Regulators must seek to achieve controlled supervision of cross border cryptocurrency firms, Hsu stated.

The United States acting Comptroller of the Currency Michael J. Hsu called for a more comprehensive regulatory framework to address the threats posed by universal cryptocurrency exchanges. The remarks come amid an ongoing institutional crackdown on crypto mining in China and increasing regulatory attention towards cryptocurrency firms across the world.

In a speech at the American Fintech Council’s 2021 Policy Summit, Hsu stated that large cryptocurrency companies with cross border operations pose risks beyond what the current regulations seek to address. The CoC thus called for such universal companies, especially those involved in issuing highly circulated stable coins to embrace “comprehensive, controlled supervision”.

He further advised federal and state bank regulators to focus on the development and incorporation of policies, staff and supervisory approaches that understand the drawbacks of current regulatory standards. This will be the first step towards bringing large cryptocurrency firms safely into the bank regulatory perimeter, Hsu explained:

“This would clearly differentiate safe and sound crypto firms from those that are regulated only partially and have a history of control lapses, such as Binance and Tether.”

Hsu also pondered on whether a Glass-Steagall-like separation of activities in the crypto space will be beneficial in ensuring that wholesale and retail activities remain separated, considering the rapid expansion of the industry.

The Glass-Steagall legislation was one of the provisions of the United States Banking Act of 1933 that was aimed at separating commercial and investment banking. The law was repealed in 1999.

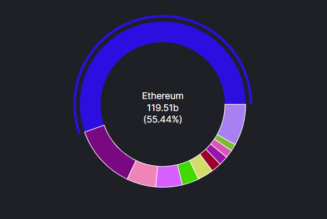

Hsu also addressed the increase in scams and consumer complaints that have come with the rapid growth of users and the total market value of the crypto industry.

“‘Move fast and break things’ is a common mantra in tech. In the financial services context, it is important to remember that those “things” are people and their money,” the regulator explained.

The Comptroller of the Currency works under the Department of the Treasury and is in charge of regulating and supervising all national banks and thrift institutions in the country.