“Go digital or go dark” – Companies that fail to heed this advice, irrespective of sector, run a great risk in the age of technological revolution.

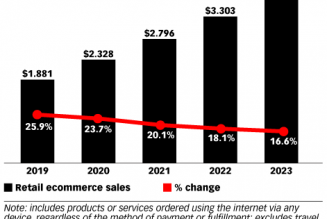

Consumers prioritise convenience and will often not see the need to step out of their houses to use a service that could be achieved with a few taps on their phones. Add to that a pandemic that has led to even further restrictions and the need to embrace digital ways of doing business becomes clearer.

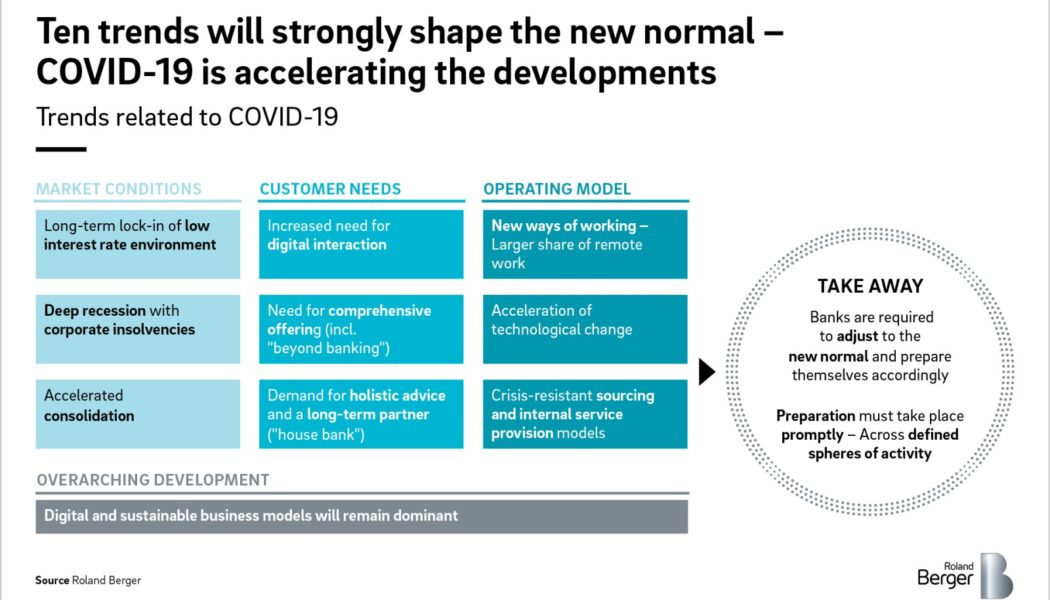

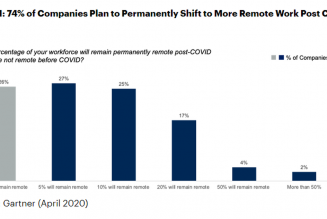

Historically, digital transformation has been a process that happens over the course of several years. COVID-19 has dramatically accelerated that timeline.

Companies were forced to adapt in order to survive, with financial services having to evolve quicker than most. That’s because every business relies on payments and if financial services companies do not accelerate digitally in 2021, they will not be able to compete.

It’s crucial to recognise that digital transformation has become a necessity for a good business strategy.

Here are 3 reasons why digital financial services need to be digitised:

1. Meet Evolving Customer Needs

With customers increasingly expecting convenience and on-demand services, going digital is essential if businesses are to thrive and meet expectations.

It’s crucial for businesses to prioritise providing a superior customer experience — but the key focus for delivering on-demand services is simply to be available for your customers when they need it. Why is this important, though?

While prospects or customers may have a positive opinion of your brand or company based on their first impressions or initial experiences, what really matters is the ability for your business to continue to stand out from the competition.

With the rise of fintech startups and other financial organisations embracing digital transformation, a key differentiating factor is to meet customers where they are and continue to be present as an option for future services within the financial industry.

2. Adapt to Increasing Regulatory Complexities

Regulation of the financial services industry has undergone dramatic changes. What started as responses to the global financial crisis, bank failures, government bailouts, and investor losses have now increased compliance spending by 60%.

One of the primary goals behind these changes is to promote financial stability by increasing financial transparency and de-risking financial systems.

Additionally, introducing strict capital requirements and restrictions on certain business activities offers increased consumer protection and prevents market abuse.

These increasing regulatory complexities highlight the need for financial services companies to accelerate digitally in order to monitor risks and adapt more efficiently.

3. Meet Requirements for Cybersecurity and Data privacy

With the recent implementation of the Protection of Personal Information Act (POPIA), customers now have greater control of their data.

Financial services providers like banks need to be accountable in the digital space and are witnessing a revolution in terms of data privacy and cybersecurity.

In order to stay ahead of the new requirements, it’s crucial for financial institutions to undergo digital transformation.

Why is Digital Transformation Crucial for the Financial Services Industry?

With the increasing levels of competition in the financial services industry, it’s difficult to imagine a financial landscape without it going digital. The number of fintech companies has continued to rise faster than ever, regulatory complexity is at an all-time high, and businesses are constantly being pushed to innovate digitally.

Despite its share of challenges, undergoing digital transformation will play a major role in your business strategy and ensure that you’re future-proofing your business to ensure long-term success.

IT News Africa Presents The DFA 2021 Virtual Summit

Digital transformation is essential not only for survival but for the continued prospering of the financial services industry. With this in mind, IT News Africa invites members of the finances industry to the #DFA2021 virtual summit.

The Digital Finance Africa (DFA) 2021 virtual summit seeks to “supercharge” your organisation’s digital transformation strategy by bringing together African financial services leaders and technology players in discussing the key factors that the finance industry must keep on the front burner as it takes the all-encompassing journey to digitization.

Learn how digital transformation is vital for your financial organisation.

Don’t get left behind – join IT News Africa on 31 August 2021 to participate in the #DFA2021.

For more information or to register as a sponsor, exhibitor or attendee – click here.

By Greg Gatherer, Account Manager, Liferay.

Edited by Luis Monzon

Follow Luis Monzon on Twitter

Follow IT News Africa on Twitter