-

Terra (LUNA), Chainlink (LINK), Uniswap (UNI) and Aave (AAVE) are all tokens that have showcased solid growth.

-

Each token fills a solid role within DeFi and has had great developments.

-

These are the go-to tokens to buy on January 17, 2022.

Decentralized finance (DeFi) has blown up in terms of both popularity as well as utility throughout the past few years.

Many tokens have attempted to introduce new solutions, some of which have exceeded expectations.

Terra (LUNA), Chainlink (LINK), Uniswap (UNI), and Aave (AAVE) are some of the best DeFi tokens you can buy on January 17, 2022.

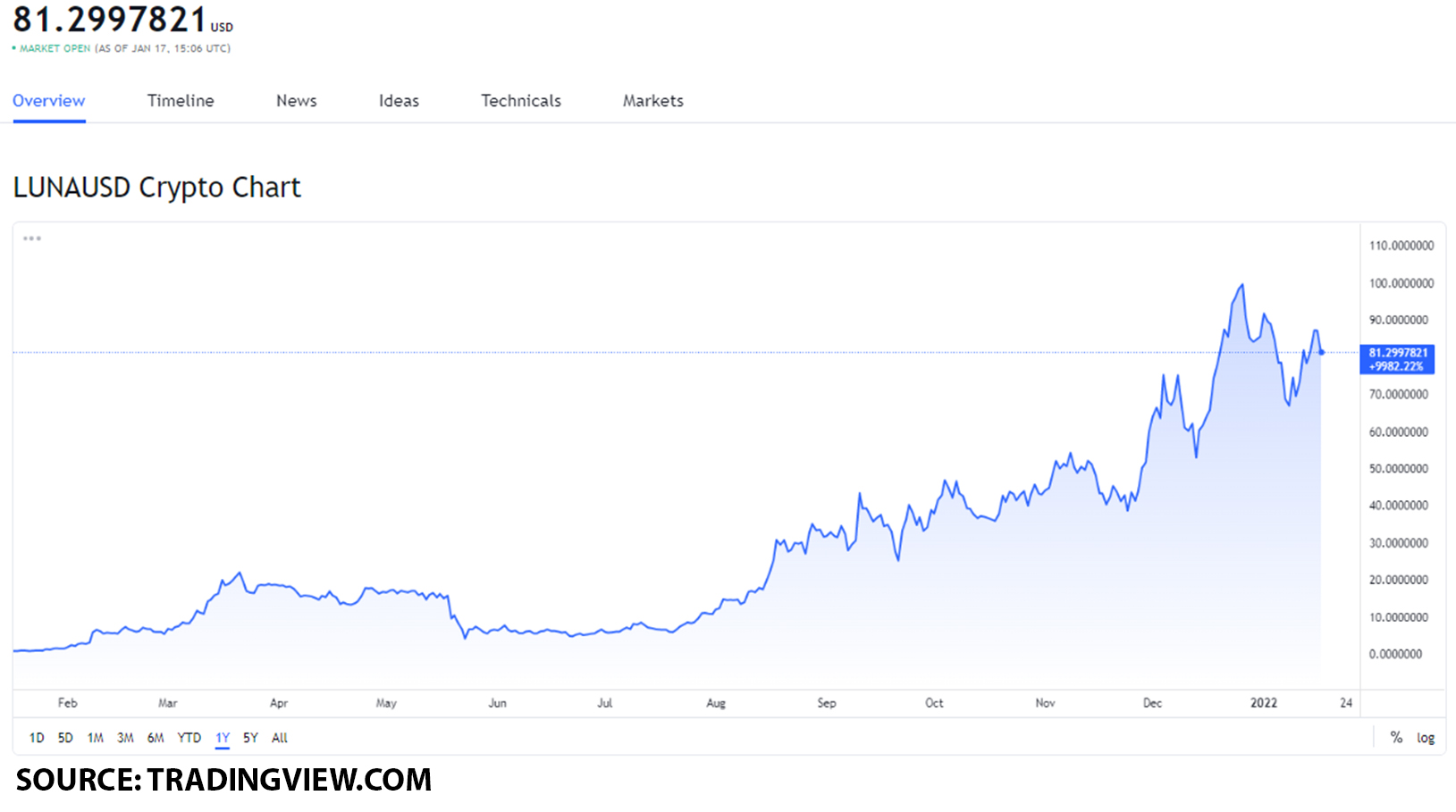

Should you buy Terra (LUNA)?

