-

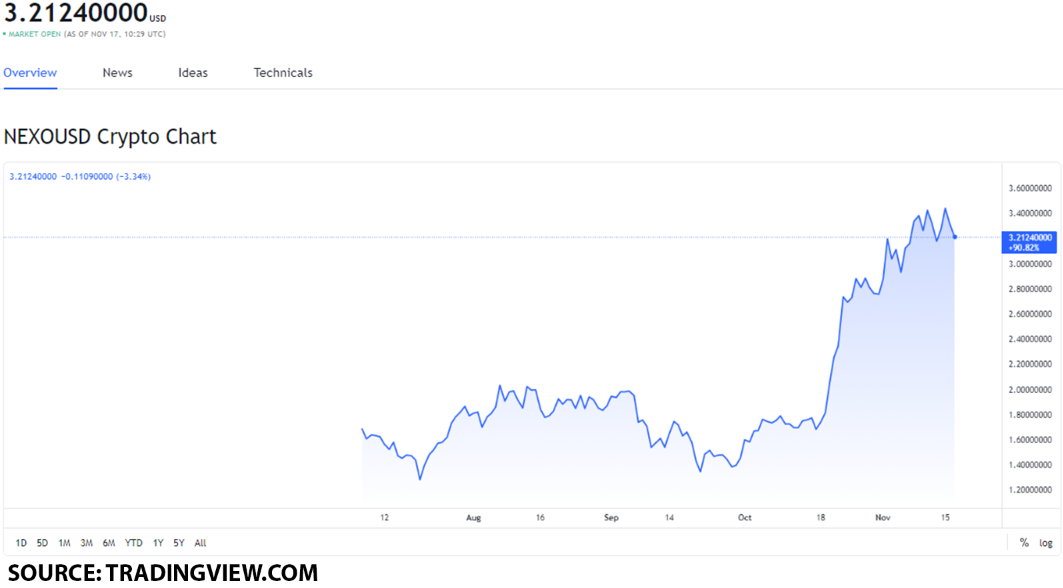

NEXO has the potential to increase its value throughout November.

-

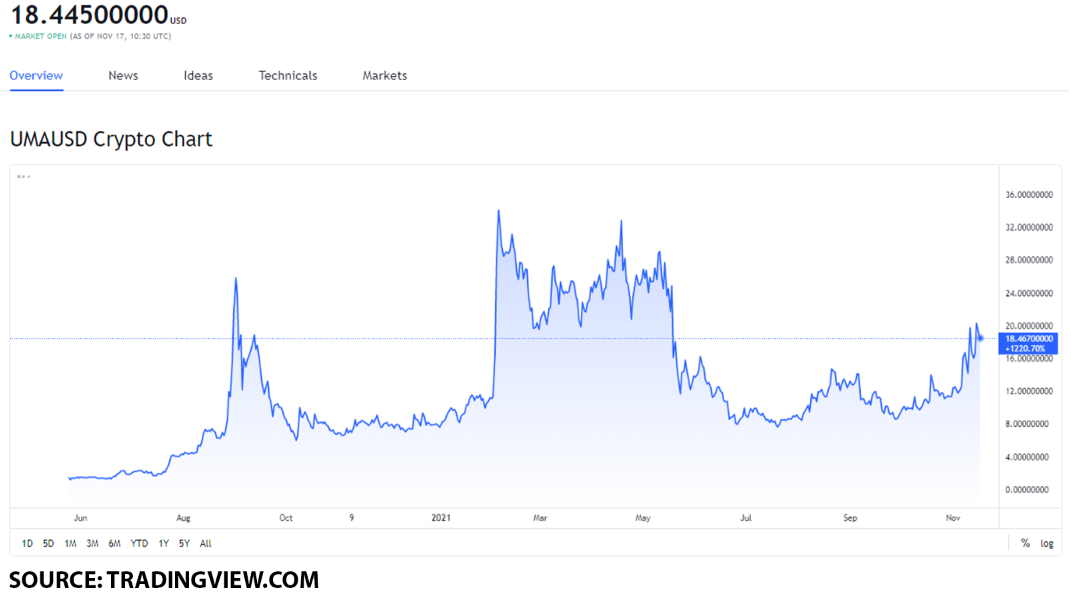

UMA is at a lower value point, which signals a solid purchase opportunity.

