Bitcoin (BTC) may be down 20% from all-time highs, but this is a golden opportunity to “buy the dip,” analysts argue.

Black Friday is living up to its name in crypto this year as both Bitcoin and many altcoins are trading at their lowest in six weeks.

Misgivings over $53,000 floor

After an overnight sell-off sparked by a declining United States dollar and macro markets rattled by a new coronavirus variant, BTC/USD is trading near $54,000.

As mainstream media highlight the fall, others are far from concerned, however — current prices arguably offer a golden entry opportunity.

#BTC Black Friday deal pic.twitter.com/TqTcQEzfqG

— Material Scientist (@Mtrl_Scientist) November 26, 2021

Others poked fun at a knee-jerk article from Bloomberg in which the publication initially declared that Bitcoin had “entered a bear market.”

On short-term targets, popular trader and podcast host Scott Melker warned over going with the herd, expecting even lower levels to buy.

“We all seemingly want to see 53K, which usually means we get front run at 53.5K or price nukes straight through and we HFSP,” he tweeted.

“The crowd rarely gets what it wants.”

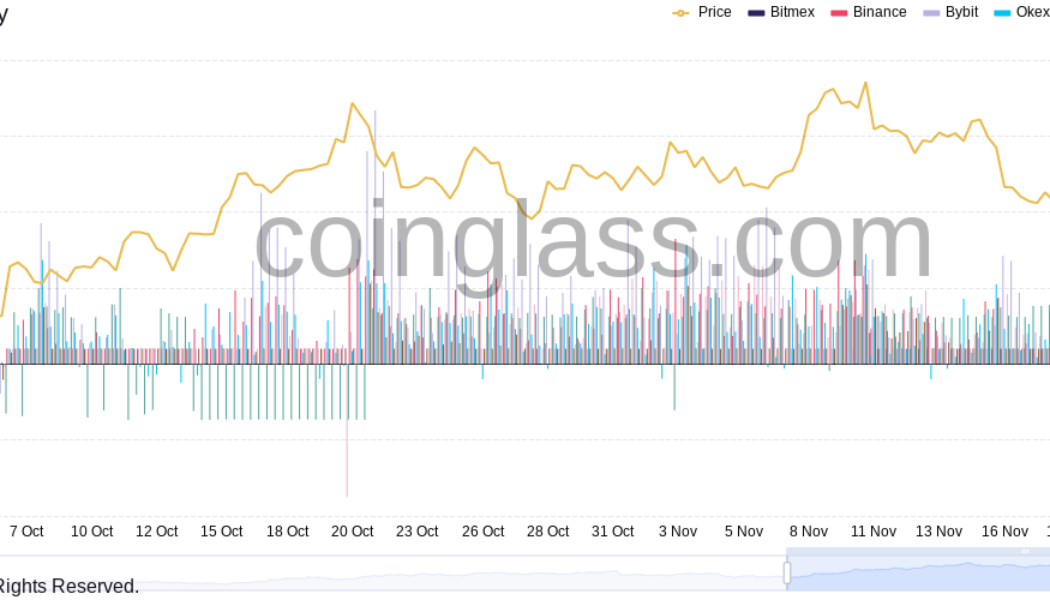

In a sign that selling is likely not yet over, funding rates across exchanges remain elevated despite 24-hour liquidations nearing $700 million.

Remember last Black Friday?

Melker, meanwhile, additionally pointed to the unusual correlation between the U.S. dollar and Bitcoin thanks notionally to the virus jolt.

Related: Bitcoin hits 6-week lows in hours as 24-hour crypto liquidations near $650M

As Cointelegraph often notes, Bitcoin tends to exhibit inverse correlation with USD, the latter having snapped a long winning streak Friday.

Far from fuelling Bitcoin’s strength, however, the largest cryptocurrency has fallen in step with both macro markets and the U.S. dollar currency index (DXY).

Dollar down, gold up, Bitcoin down, stocks down.

Good luck solving that correlation today.

— The Wolf Of All Streets (@scottmelker) November 26, 2021

Standing in the way of further losses on Bitcoin is a heavy block of buyer support at $53,000 — roughly the area that corresponds to Bitcoin’s $1-trillion market capitalization.

Meanwhile, historical data serves as a timely reminder that Black Friday bargains are something of a common theme for Bitcoin.

In late November 2020, BTC/USD dipped to around $16,400 — only to then go on to tackle and beat out $20,000 for the first time in three years.