But iHeartMedia’s net loss per share was $0.22 compared to the $0.14 loss per share expected by analysts polled by FactSet, according to DowJones Newswire, and investors were clearly hesitant about the company’s future.

iHeartMedia shares began Friday at $26.49 — 415% above its pandemic-era low of $4.31 — but fell by 17% on the day and another 4.9% on Monday (Aug. 9), bringing the two-day drop to 21.1%.

Investors have also continued to hammer Audacy, the country’s third-largest radio company, after its $0.01 earnings per share on Friday fell well below the $0.09 consensus estimate. Audacy’s forecasted 10% revenue growth from the second to the third quarter was lackluster compared to iHeart (20%), and investors reacted accordingly. Audacy shares dropped 10.9% to $3.03 on Monday and the company has lost 52.3% of its market capitalization since Feb. 23.

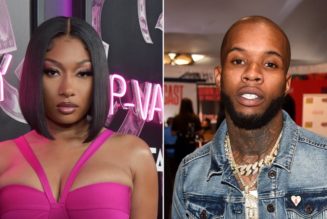

Radio was among the earliest business sectors to be hit by the pandemic after a quick dearth in local advertising led to widespread layoffs and furloughs. Now, the pandemic stubbornly continues, but the radio industry is far removed from the dark days of 2020. The three largest radio companies — iHeartMedia, Cumulus and Audacy — reported buoyant earnings that show a comeback in the making.

In the second quarter, iHeart’s broadcast business — which represented 52.4% of total revenue — climbed 84.9% from the prior-year period and 25.8% from the previous quarter. The digital audio group, which includes podcasts, grew 112.3% year over year. Podcast revenue alone improved 151.9% to $54.3 million, although it represented only 6.2% of total revenue — up from 4.3% a year earlier.

Cumulus’ revenue jumped 53.9% to $224.7 million from $146 million in Q2 2020. Adjusted EBITDA improved to $36.9 million from a $6.4 million loss the previous year. “Spot” broadcast advertising improved 66.9% and contributed 61.6% to the $78.7 million revenue gain. Also, Cumulus sold “non-core real estate” in Nashville for $34 million and will use the proceeds to pay down debt. Compared to Q2 2019, Cumulus’s revenue and operating income were down 19.6% and 84.4%, respectively.

Cumulus shares increased as much as 4.6% to $13.09 following its Aug. 4 earnings release and ended the day up 1.6% at $12.71 — but had lost those gains by Monday when it closed 2.9% below where it started before the earnings report.

Shares of Sinclair Broadcasting — which posted revenues of $1.61 billion in Q2 on Aug. 4 — rose 10% to $31 at Friday’s close. Like other radio stocks, however, Sinclair dropped on Monday, by 2.97% to 30.08, but is still 6.78% above its pre-earning opening price.

Reduced spending has bridged only part of companies’ bottom-line shortfall as their earnings per share have come in under expectations. For their part, radio companies will keep their budgets thinned after tightening their belts in 2020. iHeartMedia expects to “replicate the majority” of its $200 million cost reductions from 2020 and return to 2019 EBITDA levels by the end of this year. iHeartMedia’s six-month adjusted EBITDA was $286.7 million, compared to $420 million in the first half of 2019, when finished the year at $1 billion.

Cumulus’ fixed costs in 2022 will be more than $70 million below 2019 — up from $50 million from last quarter’s projection, president and CEO Mary Berner said in an Aug. 4 earnings call. So far in the third quarter, the company is pacing in the “mid-teens” ahead of Q3 2020 and forecasts 2022 EBITDA in the range of $175 to $200 million, Berner said.

Although radio companies receive the lion’s share of revenues from broadcast advertising, broadcast is an increasingly outmoded term: iHeartMedia, Cumulus and Audacy have well established digital businesses that include original podcast content. At iHeartMedia, digital was 23% of total revenue, up from 19.1% in Q2 2020, and got over a third of its growth from its podcast business, which is the largest in the U.S. in terms of monthly audience — more than 50% greater than second-place NPR — and monthly downloads, according to Podtrac.