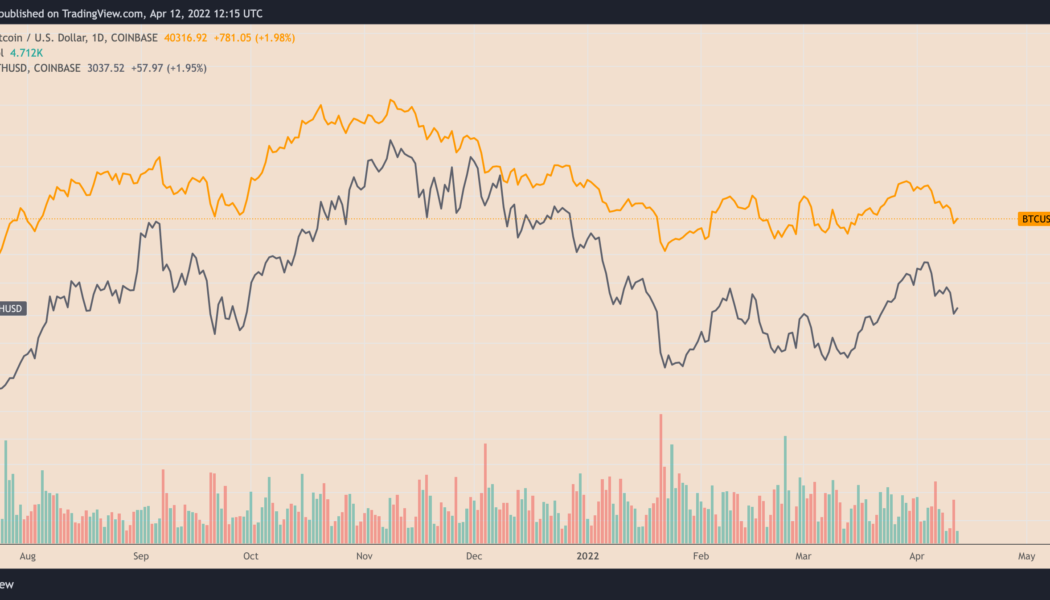

Ethereum’s native token Ether (ETH) has dropped about 17% against the U.S. dollar in the last two weeks. But its performance against Bitcoin (BTC) has been less painful with the ETH/BTC pair down 4.5% over the same period.

The pair’s down-move appears as both ETH/USD and BTC/USD drop nearly in lockstep while reacting to the Federal Reserve’s potential to hike rates by 50 basis points and slash its balance sheet by $95 billion per month.

The latest numbers released on April 12 show that consumer prices rose 8.5% in March, the most since 1981.

ETH/BTC triangle breakout

Several technicals remain bullish despite ETH/BTC dropping in the last two weeks. Based on a classic continuation pattern, the pair still looks poised to resume its strong bull run in 2022.

Notably, ETH/BTC has corrected from a horizontal resistance level that constitutes an ascending triangle range in conjunction with rising trendline support.

As a rule, ascending triangles send the price in the direction of their previous trends. Therefore, since ETH/BTC was rallying before forming one, there’s a decent chance its bull run could continue toward its Feb. 2018 highs near 0.1 BTC, based on the setup shown in the chart below.

Nonetheless, the interim market setup looks skewed to the downside, with ETH/BTC eyeing a correction towards the triangle’s lower trendline following its pullback from the upper trendline.

The bearish reversal scenario

Ascending triangle breakouts reach their upside targets nearly 73% of all time, a study by Samurai Trading Academy shows.

In a separate report, veteran investor Tom Bulkowski also highlights a 70% success rate for ascending triangles, thus underscoring the strong possibility for Ether to reach 0.10 BTC in 2022.

Related: Bitcoin claws back $40K as 24-hour crypto liquidations near $500M

Nonetheless, this still leaves ETH/BTC with a 30% chance to invalidate its ascending triangle setup.

As it happens, the pair will break below its triangle’s lower trendline, which also coincides with its 50-week exponential moving average (the red wave in the chart above) near 0.06 BTC, opening the door for a further drop to 0.05 BTC, a support area from May-June 2021.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: Bitcoin, BTC, crypto blog, Crypto news, Dollar, ETH, Ethereum, Ethereum 2.0, Federal Reserve, Inflation, Interest Rates, proof-of-stake, Quantitative Easing, Technical Analysis