-

Terra’s trading volume increased by 43% in the last 24 hours.

-

Uniswap’s volume increased by 66% in the same time span.

-

Aave also saw an increase in volume by 50%.

Terra (LUNA), Uniswap (UNI), and Aave (AAVE) have all seen significant growth in terms of trading volume and value as of recently.

This is why they are chosen as the top three DeFi tokens that you should buy on November 9 of 2021.

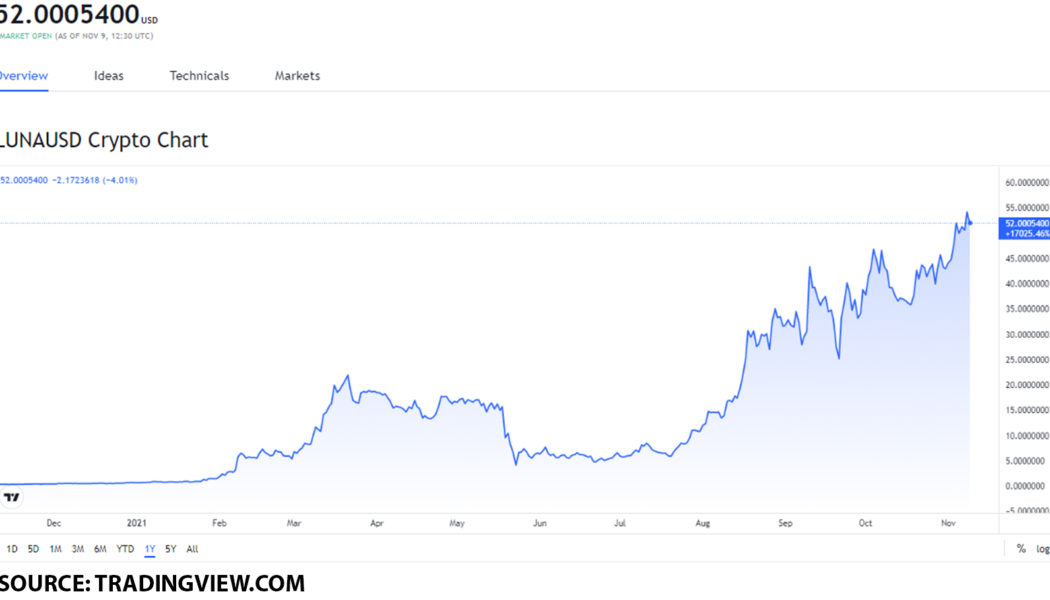

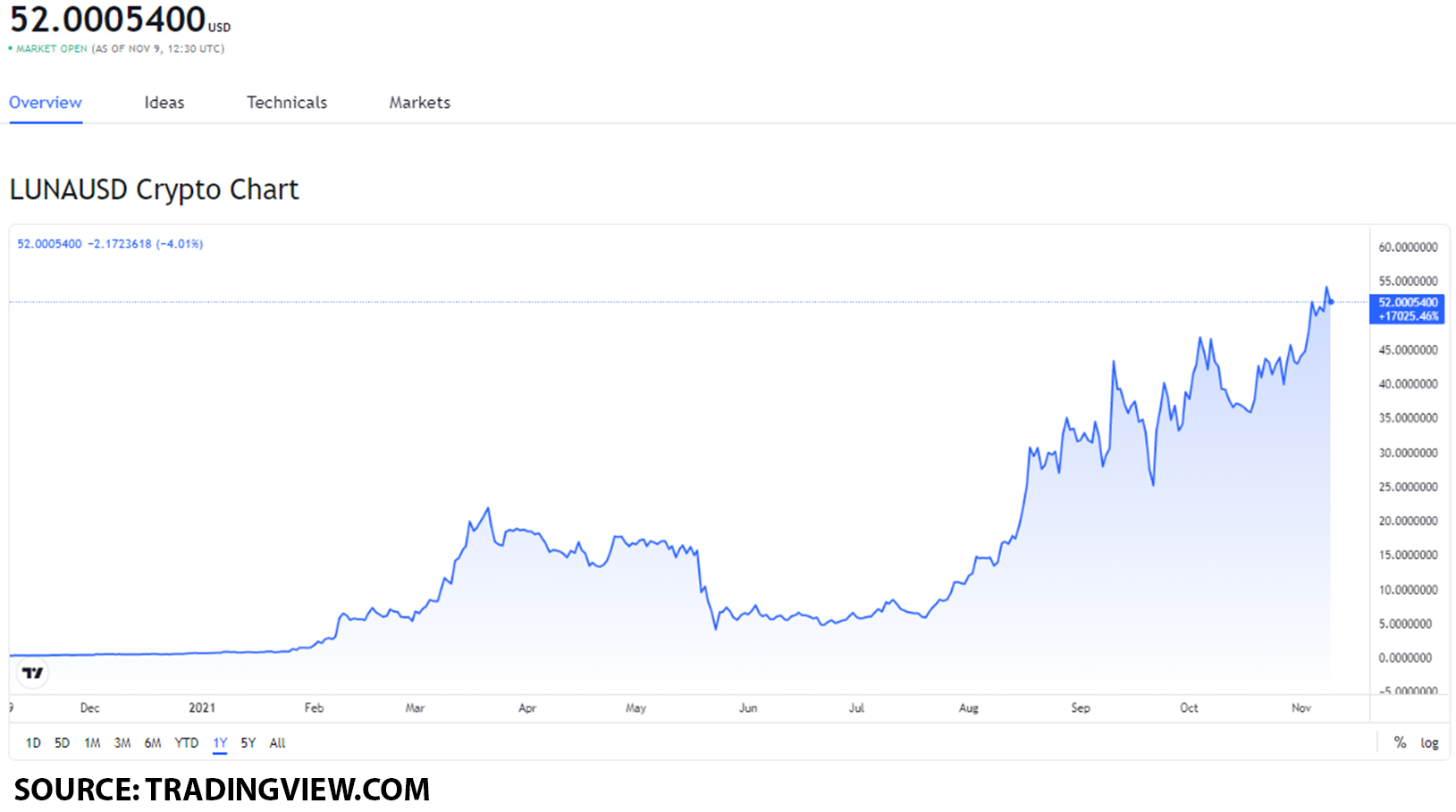

Should you buy Terra (LUNA)?

On November 9, Terra (LUNA) had a value of $52.

To get an indication of what kind of value point this is for the token, we will be going over it’s all-time high value as well as its performance in October.

Luna achieved its new all-time high value of $54.77 on November 8. This means that the token has only lowered in value by $2.77 within the span of a day.

On October 4, LUNA had its highest value of the month at $49.05.

Its lowest value was on October 17, when the token fell to a value of $35.38. This signaled a decrease of $13.67, or by 27%; however, it eventually grew to its all-time high.

From October 17 to November 8, the token increased by $19.93.

At this rate, Terra (LUNA) has the potential to reach $55, which makes it a solid purchase at $52.

