Cybercriminals aren’t easy to detect and present a real risk to their victims. The best way to avoid becoming a victim is to be aware of the threats they pose and take every precaution you can to keep yourself safe.

According to Giuseppe Virgillito, FNB Head of Digital Banking, the remote living and working requirements of lockdown have meant that most people are communicating digitally – and criminals often use this to their advantage to gain people’s trust in order to steal sensitive information, money or both.

“Fraudsters are constantly looking for new ways to get to your information,” explains Virgillito, “and if customers or businesses let down their guard as a result of physical distancing and the need to transact or operate digitally, that unfortunately presents fraudsters with another opportunity to commit their crimes.”

He points out that fraudsters will go to any means to get individuals or organisations to divulge their personal or financial information, often by tricking them with technology.

Phishing is one of the main methods of social engineering employed by fraudsters. This is where a person is tricked into providing confidential information like Personal Identification Numbers (PINs) or One Time Pins (OTPs), usually via email, or even the person’s cloud login details (usually via SMS) which can compromise one’s identity and even bank accounts.

Here are seven precautions South Africans must take to reduce cyberthreats:

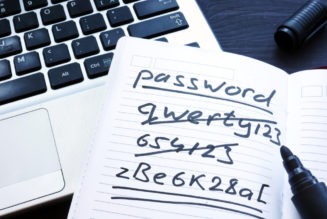

- Be careful when sharing any sensitive banking or personal information and do not save these on your device

- Most banks will never ask you for any OTPs, PINs or login details. OTP stands for ONE TIME PIN – nothing else. OTPs are used to authorize specific actions or a transaction or payment resulting in money leaving your account.

- The bank will never ask you to process a payment to reverse transactions.

- Carefully check all OTPs or App Approval Notifications (such as Smart inContact) before approving any transaction. Do not approve Smart inContacts for a transaction you are not aware of

- Make sure that your banking app is updated to the latest version and that your notifications are switched on.

- If you have a business, invest in the best possible anti-virus or security software and make sure your staff know not to open unsolicited emails without first checking them for viruses.

- Keep all business software updated and upgrade your technology as often as possible.