The acceleration of eCommerce as the global COVID-19 pandemic revolutionises buying trends is giving rise to exciting new developments in the financial technology industry.

According to research by the United Nations Conference on Trade and Development (UNCTAD), eCommerce’s share of global retail trade grew from 14% in 2019 to about 17% in 2020.

And the phenomenon shows no signs of slowing down.

“Businesses and consumers who were able to ‘go digital’ have helped mitigate the economic downturn caused by the pandemic,” says UNCTAD Acting Secretary-General Isabelle Durant.

/* custom css */

.tdi_3_7e3.td-a-rec-img{ text-align: left; }.tdi_3_7e3.td-a-rec-img img{ margin: 0 auto 0 0; }

“But they have also sped up a digital transition that will have lasting impacts on our societies and daily lives… Developing countries should not only be consumers but also active players and thus producers of the digital economy.”

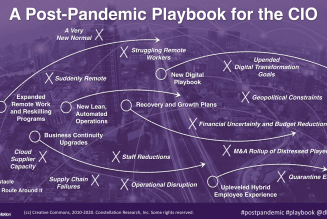

It is not surprising that eCommerce’s meteoric rise has birthed new financial products and technologies that are able to align with the needs of merchants and consumers.

In March, the New York Times described startup fintech companies as “hot tickets” among investors, and with good reason. Any company not investing in online banking and digital tools will be left behind as the economic landscape undergoes a complete overhaul.

The result is that some fintech companies have already begun to list on the New York Stock Exchange, and this is only the beginning.

Closer to home, FinTech magazine forecasts that the financial technology sector will be “critical to the recovery” of numerous countries in Africa in the wake of the pandemic.

Figures from early 2020 show that venture capital funding for African fintech startups had risen by 51%. It was reported that new fintechs raised almost $350-million (R4.9-billion) during the first quarter of 2020, with South Africa leading the way with $112m (R1.6bn) in investments.

Projects included virtual banking projects, consumer credit checks and finance apps. One such company is eCommerce payment solutions platform, Payflex.

“Payflex allows buyers on the platform to get the benefit of getting the product they want right away, but the flexibility of paying that off over six weeks is a huge advantage. There is no catch and there is no interest charged on the repayments,” says bidorbuy CEO, Craig Lubbe.

While bidorbuy is yet to see which categories are most popular for payments with Payflex, Lubbe expects that it will enable shoppers to have access to products that would, in many instances, be slightly out of reach in terms of value.

Payflex CEO Paul Behrmann believes the partnership with bidorbuy will be a “win-win” for buyers and sellers on the marketplace.

“Our innovative payment solution helps buyers on bidorbuy purchase what they want to today – and pay for it later at no additional cost. And for sellers on bidorbuy, it makes it easier to close a sale by making purchases more affordable to buyers,” he adds.

/* custom css */

.tdi_4_f3b.td-a-rec-img{ text-align: left; }.tdi_4_f3b.td-a-rec-img img{ margin: 0 auto 0 0; }