The past week has not been an easy one. After the collapse of the third-largest stablecoin (UST) and what used to be the second-largest blockchain after Ethereum (Terra), the depeg contagion seems to be spreading wider.

While UST has completely depegged from the U.S. dollar, trading at sub $0.1 at the time of writing, other stablecoins also experienced a short period where they also lost their dollar peg due to the market-wide panic.

Tether’s USDT stablecoin saw a brief devaluation from $1 to $0.95 at the lowest point in May. 12.

FRAX and FEI had a similar drop to $0.97 in May. 12; while Abracadabra Money’s MIM and Liquity’s LUSD dropped to $0.98.

Although it is common for stablecoins to fluctuate in a very narrow range around the $1 peg, these recent trading levels are seen only during extremely stressed market conditions. The question that now sits in the mind of investors is will the fear spread even wider and will another stablecoin de-peg?

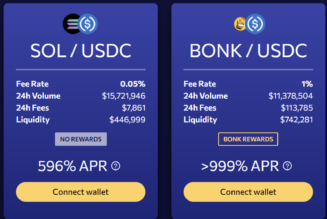

Let’s take a look at the mechanism of some of the major stablecoins and how they are currently traded in the Curve Finance liquidity pool.

The main purpose of stablecoins is to preserve a stable value and provide investors an avenue to park their money when volatility from other crypto assets are much higher.

There are two distinct mechanisms in stablecoins — asset-backed and algorithm-based. Asset-backed stablecoins are the most common version and issuers purport to back stablecoins with fiat currency or other cryptocurrencies. Algorithm-based stablecoins on the contrary seek to use algorithms to increase or decrease the supply of stablecoins based on market demand.

Asset-backed stablecoins were in favor during downturn, except for USDT

USD Coin (USDC), Dai (DAI) and USDT are the most traded asset-backed stablecoins. Although they are all over-collateralized by fiat reserves and cryptocurrencies, USDC and USDT are centralized while DAI is decentralized.

USDC’s collateral reserves are held by U.S. regulated financial institutions, whereas USDT’s reserves are held by Tether Limited, which is controlled by BitFinex. DAI, on the contrary, does not use a centralised entity but uses the primary market borrowing rate to maintain its dollar peg, which is called the Target Rate Feedback Mechanism (TRFM).

DAI is minted when users borrow against their locked collateral and destroyed when loans are repaid. If DAI’s price is below $1, then TRFM increases the borrowing rate to decrease DAI’s supply as less people will want to borrow, aiming to increase the price of DAI back to $1 (vice versa when DAI is above $1).

Although DAI’s pegging mechanism seems algorithmic, the over collateralization of at least 150% makes it a robust asset-backed stablecoin during volatile market conditions. This can be seen by comparing the price movements of USDC, USDT and DAI in the past week where DAI, along with USDC clearly showed a spike on May 12 when investors lost confidence in USDT and rushed to swap out.

Tether’s USDT has long been controversial despite its large market share in the stablecoin space. It was previously fined by the U.S. government for misstating the type of cash reserves they have. Tether claims to have cash or cash-equivalent assets to back USDT. However, a large portion of the reserves turn out to be commercial paper — a form of short-term unsecured debt, which is riskier and is not “cash equivalent” as dictated by the U.S. government.

The recent Terra debacle and the lack of transparency of their reserves triggered fresh concerns about USDT. The price reacted violently with a brief devaluation from $1 to $0.95. Although USDT’s price has recovered and repegged closely back to $1, the concerns are still there.

This is shown clearly in the largest liquidity pool on Curve Finance. The DAI/USDC/USDT 3pool in Curve shows a proportion of 13%-13%-74% for each of them respectively.

Under normal circumstances, all the assets in a stablecoin liquidity pool should hold equal (or very close to equal) weight because the three stablecoins are all supposed to be valued at around $1. But what the pools have shown in the past week is an unbalanced proportion, with USDT holding a much larger percentage. This indicates the demand for USDT is much smaller than the other two. It could also mean that for USDT to hold the same dollar value as the other two, more units of USDT are needed in the pool, indicating a lower value for USDT compared to DAI and USDC.

A similar imbalance is observed in the DAI/USDC/USDT/sUSD 4pool. It is interesting to see that sUSD and USDT both spiked in proportion around May. 12 during the peak of the stablecoin fear. But sUSD has quickly reverted back to the equal portion of 25% and has even dropped in percentage since while USDT remains as the highest proportion in the pool.

The Curve 3pool has a daily trading volume of $395 million and $1.4 billion total value locked (TVL). The 4pool has a $17 million trading volume and $65 million TVL. Both pools show USDT is still less favourable.

Are algorithmic stablecoins finished?

An algorithmic stablecoin is a different mechanism from an asset-based stablecoin. It has no reserves; therefore, it is uncollateralized. The peg is maintained through algorithmically minting and burning the stablecoin and its partner coin based on the circulating supply and demand in the market.

Due to its uncollateralized, or less than 100% collateralized nature, an algorithmic stablecoin is much more risky than an asset-backed stablecoin. The Terra UST depeg debacle has surely shaken investors’ confidence in algorithmic stablecoins. This has manifested quite clearly in the Curve liquidity pool.

FRAX — an algorithmic stablecoin by Frax Protocol — is partially backed by collateral and partially based on the algorithm of supply and demand. Although the coin is partially collateralized, the ratio of collateralized and algorithmic still depends on the market price of the FRAX.

In the recent perfect storm of stablecoin panic, the ratio of FRAX versus the other three stablecoins spiked to 63% to 37%. Although the disproportion can already be seen from early March 2022, the collapse of UST definitely exacerbated the fear of a FRAX de-peg.

A similar surge in fear triggered by the Terra UST de-peg event is also present in MIM — Abracadabra Money’s algorithmic stablecoin. The Curve MIM/3CRV pool shows the MIM proportion jumped to 90% — a similar level reached in January when the Wonderland scandal came about.

Despite the algorithm similarity to DAI, MIM doesn’t use ETH directly as collateral but instead uses interest-bearing tokens (ibTKN) from Yearn Finance — ywWETH. The additional layer of complexity makes it more sensitive to catastrophic events such as the UST de-peg event.

The goal for all stablecoins is to maintain a stable value. But all of them experience volatility and a lot of them have deviated away from the $1 peg much more than expected. This is probably the reason why it has led some regulators to quip that stablecoins are neither stable nor coins.

Nonetheless, stablecoin volatility is much lower than any of the other cryptocurrencies and still provides a safe harbour for crypto investors. It is therefore important to understand the risks embedded in different stablecoins’ peg mechanisms.

Many stablecoins have failed in the past, UST is not the first and it will certainly not be the last. Keeping an eye on not only the dollar value of these stablecoins but also how they stand in the liquidity pool will help investors identify potential risks ahead of time in a bearish and volatile market.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: crypto blog, Crypto news, cryptocurrencies, cryptocurrency exchange, Dai, Market Analysis, Markets, Stablecoin, Terra, Tether, USD Coin