-

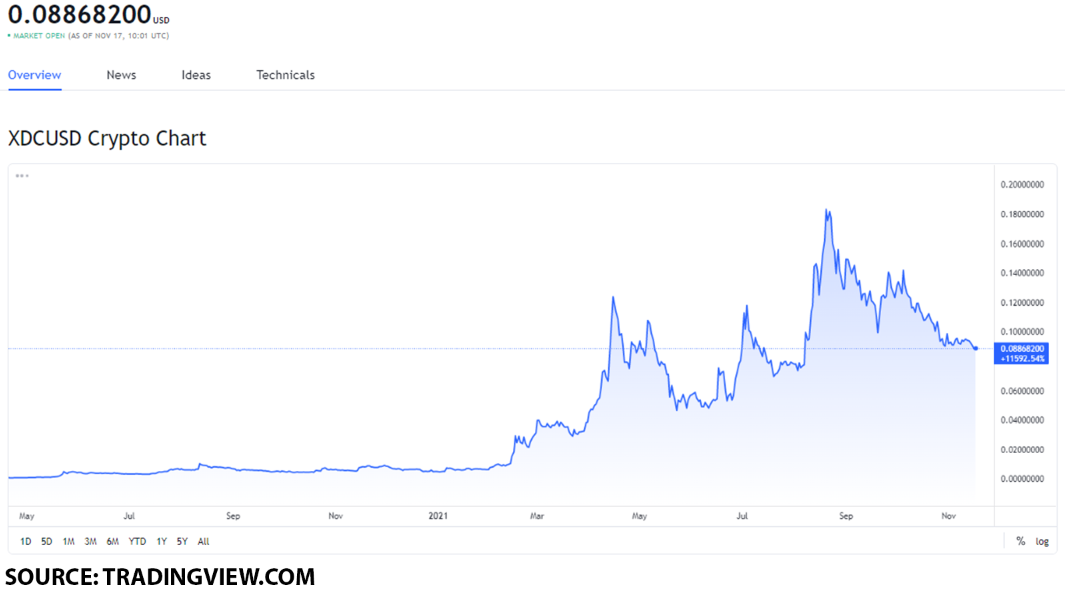

XDC specializes in international trade and finance and has the potential to grow in value tremendously.

Nexo (NEXO) is a platform that provides instant crypto loans as well as fast access to cash for the support and maintenance of ownership of digital assets. Its token is used as a source of discounts, which also provides users with other benefits.

Universal Market Access (UMA) Is an Ethereum token that is an open-source protocol that allows developers to design and create their own financial contracts as well as synthetic assets.

XinFin (XDC) Network is a hybrid blockchain company optimized for international trade and finance, where the native token is called XDC.

Should you buy Nexo (NEXO)?