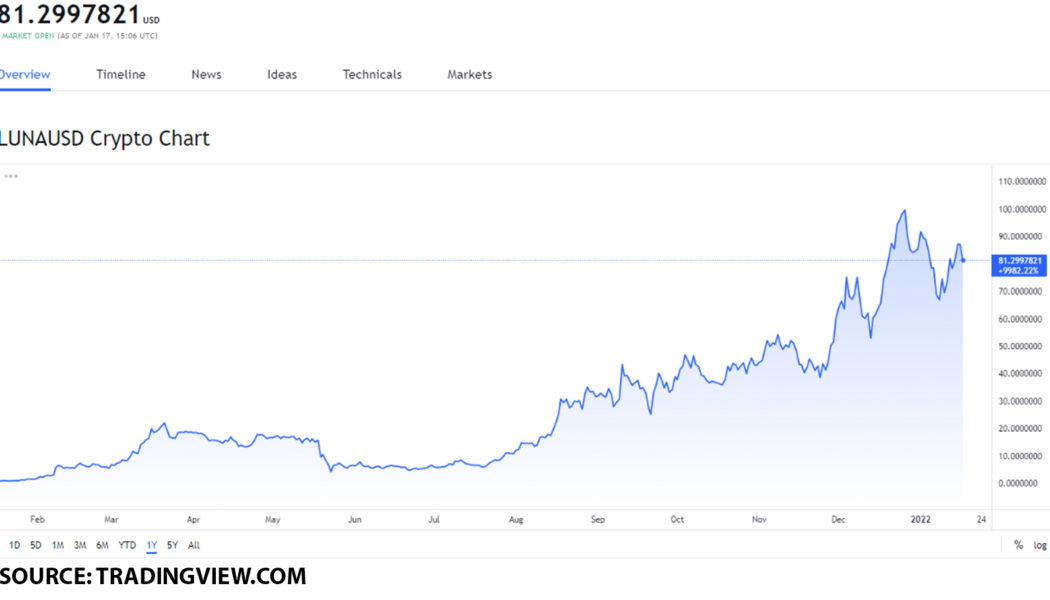

On January 17, Terra (LUNA) had a value of $81.299.

The all-time high value of the LUNA token was on December 27, 2021, when the token reached a value of $103.34. This made the token $22.041 higher in value or by 27% at its ATH point.

When we go over the performance of the token in December, we can see that the token had its lowest point on December 14 at $52.75, while it had its highest point on December 27 at $102.9. This means that the token increased by $50.15 or by 95%.

With this in mind, LUNA can reach $90 by the end of January, making it a worthwhile buy.

