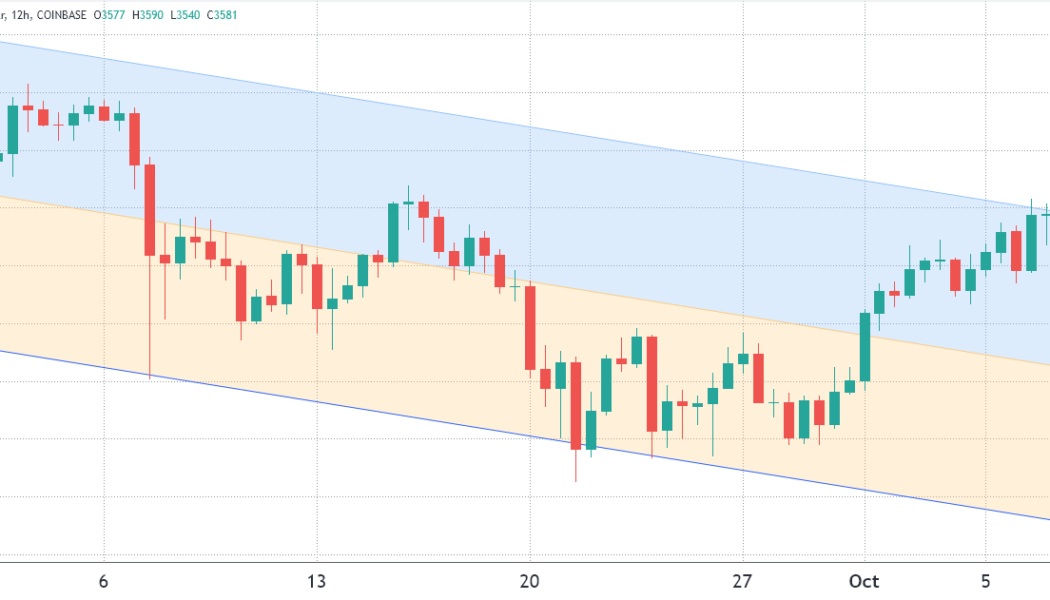

Ether (ETH) has been facing a bearish regression channel since Sept. 1, although it is currently battling to break its resistance.

But despite some headwinds, ETH bulls will likely profit $115 million on Oct. 8’s weekly Ether options expiry. The 21% pump over the past week was just enough to make the entire $250 million worth of neutral-to-bearish put options worthless.

Regulatory fear limits the upside

Understandably, negative headlines about increasing regulatory scrutiny toward crypto may have subdued prices last month, particularly as China banned all cryptocurrency activity outright.

Major crypto exchanges, including Binance and Huobi, halted most of their services in mainland China, and a couple of the largest Ethereum mining pools were forced to shut down completely.

The negative press followed.

Founder of Citadel Securities, one of the world’s biggest market-making firms, said the company does not trade cryptocurrencies due to the sector’s regulatory uncertainties. The Russian State Duma Committee on Financial Markets chairman is also talking about ramping up regulations to protect retail investors, and so on.

Based on the negative newsflow, it is possible to understand why bears placed 86% of their bets at $3,200 or lower. However, the past weeks have definitively caused those put (sell) options to lose value quickly.

The Oct. 8 expiry will be a strength test for bears because any price above $3,500 means a bloodbath with the absolute dominance of call (buy) options.

At first sight, the $250-million neutral-to-bearish instruments dominated the weekly expiry by 16% compared to the $210-million call (buy) options.

However, the call-to-put ratio is deceptive because the recent ETH rally will likely wipe out most of their bearish bets if Ether’s price remains above $3,500 at 8:00 am UTC on Friday. There is no value on a right to acquire ETH at $4,000 if it’s trading below that price.

Bears should throw the towel and take the $115 million loss

Notably, 94% of the put options, where the buyer holds a right to sell Ether at a pre-established price, were placed at $3,500 or lower. These neutral-to-bearish instruments will become worthless if ETH trades above that price on the morning of Oct. 8.

Below are the four likeliest scenarios considering the current price levels, as the imbalance favoring either side represents the potential profit from the expiry.

The data shows how many contracts will be available on Oct. 8, depending on the expiry price.

- Between $3,100 and $3,300: 14,300 calls vs. 9,800 puts. The net result is somewhat balanced between bulls and bears;

- Between $3,300 and $3,500: 21,650 calls vs. 1,900 puts. The net result favors bulls by $66 million;

- Between $3,500 and $3,700: 32,050 calls vs. 0 puts. The net result favors bulls by $115 million;

- Between $3,700 and $3,900: 43,300 calls vs. 0 puts. Bulls profit increases to $165 million.

This crude estimate considers call (buy) options used in bullish strategies and put (sell) options exclusively in neutral-to-bearish trades. However, this oversimplification disregards more complex investment strategies.

Related: Bitcoin bears risk getting trapped if BTC price remains above $50K — Here’s why

For example, a trader could have sold a put option, effectively gaining a positive exposure to Ether above a specific price. But, unfortunately, there’s no easy way to estimate this effect.

There’s a $47 million gain from the bear’s perspective by pressuring below $3,500, as the above estimate shows. On the other hand, bulls could increase their advantage by $49 million by taking Oct. 8’s options expiry price above $3,800.

As things currently stand, bulls have absolute control going into the Oct. 8 expiry, and the incentives for both sides to try pushing the price $200 above or below seem balanced. Therefore, bears should throw the towel and regroup for next week’s expiry.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.