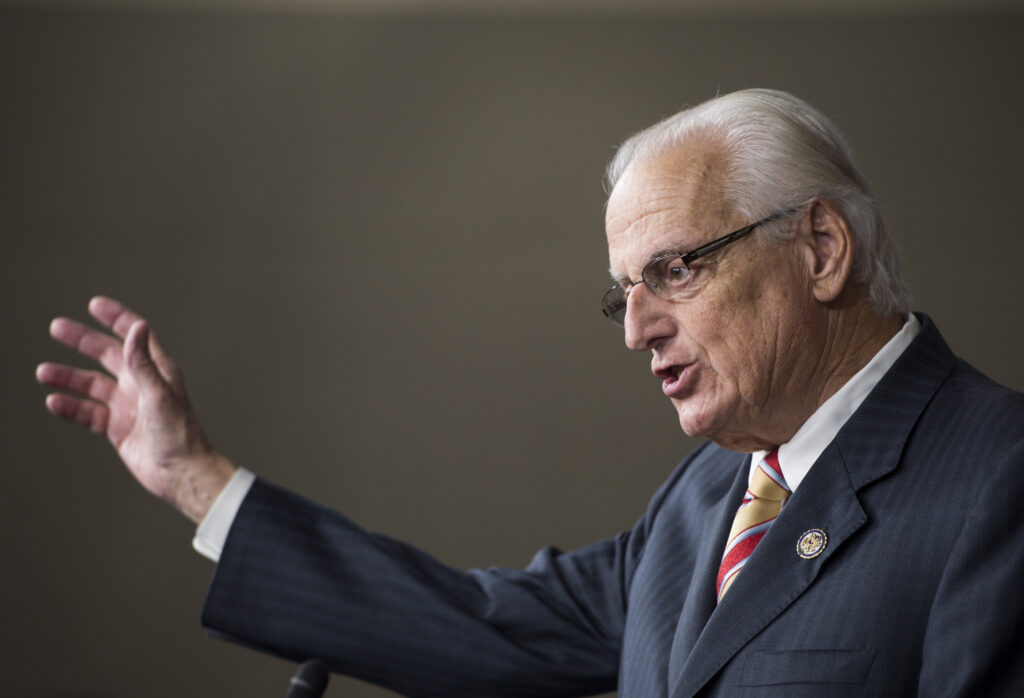

Although the Skoufis-led reforms in New York are the only notable new ones on the books, it hasn’t been for a lack of trying by other politicians. In 2019, New Jersey congressmen Bill Pascrell Jr. and Frank Pallone Jr. introduced the cleverly named BOSS Act (“Better Oversight of Secondary Sales and Accountability in Concert Ticketing”), which would have required the Federal Trade Commission to issue rules about transparency in primary and secondary ticket sales, particularly when it came to fees and transferability. Most artists supported the bill, but in a surprising move, Pearl Jam objected to some proposed changes involving non-transferable tickets and holdback disclosures in an open letter to Pascrell and Pallone.

“The live event ticketing market has gotten out of control,” Pallone said in early 2020. “Consumers have little insight into schemes designed to drive up prices and efforts to limit their options once a ticket has been purchased. The BOSS Act begins to tip the scales in favor of consumers by providing them greater transparency and control.”

Sadly, the BOSS Act has languished in Washington since the COVID-19 pandemic, but Pascrell told NJ.com after the Springsteen on-sale fiasco that he is planning to reintroduce it sometime this year (Pascrell did not respond to multiple requests for comment from SPIN).

The congressman took things a step further in March, writing to the heads of the FTC and the Department of Justice’s Antitrust Division that “the union of Live Nation and Ticketmaster is a poster child of consolidation gone bad” and urging regulators to undo the merger. “When Live Nation, the nation’s biggest concert promoter, and Ticketmaster, the largest ticket provider sought to combine, they assured regulators that their fusion would promote competition in the live events marketplace. Twelve years later, there are no strong competitors taking root, growing or thriving, in the primary ticket market and live events market.”

The BOSS Act has an unlikely champion in the form of the National Association of Ticket Brokers, whose members have a vested interest in preventing Ticketmaster from hoarding the lion’s share of the secondary market. “We were one of the most vocal opponents of the Live Nation/Ticketmaster merger, and through that, we built relationships with reputable consumer groups like the Better Business Bureau,” NATB executive director Gary Adler tells us, adding that he also supported Skoufis’ ticketing reforms in New York. “Ticketmaster has a resale marketplace that we have a very good relationship with, but they cannot succeed by eliminating competition and free markets. The BOSS Act has the potential to create a federal standard that would protect consumers, make tickets more accessible and add much-needed transparency to the market.”

