DeFi insurance protocol InsurAce says it was well within its rights to reduce the claims period for people affected by the Terra USD (UST) depeg event from 15 days to seven — but added it has already processed nearly all 173 submitted claims and will pay out $11 million.

InsurAce (INSUR) is the third largest insurance provider for decentralized finance (DeFi) protocols, with a market cap of $15 million.

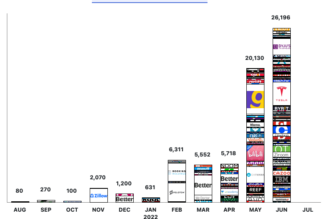

On May 13, InsurAce caused a stir when it announced it had shortened the claims window for those with cover related to Anchor (ANC), Mirror (MIR), and stablecoin Terra USD (UST) following the collapse of the Terra (LUNA) layer-1 blockchain.

But CMO Dan Thomson told Cointelegraph on Thursday that its move to shorten the claims window for the 234 covers of Terra portfolios was necessary to prevent further losses as UST had dropped to $0.08 by May 13, according to CoinGecko. He added:

“It is in our terms of service to make such changes. We felt there was no point in delaying the process on behalf of those who lost money and stakers who would have to pay out claims.”

The move was controversial in the crypto community, some of whom suspected InsurAce was trying to reduce the amount of claims it would have to pay. Terra Research Forum member FatMan told his 52,000 Twitter followers on May 24 that InsurAce has made “A dirty move,” and the firm should not try to “weasel out” of its agreement with clients.

A dirty move from @InsurAce_io – setting an arbitrary ‘claim deadline’ after which UST holders who bought depeg insurance cannot get their money back. I know you guys didn’t collect premiums for long, but this is how things work – a promise is a promise – don’t weasel out of it. pic.twitter.com/5dYuN7hGOZ

— FatMan (@FatManTerra) May 23, 2022

But Thomson said that outside of those rejected, most of the 173 claims submitted have already been processed and that the protocol was ready to pay about $11 million to claimants. He added,

“We want the best for everyone here, but if this were traditional insurance, people would be stuck in litigation for months or years.”

Thomson also suggested that the protocol may consider processing claims for the remaining 61 covers that haven’t been filed yet.

The collapse of Terra and UST has attracted the attention of regulators across the globe with the legendary South Korea financial crimes unit the “Grim Reapers of Yeoui-do” resurrected to discover if any crimes had been committed by Kwon or the Luna Foundation Guard (LFG) which managed Terra’s funds.

Related: Korean watchdog begins risk assessment of crypto as Terra 2.0 passes vote

In the instance that the UST de-pegging was not just a protocol failure, Thomson pointed out that InsurAce may also have legal recourse. However, he said: “I’m sure Terra and LFG have bigger fish to fry, so that’s a bridge we will cross when we get to it.”

INSUR is down 7.6% over the last 24 hours, trading at $0.28 according to CoinGecko.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: crypto blog, Crypto news, Do Kwon, InsurAce, LFG