In 2021, crypto has been one of the biggest trends shaping tech and finance, and according to mainstream news headlines, decentralized autonomous organizations (DAOs) are set to be a force to be reckoned with in crypto in 2022. Mark Cuban called them the “ultimate combination of capitalism and progressivism.” Yet, while DAOs are relatively easy to understand conceptually, they’re a segment of the crypto market in a state of rapid flux, with many innovative use cases emerging. However, setting up and running a DAO also comes with its own set of unique challenges, which are also changing and developing over time.

What is a DAO?

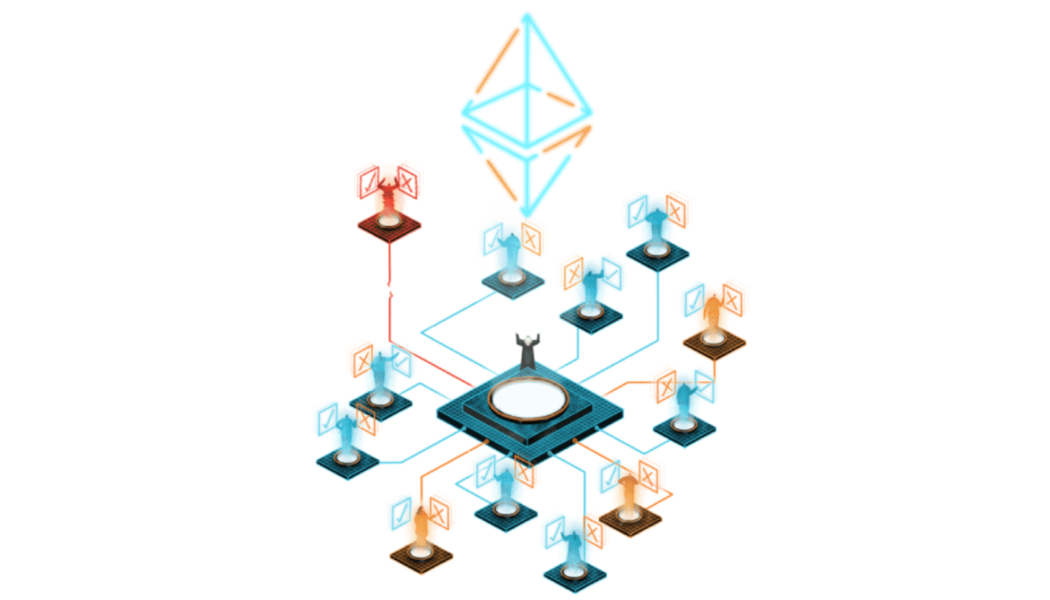

The purest definition of a DAO is inherent in the name. An organization is a group of people and entities with a common goal or idea. It’s decentralized, so there is no CEO or board of executives responsible for decision-making, and it’s autonomous, meaning it’s self-governing. Self-governing means that there are governance rules programmed into blockchain-based smart contracts, and members of the DAO vote on matters affecting the DAO according to those rules.

One of the earliest DAOs, a project called The DAO, illustrates one of the most straightforward use cases of a DAO and also happens to be pivotal in the history of DAOs. The Genesis DAO, as it was also known, was an investment contract allowing Ether (ETH) holders to deposit their funds. Projects could apply to The DAO for funding, and if DAO token holders agreed to the investment terms, the smart contract would disburse funds. However, in June 2016, within weeks of launch, a hacker found a bug in the underlying smart contract code and managed to drain The DAO of around $70 million worth of ETH.

At the time, the incident wreaked havoc in the Ethereum community, and as a result, DAOs made little progress over the subsequent two or three years. However, once the touch paper of the DeFi movement was lit, the idea of DAOs took off once again.

Related: DAOs are meant to be completely autonomous and decentralized, but are they?

DeFi and the return of DAOs

DeFi emerged from the desire among the blockchain community to create an open, permissionless, decentralized financial system. As such, DAOs offered an attractive way for projects to demonstrate their commitment to decentralization through community governance.

As a result, during 2020, when DeFi began to gain rapid ground, governance tokens became vastly popular. Flagship DeFi apps including Compound (COMP), Uniswap (UNI) and Aave (AAVE) launched tokens allowing users to participate in decentralized governance, while newcomer DeFi projects have taken to launching their governance tokens from the start.

Current and emerging trends

So why are DAOs now making such a splash even among mainstream news outlets? Part of the reason is the surge in popularity of nonfungible tokens (NFTs), which are set to play a more significant role in DAO governance and who gets to participate.

In September, Andreessen Horowitz invested $5 million into “Friends with Benefits,” a Discord chat comprised of various crypto enthusiasts, artists and NFT collectors. The group raised a total of $10 million when it decided to operate as a DAO, demonstrating the value to be generated from the vast online communities that have formed — even without economic incentives — on platforms like Facebook and Telegram.

In November, things took an even more intriguing turn when “ConstitutionDAO” raised more than $40 million to bid on the rights to acquire an official copy of the U.S. constitution document in a Sotheby’s auction. It was the first time Sotheby’s had worked with a DAO, which had managed to gather support from over 17,000 donors in advance of the auction. Although ConstitutionDAO was ultimately outbid by Citadel CEO, Ken Griffin, the experiment itself was arguably a success in that it demonstrated its intended concept.

Related: Decentralized autonomous organizations: Tax considerations

Another emerging trend is investment DAOs, as some believe that DAOs are set to disrupt the traditional VC model of funding entirely. These DAOs are allowing groups of Web3 natives to pool and deploy capital in such a way that now allows individuals to compete with traditional finance entities.

So it’s understandable that with such a wide range of applications out there, DAOs are causing considerable excitement and could prove to be as big as NFTs have been in 2021. However, there will be challenges along the way.

The path to DAO adoption isn’t smooth

Firstly, education is still a considerable gap. Even within the cryptocurrency community, the DAO concept is still gaining traction, and implementation is far from advanced. There are still relatively few “user interfaces” for DAO governance, although more and more tools are coming online to help organize and overcome the challenges that traditional organization structures have wrestled with for years.

Regulation can be another challenge that DAOs will have to grapple with as they transition into the mainstream. Laws around incorporation and tax structuring are ambiguous and often outdated, leaving DAOs to make their interpretation to fill in the gaps.

It’s also worth noting that decentralization is a spectrum and not binary. Although DAO governance tokens allow users to participate in decentralized governance, most projects still operate with a degree of centralization.

Related: Decentralization vs. centralization: Where does the future lie? Experts answer

Finally, decentralized governance is hard, particularly at scale. It’s a large challenge with multiple obstacles that have plagued blockchain developers since the early days. How do you keep voters engaged once the community becomes large enough, and votes need to be conducted with increasing frequency?

How do you stop wealthy whales from buying their way to power by scooping up a majority of tokens? To what extent should code be law, and shouldn’t there be fail-safes in place in case a malicious entity manages to wrest majority control? If so, who controls the fail-safes?

There are no easy answers to these questions, but now that crypto, NFTs and DeFi have found a foothold to reach the mainstream consciousness, it seems natural that DAOs will follow. Furthermore, as they become more mainstream, it should become easier to identify smother means by which communities can decentralize governance.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Hannes Graah is the former vice president of growth at Revolut, and founder of stablecoin yielding protocol Gro. He also spent eight years at Spotify scaling company operations and assorted growth projects until mid-stage, then launching new regions until the initial public offering. A four-time startup founder, he is also an investor and advisor in more than 10 companies as well as a growth strategist for more than 30 brands and companies.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: crypto blog, Crypto news, DAO, Decentralization