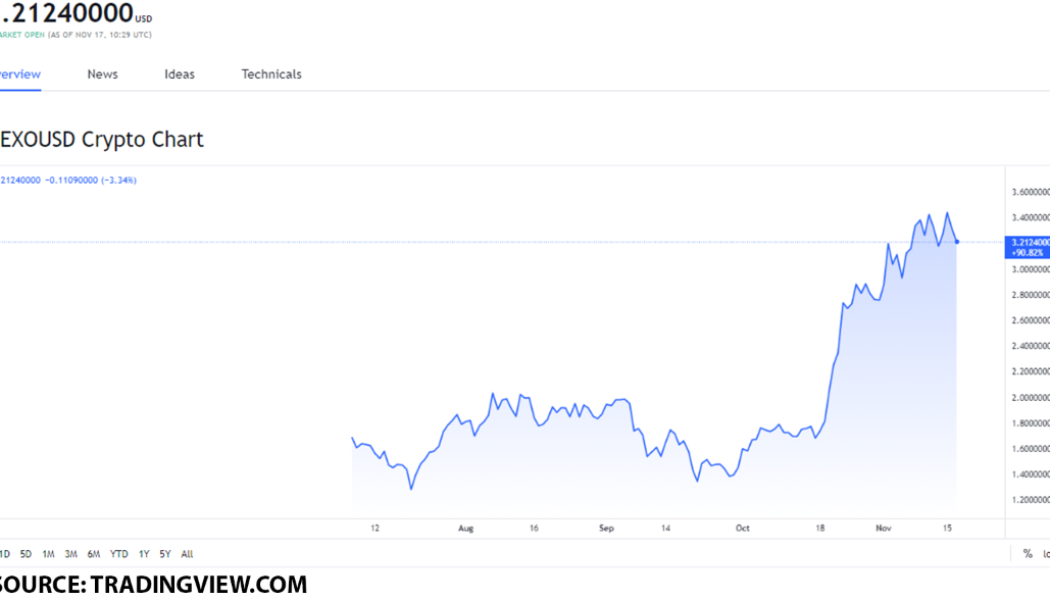

On November 17, Nexo (NEXO) had a value of $3.212.

To get a bigger perspective on the value point for the NEXO token, we will review its all-time high value and its performance in October.

NEXO had its all-time high value of $4.07 on May 12. At this ATH point, the token was $0.858 higher or 26% higher in value than on November 17.

On October 10, NEXO had a value of $1.449, which was the token’s lowest point of value of the month.

With that in mind, on October 28, the token’s value increased to $3.081, which was its highest point of value.

Here, we can see that the token increased in value by $1.632 or by 112%.

With this in mind, we can expect NEXO to reach $4 by the end of November, making it a solid buy.

Should you buy UMA (UMA)?

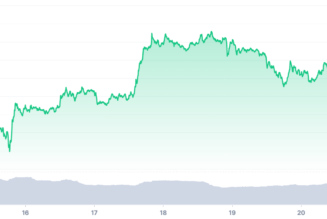

On November 17, UMA (UMA) had a value of $18.445.

With the goal of getting a better perspective as to what this value point means for the token, we will go over its all-time high value as well as its performance in October.

UMA achieved its all-time high-value point on February 4, when the token reached a value of $41.56. At this ATH value point, the token was $23.115 higher in value or by 125%.

When it comes to October’s performance, on October 1, the token had a value of $8.998.

On October 20, the token had its highest point of value of the month at $14.36. Here, we can see that the token increased in value by $5.362 or by 59%.

With this in mind, we can expect UMA to reach $22 by the end of November, which makes it a worthwhile purchase.

Should you buy XDC Network (XDC)?

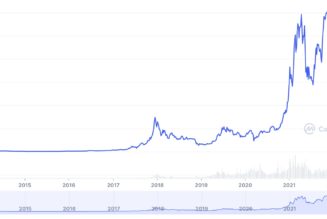

On November 17, XDC Network (XDC) had a value of $0.08868.

To get a better perspective as to what kind of value point this is for the token, we will go over its all-time high value as well as its performance in October.

XDC had its all-time high value on August 21 when the token reached a value of $0.192754. At its ATH, the token was $0.104074 higher in value or by 117%.

On October 5, XDC had its highest point of value at $0.142.

That said, on October 31, it fell to its lowest point of value of the month at $0.0889.

Here we can see that the token decreased in value by $0.0531 or by 37%.

From October 31 to November 17, the token decreased by an additional $0.00022.

However, this might be the perfect opportunity to buy XDC while the value is low, as it has the potential to raise its value to $0.1 by the end of November.