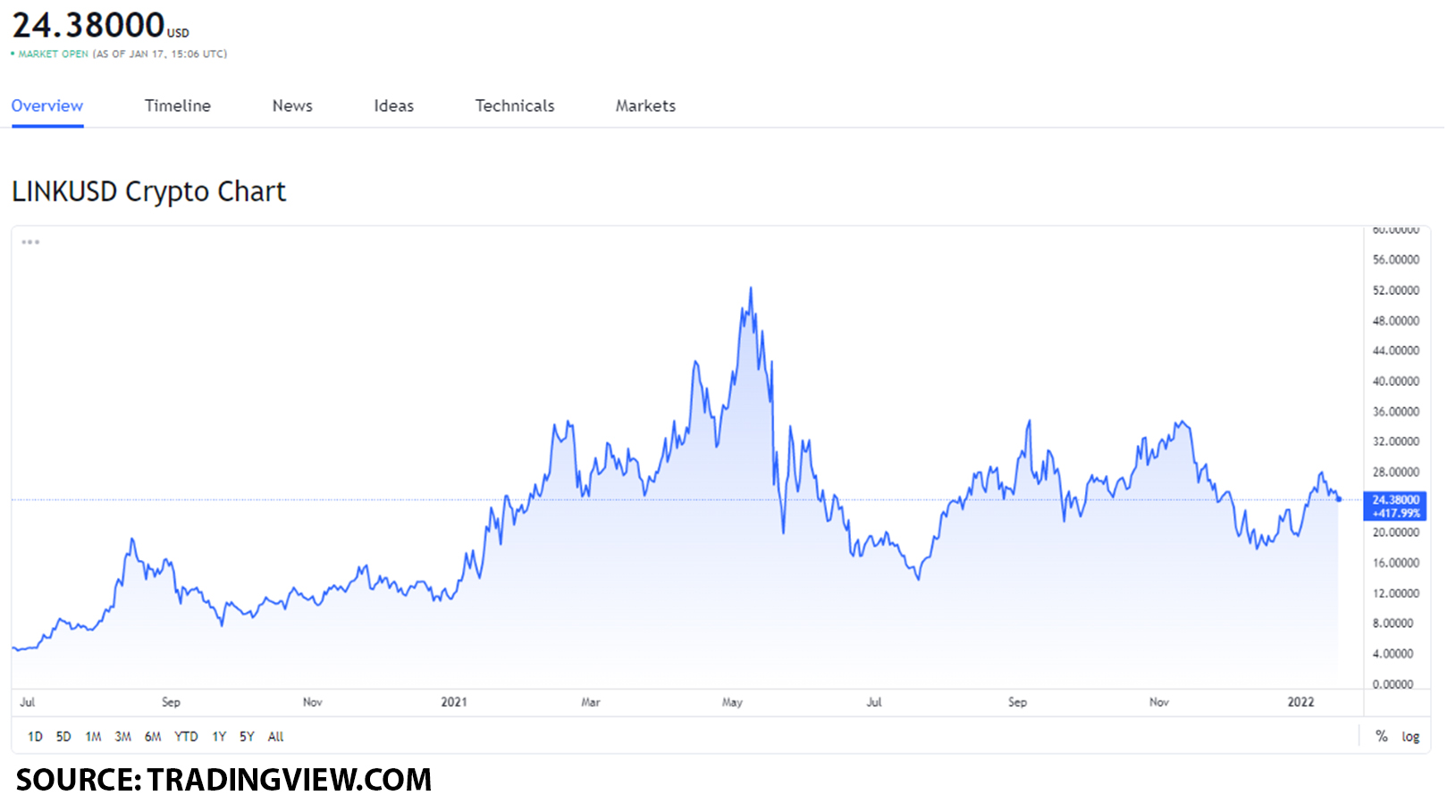

Should you buy Chainlink (LINK)?

On January 17, Chainlink (LINK) had a value of $24.38.

The all-time high value of the LINK token was on May 10, 2021, when it reached a value of $52.70. This gives us an indication that at its ATH, the token was $28.32 higher in value or by 116%.

When we go over the performance of the token in December, we can see that the token had its highest point on December 1 with a value of $26.76, while its lowest point of value was on December 15, when it decreased to $17.33. This is a $9.43 decrease.

However, the token did increase to $24.38 afterward, and if it keeps up this pace, it can reach 28 by the end of January, making it a solid buy.

