2020 was a tumultuous year for the South African telecommunications sector which saw network providers left to grapple with calls for data price cuts in the face of a pandemic-driven demand for connectivity and digital customer service.

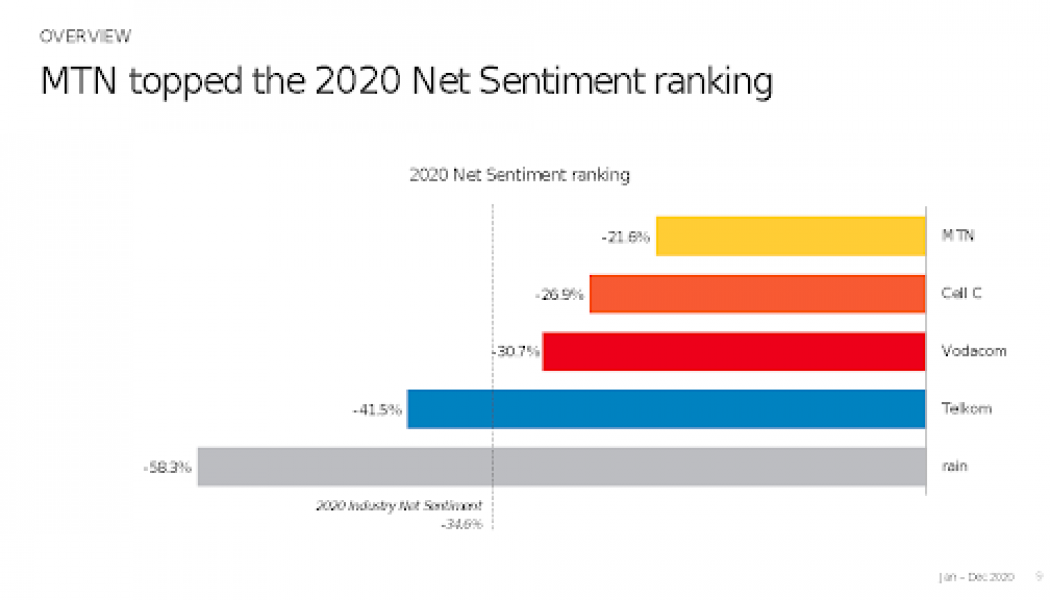

From the perspective of consumers, however, the performance of local telcos has left much to be desired. That said, having tracked over two million social media posts about Cell C, MTN, rain, Telkom, and Vodacom throughout the year, BrandsEye’s latest Telco Sentiment Index – conducted in partnership with Deloitte Africa – found that some telcos received significantly more negativity than others.

MTN comes out tops while rain gets left in the gutter

Newcomer rain ranked last, scoring over 20 percentage points below the industry average. On the other end of the spectrum, having scored the lowest negative sentiment and highest positive sentiment, MTN ranked first. Unexpectedly, Cell C – whose survival came into question during 2020 – placed second, while Telkom placed second-last despite seeing the most annual customer growth.

rain saw above-industry levels of risk conversation about downtime, evidencing network quality as one of its major weaknesses. Despite slashing data prices by up to 40%, Vodacom still saw the most negativity around pricing, while Cell C recorded the best pricing Net Sentiment.

Pricing complaints followed a downward trend across the industry in 2020, largely driven by the data price cuts implemented following the Competition Commission’s inquiry. However, despite slashing data prices by up to 40%, Vodacom still saw the most negativity around pricing. Cell C recorded the highest positive and least negative pricing sentiment, ranking them first in this regard.

Customer service emerged as the area that most negatively impacted sentiment towards telcos in 2020. Unsurprisingly, service complaints saw a steep increase a month into lockdown and remained consistently above pre-lockdown levels for the rest of the year.