The US Securities and Exchange Commission (SEC) is dealing with an influx of cryptocurrency ETF applications

Investment firm Victory Capital has announced that it has filed with the US SEC to launch a cryptocurrency exchange-traded fund. The ETF will be a private fund that will only be available to accredited investors and will track the performance of several cryptocurrencies.

According to its press release yesterday, Victory Capital said it filed the S-1 registration form with the SEC on Tuesday. The crypto ETF will track the performance of the Nasdaq Crypto Index, and Victory Capital will work with Brazilian fund manager Hashdex to launch it.

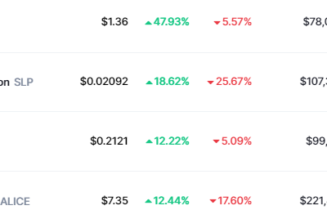

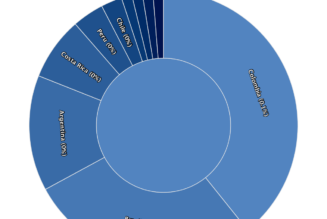

Unlike other crypto ETFs that focus on tracking the performance of a single cryptocurrency, the Victory Capital ETF will track the performance of eight cryptocurrencies: Bitcoin (BTC), Ether (ETH), Bitcoin Cash (BCH), Litecoin (LTC), Chainlink (LINK), Stellar Lumens (XLM), Filecoin (FIL) and Uniswap (UNI).

“The Company believes the new private fund is unique in the digital asset investment landscape due to its multi-coin access, daily liquidity at NAV and Nasdaq index governance, which includes rigorous vetting of crypto assets, custodians and exchanges with quarterly rebalancing and reconstitution,” the press release reads.

Mannik Dhillon, President of VictoryShares, Victory Capital’s ETF provider, added that a potential future ETF would make it easier and more convenient for their clients to gain exposure to multiple cryptocurrencies.

The SEC is yet to approve a single cryptocurrency ETF application filed by numerous investment firms. Currently, the SEC has nine Bitcoin ETF proposals, including the one submitted by Ark Invest in June. The regulatory agency also has two Ether ETFs filed by VanEck and WisdomTree.

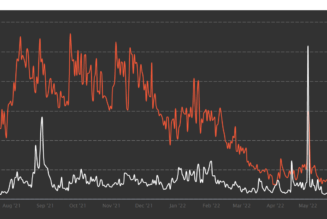

While the US continues to delay the launch of a cryptocurrency ETF, Brazil and Canada have both approved Bitcoin and Ether ETFs.