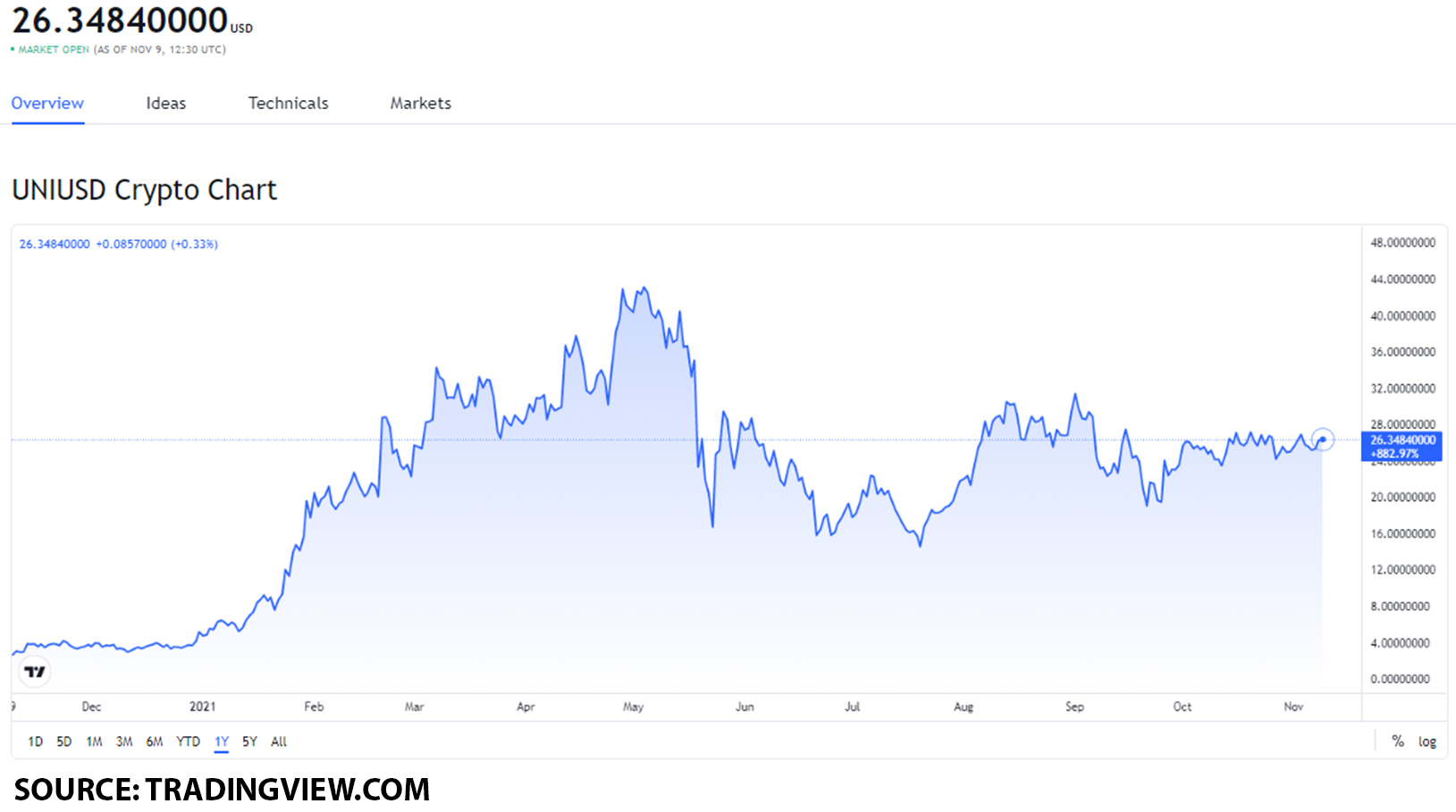

Should you buy Uniswap (UNI)?

On November 9, Uniswap (UNI) was worth $26.34.

To get a better perspective as to what kind of value point this is for the token, we will be comparing it to it’s all-time high value as well as its performance in October.

Uniswap achieved its all-time high value on May 3, when the token reached a value of $44.92. The token was 70% higher in value, or by $18.58 at its ATH point when compared to the value on November 9.

On October 12, the token had its lowest point of value at $22.48.

Its highest point was on October 26, when it reached $27.99. Here we can see that the token grew by $5.51 or by 24%.

With this in mind, we can see that UNI has the momentum in place to reach $30 by the end of November, making it a solid purchase.

