Web3 and social games publisher Carry1st has raised $20 million in Series A funding to further expand product development in Africa — a continent that could become the premier hub for the gaming industry over the next decade.

The investment round was led by Silicon Valley venture firm Andreessen Horowitz, which has been highly active in the blockchain space, with additional participation from Avenir and Google-parent Alphabet. Carry1st’s existing backers, including Riot Games, Konvoy Ventures, Raine Ventures and TTV Capital, also participated in the investment round.

The cash injection will be used by Carry1st to expand its content portfolio, grow its in-house development team and spearhead a new growth strategy to attract tens of millions of new users. A key pillar of its growth strategy is developing infrastructure to support play-to-earn gaming, which allows users to monetize their gaming experience.

Alphabet’s investment in Carry1st is part of its Africa digital transformation initiative, which was announced in October 2021 by CEO Sundar Pichai. At the time, Pichai identified Africa as a major growth driver for the digital economy with an estimated 300 million people expected to come online over the next five years. If existing trends are any indication, many of those new users will be gamers.

As a leading publisher of social games in Africa, Carry1st appears to be in a unique position to capitalize on this potential. In addition to providing a full-stack publishing platform, the company develops games with embedded payments solutions and online marketplaces to support monetization. The company has publishing deals with several developer studios, including Tilting Point, the publisher of Nickelodeon’s SpongeBob: Krusty Cook-Off and Sweden’s Raketspel.

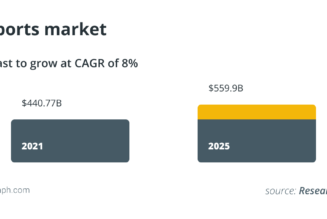

Africa is quickly asserting itself as one of the biggest consumer markets for peer-to-peer payments and decentralized networks. Several major economies in the region, including Nigeria, have embraced Bitcoin (BTC) for payments and remittances. Blockchain analytics firm Chainalysis estimates that the continent’s crypto market grew 1,200% between 2020 and 2021. The gaming industry is expected to grow exponentially over the next 10 years, creating new opportunities for Web3 and play-to-earn business models.

Related: Binance sponsors AFCON to further develop crypto adoption in Africa

According to research from Newzoo and Cary1st, the number of gamers in Sub-Saharan Africa is set to grow 275% over the next decade.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: Africa, Andreessen Horowitz, crypto blog, Crypto news, Funding, google, Venture Capital