- Bloomberg analysts predict Ether to retreat to $1,700 before surging again

- Bybit exchange has announced a partnership with Cabital to bring more on-ramp integrations

- Canadian lawmaker tables bill to promote the growth of the cryptocurrency industry

The cryptocurrency sector saw it all in the second week of February – from volatility in the market to major partnerships within the industry. Here is a rundown of the major stories that you might have missed

Bloomberg analysts foresee Ethereum sliding back to $1,700

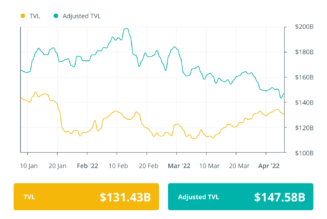

As markets struggle to recover from the January dump, Ethereum could not yet be out of the woods. A team of Bloomberg analysts has predicted that the second-largest crypto asset is likely to crash to $1,700, though the fundamentals are expected to remain unaffected.

The Crypto Outlook February 2022 report noted that Ethereum has been consolidating at the end of a bull run. Both sellers and buyers have benefitted from the period ETH has traded the price range of $2,000 to $4,000. That said, Ethereum is likely to emulate the movements seen last summer that saw its price hit $1,700, before it set off for a rally towards $4,800, as soon as the “weaker long positions were purged.“

The rationale for this predicted plunge is that technicals show that Ethereum is edging towards establishing a support 30% below its 52-week moving average. The report also observed that owing to increased adoption and the decreasing supply of tokens that Ethereum is seeing – a result of the deflationary effect of the new burn mechanism – the token’s price should remain on an upward trend unless “something unlikely reverses the proliferation.”

Bill Miller: Bitcoin is like insurance against financial calamity

In an interview that aired Wednesday on CNBC, famed American fund manager and investor Bill Miller has equated hodling Bitcoin to insurance coverage against a financial catastrophe.

Miller, who is known for outperforming the S&P 500 index for 15 years in a row, explained that ideally, insurance policies have no intrinsic worth. His train of thought is that while Bitcoin holds no intrinsic value, it is comparable to high-value assets such as a Picasso painting.

Miller also pointed to the dire economic situation in countries such as Afghanistan and Lebanon throughout the COVID-19 pandemic, where he says Bitcoin would have provided a shield against the financial downturn.

The legendary fund manager also clarified comments he made last month that suggested he’s put half of his wealth into Bitcoin and other cryptocurrencies. He explained that his remarks had been misinterpreted as he only put a small portion of his portfolio into Bitcoin, which then appreciated into half his wealth.

Without floating any numbers, he said the proportion had decreased as crypto has significantly fallen since last November, though insisting that “it’s still a very big position.“

Crypto exchange Bybit partners with Cabital, adds another fiat-to-crypto option

Last week, Singapore-based Crypto exchange Bybit announced that it has teamed up with digital finance institution Cabital to bring users additional on-ramp integrations.

In effect of the partnership, ByBit users have now gained a fiat on-ramp pathway by which they buy crypto using their British pound sterling (GBP) and the Euro (EUR) holdings. Transactions between Bybit wallets and Cabital would charge no transfer fees.

Cabital weighs various exchanges to give users the most competitive prices, ensuring complete price transparency, as it aims to enable people leverage cryptocurrencies to earn passive income. Via Cabital’s solutions, Bybit customers can buy crypto into their portfolios without switching platforms.

Further, the buys are completed at low gas fees. Cabital also enjoys the cutting-edge tech from prominent digital asset management platform Fireblocks, enabling it to safeguard user holdings with advanced institutional-grade security.

Cabital CEO Raymond Hsu has lauded the initiative as one that would leverage off-chain settlements to enable Bybit users to seamlessly buy crypto and shield them from hefty gas prices. Similar to the comments of Bybit CEO Ben Zhou, Hsu also anticipates that this partnership would help revolutionise finance for various people in the society.

Binance jumps $200 million deep into Forbes

Fortunes have changed as Binance announced that it’s set to take a $200 million stake in Forbes, the news outlet it sued for defamation last year, before dropping the suit altogether.

As first reported by CNBC, Binance will take over half of the $400 million commitments reached by institutional investors in the previously-announced private investment in public equity (PIPE) agreement between Forbes and SPAC firm Magnum Opus Acquisition Limited. The deal will take Forbes public to trade on the New York Stock Exchange under the FRBS ticker.

Following the deal’s conclusion, Binance shall become one of the top two most prominent owners of Forbes and get two board seats on the long-running news outlet’s board – Chief communications officer Patrick Hillmann and head of the exchange’s incubator and venture arm Bill Chin will be joining.

A Binance spokesperson said that this financial investment is strategic. The exchange believes that just as Web 2 had a massive impact on the media, Web 3 may have a significant role to play in the future. Moreover, as Forbes is on a digital transition path, Binance will help with digital asset and Web3 strategy.

Canadian MP proposes pro-crypto bill to encourage sector-wide growth

Canadian MP Michelle Rempel Garner last Wednesday introduced a new bill, Bill C-249, to the House of Commons that seeks to encourage growth in the cryptocurrency sector.

The bill, titled “Encouraging the Growth of the Cryptoasset Sector Act,” seeks to establish a concrete crypto framework and has proposed that Canada’s Minister of Finance, Chrystia Freeland, consults industry stakeholders/ experts in specified provinces and territories. Garner said this should upset the current state, that lawmakers are establishing policies for the sector even though they are unfamiliar with it.

Moreover, the framework would aim to lower entry barriers into the cryptocurrency industry, cut down on “administrative burden,” and define protection for those within the sector.

Garner feels that Canada should be reaping massively from the crypto sector, meaning she would be hoping to avoid political polarisation of the matter. Being a member of the minority Conservative Party, support from other parties would be much needed.

If passed, the bill would also require that the finance minister update the framework and establish legislation within the first three years.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: crypto blog, Crypto news, Crypto regulation, Exchanges, Markets, Price predictions