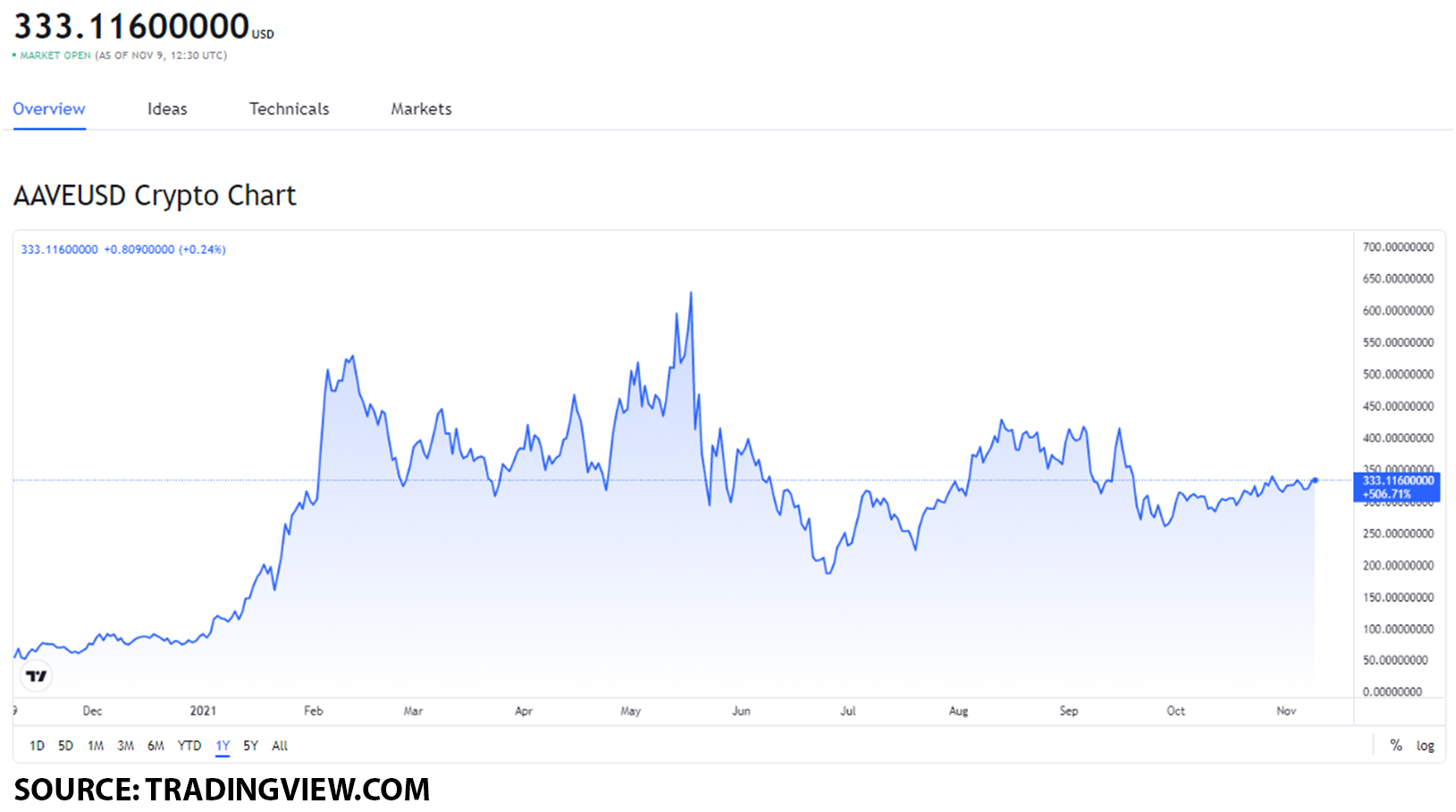

Should you buy Aave (AAVE)?

On November 9, Aave (AAVE) had a value of $333.11.

With the goal of establishing what kind of value point this is for the token and to figure out how far it can climb, we’ll compare it with its all-time high value as well as its performance in October.

Aave had its all-time high on May 18, when it reached $661.69. At its ATH point, the value was $328.58, or 98% higher than its value on November 9.

On October 12, AAVE had its lowest value of the month at $272.61.

Its highest point was on October 27, when the token rose to a value of $422.97. Here, we can see a $150.36 increase in value or by 55%.

However, it then decreased to the value we saw on November 9. From October 29 to November 9, the token decreased by $89.86 or by 21%.

This does put it at a point where it can rise up in value, and with its current momentum, it has the potential to reach $350 by the end of November, making it a solid purchase.