Understanding the valuation matrix

There is no rule book on how to assess an NFT valuation. The metrics you use for evaluating private companies or conventional investment vehicles such as shares are simply not applicable to NFTs. Usually, the payment rolled out by the last buyer gives some indication of the value. For NFTs, however, it is hard to guess what the next buyer might pay, depending on their estimates.

Most buyers lack the skills to ascertain the value of NFTs logically and base their quotes on guesswork. For sellers too, it is hard to determine what they might end up receiving for the tokens they hold. Over time, the value of NFTs is driven by a perception over which both buyers and sellers may lack any control.

An example can bring home the point even better. An artwork NFT might be in great demand for a certain time, with possible buyers assuming it is rare and expecting to derive value in near future. Then, all of a sudden, they may discover that the digital image is available on the Internet for free and there might be no buyers left for the NFT.

Related: Nonfungible tokens: How to get started using NFTs

Factors that determine the value of NFTs

Artwork NFTs of renowned artists or tokens associated with tangible assets of repute might have defined values. In most cases, however, investors and traders find it hard to determine what an NFT is worth.

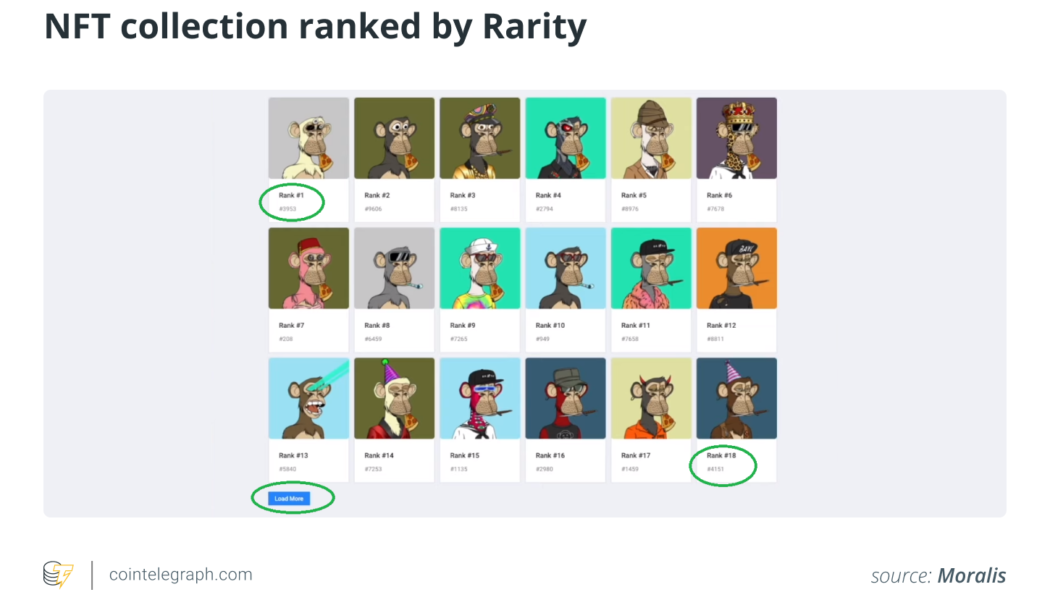

Rarity

Demand for an NFT is directly proportional to its perceived scarcity but how can you tell how rare an NFT is? Unique artworks from renowned illustrators might make good examples of rare NFTs as will the tokens minted by top-grade celebrities. Some rare game items can also successfully call for this category. Rarity factor brings in plenty of intrinsic value to these NFTs.

An immutable proof of ownership gives the holder of the NFT a sense of distinction and subsequently, value. Everyday’s The First 5000 Days by Beeple and Jack Dorsey’s first NFT are prime examples of NFTs with a rarity element.

Utility

For figuring out how to evaluate NFT projects, utility emerges as a key parameter. To carry value, an NFT needs to have a utility in a real application. For instance, NFTs could be used for tokenizing real estate, precious metal and even securities; to represent virtual land or game assets and in many more ways. The NFT world is still at a nascent stage and as it matures, new innovative use cases are sure to emerge.

Right after minting, an NFT draws value from its inherent characteristics. Over time, the value accrues depending on the utility and community strength of the underlying project. Decentraland NFTs, which refer to virtual land plots in the project, are an excellent example of such tokens.