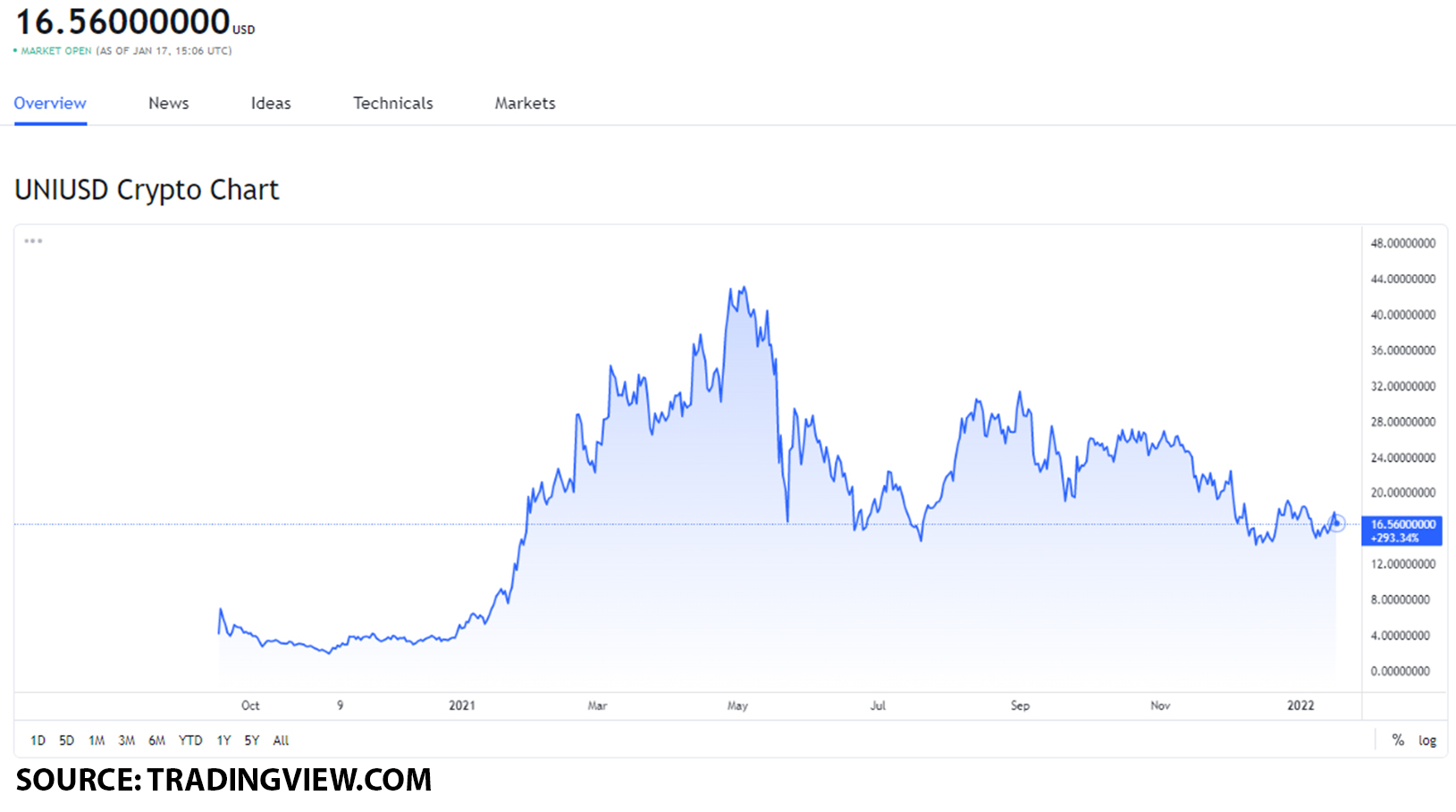

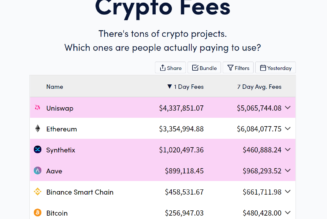

Should you buy Uniswap (UNI)?

On January 17, Uniswap (UNI) had a value of $16.56.

The all-time high value of the UNI token was on May 3, 2021, when it reached a value of $44.92. At its ATH point of value, the token was $28.36 higher in value or by 171%.

When we go over the performance of the token in December, we can see that the token had its highest point on December 2 with a value of $22.86, while its lowest point was on December 17 with a value of $13.86. This is a $9 decrease or by 39%.

Since then, the token increased to $16.56 and has the potential to reach $20 by the end of January, making UNI a solid token to buy.