Referencing Skoufis’ concerns about Ticketmaster’s exclusive venue contracts, Adler notes, “Ticketmaster didn’t become so successful because they’re innovators of some secret sauce. They’re very powerful politically, and they wield that power. We see more of it on the primary side, like what they did to venues. They and their clients aren’t against resale, but they want to capture all of it for themselves, and that’s really bad for consumers.”

Adler concurs with Skoufis that holdbacks are a pressing concern to the industry, if only because the perceived lack of supply often gets blamed on the ticket brokers Adler represents, rather than the artist and venue setting aside the seats for other purposes. “In New Jersey for years, holdbacks were capped at 5%,” he says. “On a summer Friday in 2018, without any real notice or public hearings, a bill was passed in the New Jersey legislature removing that restriction. We encouraged the governor to veto it, but it didn’t happen. This provision was really helpful but it was onerous to content providers like Ticketmaster, so they were able to get it removed through politics. New York got all-in pricing passed, so anything’s possible. But the one thing the primary industry fights the hardest on is disclosing how many tickets are actually made available to the public.”

Asked why Ticketmaster and Live Nation have taken this aggressive approach, a rival executive opines, “they don’t want it to be transparent, because that’s how they make their money and raise their stock price. Ticketing is purposefully confusing, and that’s to their advantage. When a huge show goes on sale at the Garden, everyone’s like, ‘Fuck Ticketmaster! There’s no tickets!’ Do you know how many tickets that artist is holding back? Or how many the venue is holding? The artist knows every single ticket that’s being held, because they want to make money off of them too.”

Despite new consumer protections and renewed calls for transparency, the ticketing industry will likely remain a controversial one simply due to the allure of the almighty dollar. As such, artists are disincentivized from speaking out against the major players, because it could not only hurt their fans in the long run but also make a dent in their bottom line. Innovations like paperless ticketing are also problematic, since each digital ticket must be manually checked against an ID, causing huge venue entry delays even at club-sized shows.

“No matter what you’re doing, if your show’s hot, you’re going to disappoint someone who really wants to go but either can’t afford it or can’t get a ticket in the first place,” says an artist manager. “Being an artist is not an easy way of making a living. Everyone talks about the 1%, but it’s not the most lucrative industry in the world. When there’s moments where you can cash in, I think artists should cash in.”

Asks another manager, “Ethics are a tricky thing, right? To suggest it’s the more ethical thing to keep arbitrary pricing low is motivation-based naivety. Ultimately, a ticket’s going to go for what a ticket’s going to go for, unless you put up a remarkable amount of roadblocks, and I commend certain artists who do that. There’s no question that making an affordable ticket for your fan is noble, but if you do that, you have to meet the moment and do the things that prevent leaving money on the table.”

The rival ticketing company executive says Ticketmaster is certainly greedy, but that there’s no inherent malfeasance about utilizing dynamic pricing per the artist’s wishes. “Back in the day, if you’d camp out at Tower Records for a Bruce ticket, of course you’d get one,” the executive says. “There’s no guarantee you’ll get one now. That’s what’s really frustrating. In high-demand situations, the internet exponentially magnifies the tensions of supply and demand.”

Skoufis isn’t buying the industry’s claim that tickets would disproportionately fall into the hands of brokers without programs such as dynamic pricing, which “assumes, very wrongly, that every single one of these tickets would somehow not be bought by genuine fans. It assumes all of them would be bought by scalpers and resold. That’s just hogwash. Some very high percentage of those tickets, if they weren’t dynamic, would be bought by people who want to go and see the show.”

“A lot of other industries employ dynamic pricing, and in many instances the prices are adjusted lower, like when a concert isn’t selling well,” he concedes. “I have mixed feelings about it. I’d prohibit dynamic pricing while someone is in the queue and has started a transaction. If you click on a seat, you click on a price. We proposed it, and there was immense opposition. I loathe this idea of tickets being sent off to privileged groups of people. It becomes complicated to craft the statute to capture that kind of activity, but in my mind it should be prohibited. There’s a way to thread the needle, because sometimes dynamic pricing can be to a fan’s benefit. But we can rein in the horrific activity that takes place here, like what we saw with Springsteen.”

Tagged: Bruce Springsteen, FEATURES, Live Nation, ticketmaster