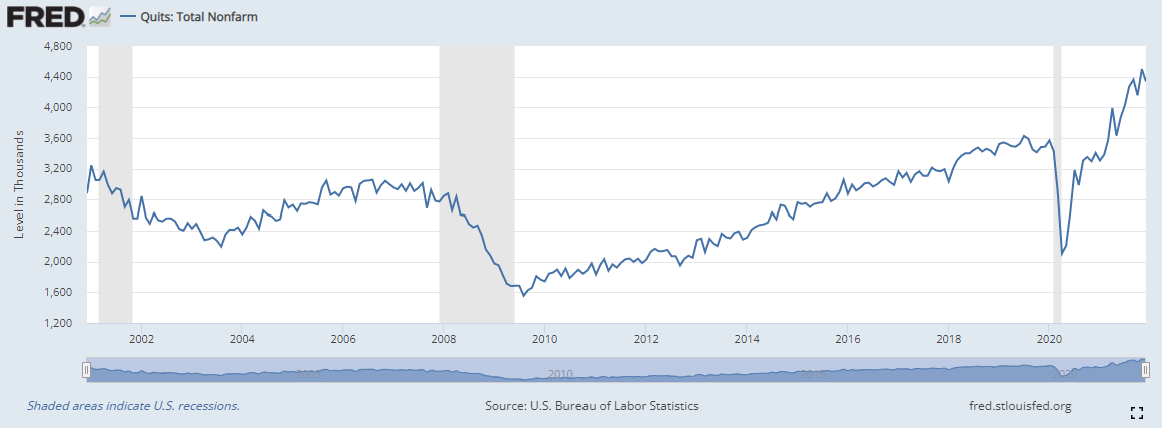

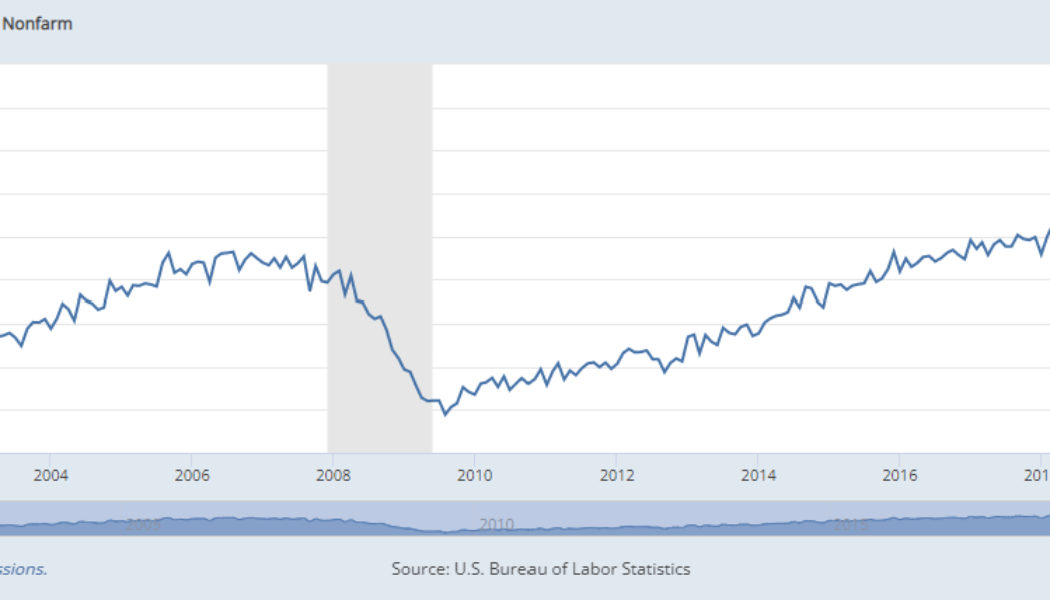

The inexorable flow of workers handing in their notices has become known as the Great Resignation. Over 33 million Americans quit their jobs between spring 2021 and end of year, with the graph below showing visually quite how stark the trend has been in historical terms.

Via FRED St. Louis

Via FRED St. Louis

Pandemic Effects

The pandemic has ushered in a completely new way of working. Employees have realised quite how un-fun sitting in traffic is for two hours each day, or how much they dislike packing into a rush-hour subway, their face brushing up against the sweaty armpit of a 6”4 guy (why is there always somebody without deodorant?).

People enjoy flexible hours (especially with children in the picture) and an employer that cares about their desires. Personally, I thank a higher power every morning that I no longer have to wear ill-fitting chinos and a chaffing shirt into the office each morning. I’ll take the sweatpants, thanks.

But there’s something that I have found particularly interesting about resignation patterns – and that’s the exodus of trad-fi workers into the crypto space. And yes, I’m comfortable using the word exodus, because that is exactly what it is. Investment banks, trading firms, law firms – an increasing number of employees are leaving such jobs to make the leap into crypto (I was one of them!).

Andrew Pompliano wrote a couple weeks ago that the crypto exchanges of Coinbase, Binance, Kraken, BlockFi and Gemini added nearly 5,000 employees. Anecdotally, of myself and my three housemates, only one out of the four of us has yet to seek a remote crypto job (he will cave eventually). I also love this story of four Facebook devs quitting together to found a Web3 start-up.

Maya Miller, CPO at Blockchain.com, summed it up well when she said:

“I don’t think anyone can say there’s no migration. But why do they do it? Money, money, money and the upside is huge. But what’s the downside? Maybe it doesn’t work out.”