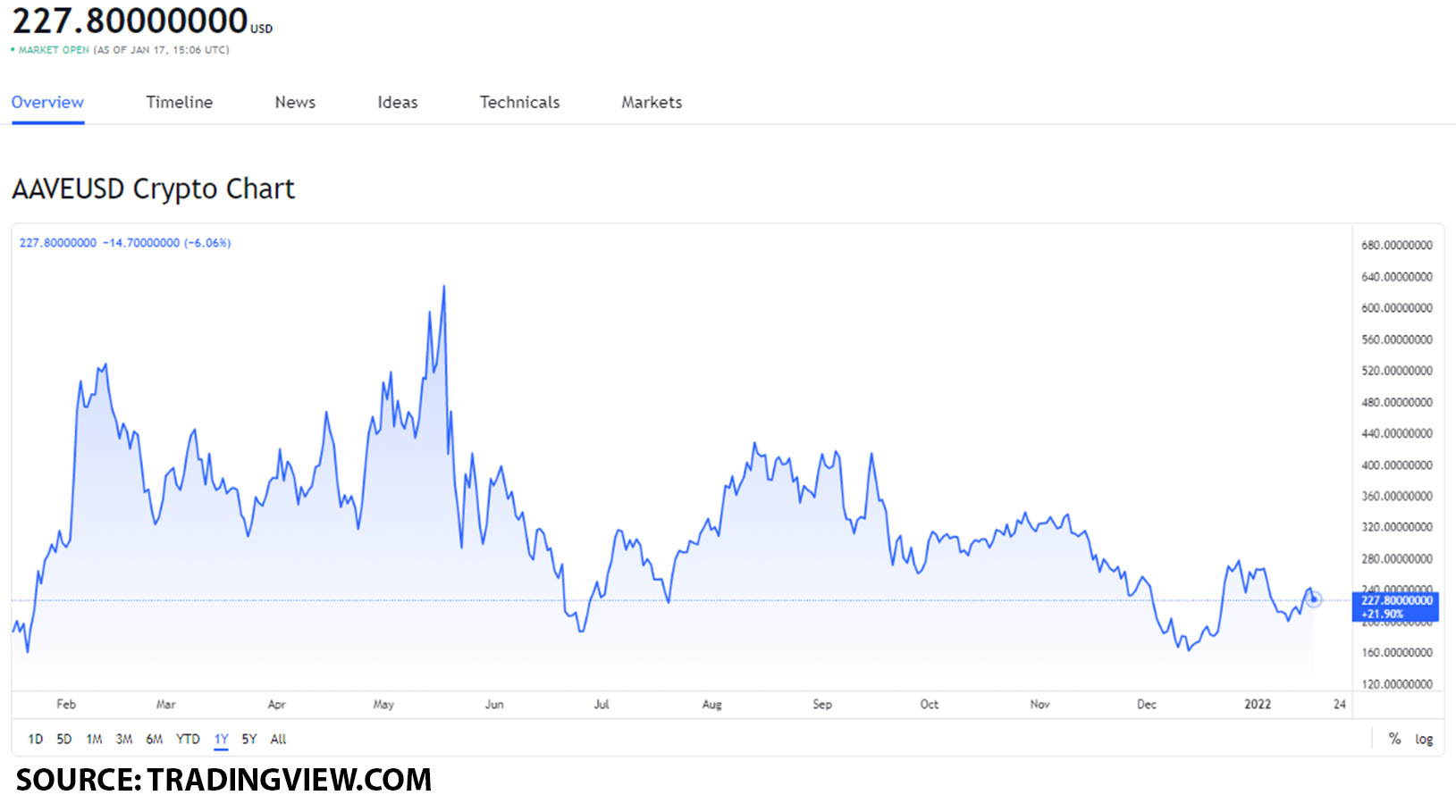

Should you buy Aave (AAVE)?

On January 17, Aave (AAVE) had a value of $227.8.

It’s all-time high point of value was on May 18, when it reached $661.69. At its ATH, the token was $433.89 higher in value or by 190%.

When we go over the performance of the token in December, we can see that its lowest point was on December 15 with a value of $160.05, while its highest point was on December 28 at $292.84. This marked a $132.79 increase, or by 83%.

With this in mind, AAVE can reach $240 by the end of January, making it a solid buy.

[flexi-common-toolbar] [flexi-form class=”flexi_form_style” title=”Submit to Flexi” name=”my_form” ajax=”true”][flexi-form-tag type=”post_title” class=”fl-input” title=”Title” value=”” required=”true”][flexi-form-tag type=”category” title=”Select category”][flexi-form-tag type=”tag” title=”Insert tag”][flexi-form-tag type=”article” class=”fl-textarea” title=”Description” ][flexi-form-tag type=”file” title=”Select file” required=”true”][flexi-form-tag type=”submit” name=”submit” value=”Submit Now”] [/flexi-form]

Tagged: Analysis, crypto blog, Crypto news