Related: How to create an NFT: A guide to creating a nonfungible token

Tangibility

NFTs associated with real-world objects draw an element of tangibility. Clubbed with ownership immutability on blockchains, it creates an immediate value in tangibility. NFTs can be effectively used to underline ownership rights and eliminate instances of fraudulent activities. The practical use of NFTs in the projects in which they are involved has a bearing on their value.

NFTs holding tangible value are the perfect fit for short-term as well as long-term trading. Some NFTs, like tickets, might have expiry dates, while others, such as those representing real estate, can cultivate more value over time.

Interoperability

A key factor in the NFT value proposition is interoperability, i.e., the ability to use the tokens in different applications. For instance, if the same weapon can be used in different games, there are more chances of the token accruing value. How the nonfungible tokens work on different blockchains is always going to make transactions simpler.

It is hard to realize interoperability, however, as developers have to build a vast network of applications on which the tokens can be used. A set of attractive use cases help infuse interoperability of the NFT. Another strategy developers could follow is to develop partnerships with other projects to bring benefits to people who own their tokens.

Social proof

The social proof associated with the project behind an NFT is one of the decisive factors that determine the NFT’s value. Checking their profiles on social media platforms like Twitter and Instagram can help one gauge their acceptability. If the numbers lie low, it indicates they haven’t yet been able to create a solid ground for themselves.

When encountering any person or project for the first time, there is a natural tendency to take cues from the people around the project. Social proof indicates what people, in general, think about a project and helps in making a decision.

Ownership history

The identity of the issuer and previous owners of an NFT has a bearing on its value. Tokens created by eminent persons or corporate entities benefit from a high ownership history value. You can enhance the NFT value proposition by working in tandem with people or enterprises with strong brand value for issuing the NFTs.

Reselling NFTs previously held by influential people is another way to gain traction. Marketplaces and sellers can help buyers find information about previous owners of NFTs by providing a simple tracking interface. Highlighting the addresses of investors who took home a good amount from NFT trading will help buyers gain valuable insights.

Liquidity premium

NFTs with high liquidity carry higher value as well. Secondary markets provide a venue to trade ERC or BSC standard NFTs in a frictionless manner, immediately giving access to buyers. Traders prefer to put their money in NFT categories with a high trading volume as more liquidity helps them take their profits with ease. A highly liquid NFT is likely to retain its value even in case the associated platform is closed.

Token economics stresses increasing engagement and subsequently, liquidity will propel the NFT value proposition upwards. An in-built system that depreciates NFTs on being idle for long and encourages competitive assets can help to build a robust market. As the NFT market grows, systems will come in place to support the liquidity of assets.

Speculation

There are times when speculation becomes the catalyst behind price appreciation, for instance, the price of CryptoKitty #18 skidded from 9 ETH to 253 ETH in just three days in December 2017. While one line of thought critically opposes speculation as one of the drivers of valuation, speculating comes naturally to humans and cannot be eliminated practically.

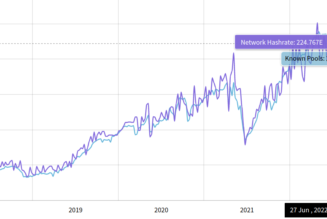

Even in the conventional financial system, instruments like derivatives are based on speculation. In this light, speculation becoming a non-trivial component of the NFT ecosystem isn’t a surprise. Price performance charts of NFT items, changes in the assets lying underneath of projects, and even events beyond your direct control can fan speculation and drive the prices of NFTs.

Continual change in the NFT ecosystem

NFTs are a nascent ecosystem undergoing continual evolution. Various factors influencing the value of NFTs are rapidly evolving and to augment accuracy, you need to take them all into account. Moreover, value is broadly a subjective concept, though you may argue that the discussion is about intrinsic value. In this scenario, resolving how you determine future NFT value becomes even more challenging.

As NFTs are an asset class with endless possibilities, we can safely assume that their versatility will steadily grow and lucrative opportunities will be available in various sub-categories. The number of use cases of NFTs has been increasing at a great pace. Now, NFTs can be used in applications like ticket distribution to ensure voting rights.

While exploring an NFT value estimator, you just need to be mindful that all things that shine aren’t diamonds. So be patient and take into account a full array of factors while arriving at a decision. At a time when all sorts of NFT marketplaces are coming up, from all-inclusive platforms like OpenSea to niches such as Real Nifty, doing your due diligence and making an informed decision becomes especially important.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: crypto blog, Crypto news, NFT Valuations, NFTs, Rarity, Utility