She makes a poignant point about the downside – I guess maybe it doesn’t work out?

Why Crypto?

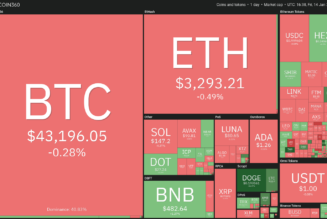

Juiced with VC cash, a lot of crypto firms certainly do have money to offer. But there are more pull factors at play here. Applicants are flocking to join a space that is growing at a staggering rate, innovating and transforming seemingly daily, while mainstream media is providing more and more coverage to the nascent industry. NFTs, meme coins, decentralised finance, metaverse, social tokens – the scope is vast and there are new facets to the space popping up all the time.

It also ties in with wider themes seen throughout the Great Resignation – a lot of these firms are remote and offer more flexible terms than historically straight-laced trad-fi firms, while workers see more of a purpose working at companies which are often much smaller but growing at tangible rates, who desire their capital market experience. Additionally, there is an inherently irreverent, anti-corporate attitude among the rebellious world of crypto; the days of formal, regimented, eggshell-walking behaviour in work are behind us, something employees have grown to value more during the pandemic. People want to enjoy their work.

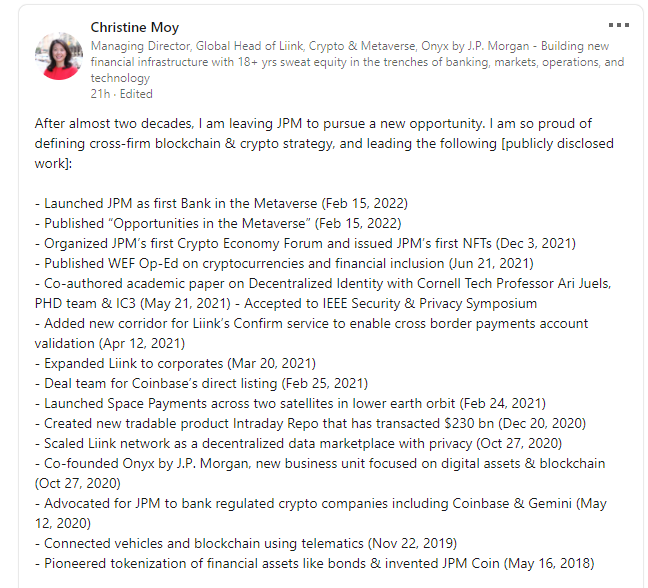

Christine Moy

Christine Moy, JP Morgan’s head of cryptocurrency and metaverse, has become the latest to flee the trad-fi world. Well, to be clear, we don’t know for sure that she is headed to crypto, but JP Morgan confirmed in a statement that it is “an external opportunity”.

Reading between the lines and given the fact that, in JP Morgan’s own words, she has been “instrumental in building and leading JP Morgan’s blockchain program, dating back to 2015 when the blockchain team consisted of fewer than five people”, I’m willing to bet that Moy is headed to crypto. Perhaps the strongest evidence of all is actually in her seemingly innocuous sign-off on the statement of her LinkedIn post: “As for my next world building adventure, please stay tuned. I am super excited to share with you what is next! #wgmi” – the #wgmi, of course, is a popular acronym in crypto, standing for “we gonna make it”. Ye, I’m pretty sure she’s headed to the metaverse.

Timing

The timing is somewhat quirky. Only last week, JP Morgan became the first bank to enter the metaverse, opening a branch in Decentraland – named Onyx Lounge. It was a seminal moment for the bank, whose CEO Jamien Dimon has infamously labelled Bitcoin a “fraud” in the past and predicted that “it won’t end well”.

Within the metaverse branch, a portrait of Jamie Dimon can ironically be seen on the wall, but when you approach with your avatar, it actually changes to that of Christine Moy. A speech bubble pops up from Moy, saying “welcome to our space!”. In navigating my avatar there just now, off the back of news of Moy’s resignation, the welcoming message read a little hollow. It will be interesting to see if/when JP Morgan change it.

My avatar in the JP Morgan metaverse branch, with Christine Moy’s (NFT) portrait on the wall. And yes, that’s a tiger prowling the lobby.

Big Loss for JP Morgan

It’s a big loss for the investment bank and an enormous haul for whichever crypto firm snatches her, assuming that is where she ends up. Preceding her seven years leading the blockchain team, she also worked in syndicated loan trading, global commodities and marketing during a stint at JP Morgan that spanned 18 years.

Crypto enthusiasts often look down upon Wall Street as corporate stooges stuck in their ways; dinosaur species who have rigged an inefficient system to their benefit. Moy, for her part, carries no such reputation. Passionate about blockchain technology and cryptocurrency at large, Moy has been vocal of her support for the industry, and a quick read of the accomplishments she outlined in her LinkedIn statement shows the depth of knowledge and criteria of candidate she is.

Beats my resumé…

Beats my resumé…

In digging through forums and Twitter, I strived to find any hints about where Moy may land. Alas, I couldn’t find anything of substance, but I’m sure an announcement is imminent.

Our mission has been ‘to make the Impossible possible,'” Moy continued in her statement. “I drive a team culture that is centred on being bold & resilient, challenging the status quo, and acting with urgency.”

She has done all that and more, and no doubt will continue to do so going forward. It just won’t be with JP Morgan; it may not be with a trad-fi firm at all.

Looks like crypto has caught another fish, and this is a big one.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: Analysis, crypto blog, Crypto news, cryptocurrency, JPMorgan